ULTA BEAUTY INC (NASDAQ:ULTA) stands out as a potential candidate for quality investors, meeting key criteria from the Caviar Cruise screen. The company demonstrates strong profitability, financial health, and consistent growth, making it a compelling option for long-term investors.

Key Strengths of ULTA BEAUTY

- High Return on Invested Capital (ROIC): ULTA’s ROIC (excluding cash and goodwill) is 31.7%, well above the 15% threshold for quality stocks. This indicates efficient use of capital to generate profits.

- Strong EBIT Growth: The company has delivered a 5-year EBIT CAGR of 11.7%, outpacing its revenue growth, which suggests improving operational efficiency.

- Healthy Profit Quality: ULTA’s 5-year average profit quality is 143.8%, meaning it converts net income into free cash flow at an exceptional rate.

- Zero Debt: With no outstanding debt, ULTA maintains a strong balance sheet, reducing financial risk.

- Revenue Growth: While 5-year revenue growth is modest at 4.6%, the company has maintained profitability and operational strength.

Fundamental Analysis Summary

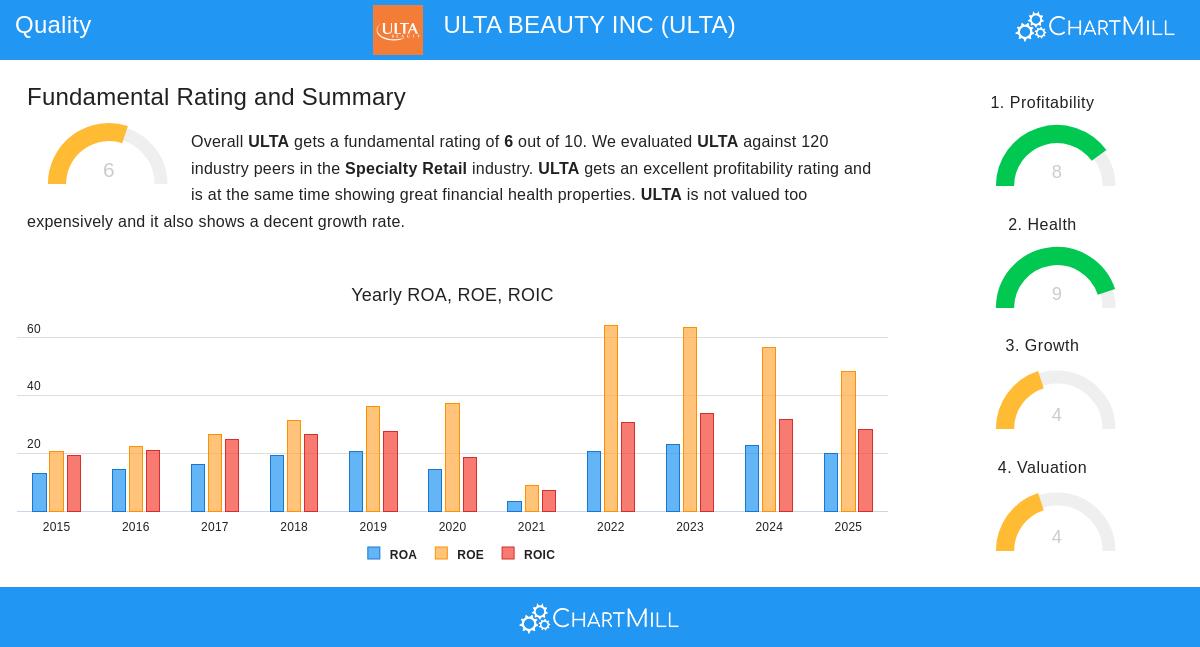

ULTA scores 6 out of 10 in our fundamental rating, performing well in profitability and financial health. Key highlights include:

- Profitability: High margins, with an operating margin of 13.7% and ROE of 49.1%, both ranking above most industry peers.

- Valuation: P/E of 18.6 is slightly below the S&P 500 average, offering reasonable pricing for its growth prospects.

- Growth Outlook: Analysts expect steady revenue and earnings growth in the coming years.

For investors seeking quality stocks with strong fundamentals, ULTA presents a well-rounded profile.

Our Caviar Cruise screener provides more quality investment ideas.

Disclaimer

This is not investing advice! Always conduct your own research before making investment decisions.