Investors looking for companies that mix solid increase with a fair cost frequently use a "Growth at a Reasonable Price" (GARP) or "Affordable Growth" method. This tactic aims to sidestep the pitfalls of paying too much for very fast increase while still gaining from companies growing quicker than the market. A useful method to apply this is by employing a stock screener that selects for a balanced fundamental picture: strong increase, fair valuation, and acceptable basic financial condition and earnings. This confirms the increase narrative is backed by a sound business, not merely hopeful excitement.

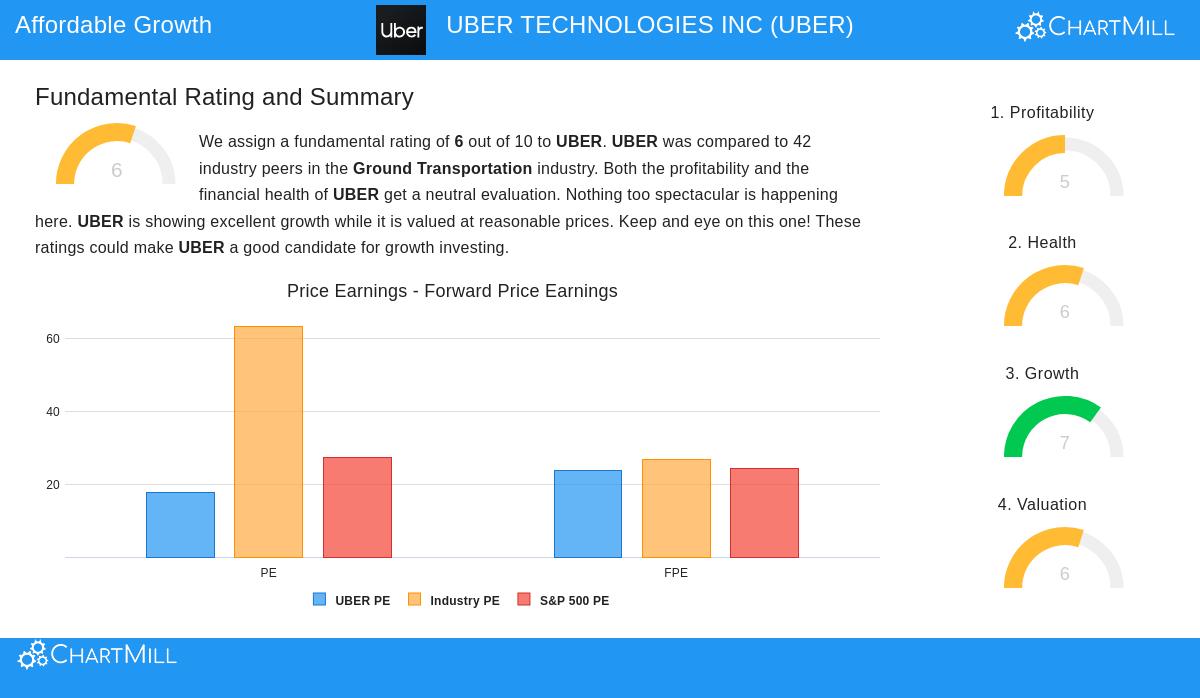

One company that recently appeared from this sort of screening process is UBER TECHNOLOGIES INC (NYSE:UBER). The ride-hailing and delivery leader, which has moved into freight logistics, offers an interesting example. According to a fundamental analysis report created by ChartMill, UBER receives an overall rating of 6 out of 10. More significantly, its separate scores match well with the affordable increase idea, highlighting the particular advantages and compromises that characterize this investment style.

Growth: The Main Driver

The main draw for any increase-focused investor is, expectedly, a company's expansion path. UBER performs well in this group, achieving a Growth Rating of 7. The company is showing forceful momentum from both a past and future viewpoint.

- Strong Past Results: Over the last year, UBER's Earnings Per Share (EPS) rose by a notable 137.62%, while revenue increased by 18.25%. The longer-term revenue increase rate averages a very solid 27.60% over recent years.

- Good Future Projections: The increase story is anticipated to persist. Analysts forecast an average yearly EPS increase of 30.03% and revenue increase of 13.81% in the next years.

This mix of excellent past results and a solid forward view creates the basic "increase" part of the tactic. Without this component, the hunt for a fair valuation would be pointless.

Valuation: The Fair Cost

Finding solid increase is only part of the challenge; the other is making sure you are not paying too much for it. This is where the valuation check becomes important, and UBER's Valuation Rating of 6 implies it resides in a fair area, particularly compared to its increase.

- Varied but Positive Measures: UBER's Price-to-Earnings (P/E) ratio of 17.68 is seen as high by itself. However, perspective matters:

- It is less expensive than 85.7% of similar companies in the Ground Transportation industry.

- It is priced below the current S&P 500 average P/E of 27.38.

- Increase Adjustment: The Price/Earnings-to-Growth (PEG) ratio, which modifies the P/E for projected earnings increase, shows UBER's valuation is "fairly inexpensive." This measure is important to the GARP thinking, as it directly connects price paid to increase received.

- Cash Flow View: Possibly most interesting is UBER's Price-to-Free-Cash-Flow ratio, which indicates the company is valued more inexpensively than 90.5% of its industry peers, hinting the market might be pricing its cash generation possibility too low.

For the affordable increase investor, these numbers show that while UBER is not a bargain-priced stock, its cost seems acceptable—and in some measures appealing—compared to both its high increase rate and its competitive and wider market setting.

Supporting Basics: Condition and Earnings

Lasting increase cannot stand alone; it must be backed by a steady financial base and the capacity to produce profits. UBER's scores here are average but sufficient, which is exactly what a screen for "acceptable" condition and earnings tries to find.

Financial Condition (Rating: 6) UBER's balance sheet displays both positive aspects and points of interest. Solvency measures are firm, with an Altman-Z score showing no bankruptcy danger and a low Debt-to-Free-Cash-Flow ratio of 1.36, indicating a good ability to reduce debt. Liquidity, with current and quick ratios near 1.15, is viewed as normal. A significant point for increase investors is the rise in shares outstanding over time, a typical action for funding expansion but one that can lessen value for current shareholders.

Earnings (Rating: 5) The company's path to steady earnings is a central piece of its narrative. After years of deficits, UBER has reached a new stage:

- It recorded positive net income and operating cash flow over the past year.

- Key efficiency ratios are now best in their industry, including a Return on Assets of 26.27% and a Return on Equity of 59.15%.

- Its Profit Margin of 33.54% also sits at the top of its industry.

These bettering earnings measures are vital. They change UBER from a pure "increase narrative" into an "earning increase narrative," lowering risk and improving the staying quality of its expansion.

Conclusion and Next Steps

UBER TECHNOLOGIES INC illustrates the kind of company an affordable growth screen is meant to identify. It has a forceful, double-digit increase driver in both earnings and revenue, which is the main source of investment attention. This increase is not combined with an extremely high valuation; instead, measures like its industry-relative P/E and good PEG ratio suggest the cost may be fair for the increase being provided. Also, the company's recent arrival at profitability and its generally acceptable financial condition supply a base that makes the increase path seem more durable.

The complete fundamental analysis that backs this view can be examined in the full ChartMill Fundamental Report for UBER.

For investors wanting to use this structured method to find other possible chances, the specific "Affordable Growth" screen that identified UBER is available here: View the Affordable Growth Stock Screen. This tool allows for more adjustment and finding of companies that balance increase, value, and fundamental soundness.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any securities. The analysis is based on data and ratings provided by ChartMill, and investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.