For investors aiming to build a portfolio centered on reliable income, a disciplined screening process is important. One useful method involves filtering for companies that not only provide an attractive dividend now but also have the basic financial strength to maintain and possibly increase those payments over time. This strategy focuses on quality and long-term viability over seeking the highest possible yield, which can sometimes indicate a troubled company. A practical way to apply this is by using a multi-factor screen that finds stocks with high dividend ratings, along with acceptable scores for profitability and financial soundness. This method helps sort through the market to find companies like Timken Co (NYSE:TKR), which may offer a balanced option for dividend-focused investors.

Examining Timken's Dividend Profile

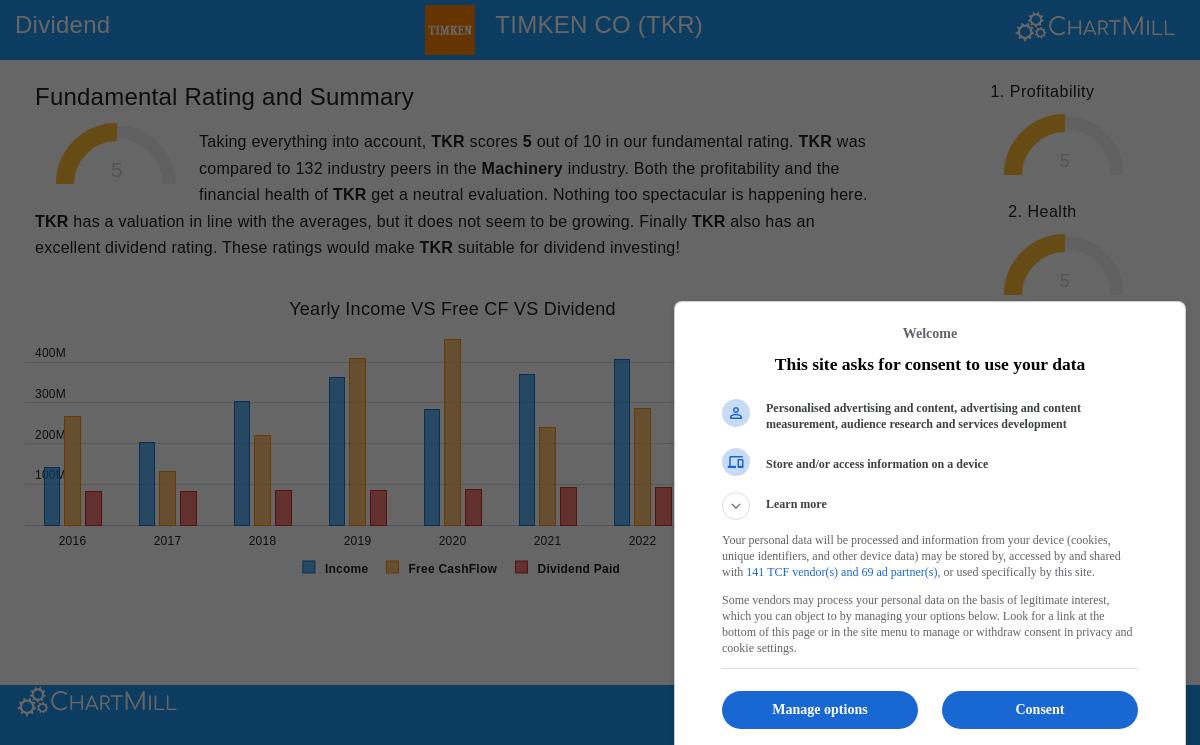

Timken Co, a long-established manufacturer of engineered bearings and industrial motion products, presents a strong case for dividend investors based on its fundamental report. The company receives a solid ChartMill Dividend Rating of 7 out of 10, a key measure that combines several important factors for income-seeking investors.

- Yield and Reliability: Timken currently provides a dividend yield of 1.55%. While not the highest available, it is almost double the average yield of its peers in the machinery industry (0.80%) and is similar to the broader S&P 500. Significantly, the dividend is supported by a good history. The company has paid dividends without interruption for more than ten years and has not cut its payout in that period, showing a management dedication to returning capital to shareholders.

- Growth and Sustainability: The dividend has increased at an annual rate of about 4.12% over the last five years. This growth is helped by a conservative payout ratio of 32.9%, meaning less than a third of its earnings are used to pay the dividend. This low ratio is a foundation of dividend sustainability, as it provides significant room for the company to invest in its operations, handle economic challenges, and continue increasing the dividend without pressuring its finances.

Supporting Fundamentals: Profitability and Financial Soundness

A high dividend rating by itself is insufficient, it must be backed by a sound business. This is why the screening criteria also call for acceptable scores in profitability and financial soundness. Timken’s ratings in these areas (both a 5 out of 10) point to a stable, though not outstanding, basic business.

- Profitability Assessment: The company’s profitability measures are generally comparable to industry averages. Its operating margin of 13.21% is a relative positive, doing better than about 65% of its competitors. While its profit margin has faced some recent pressure, the company keeps positive earnings and cash flow from operations, which are fundamental needs for consistently supporting a dividend.

- Financial Health Check: Timken’s balance sheet shows a varied but acceptable situation. On the positive side, the company displays good liquidity, with a current ratio of 3.11 indicating no problem in meeting short-term obligations. Its debt-to-equity ratio of 0.67 points to a moderate level of debt. The analysis observes that Timken’s return on invested capital is currently higher than its cost of capital, meaning it is still generating value for shareholders, an important factor for long-term dividend sustainability.

Valuation and Growth Factors

From a valuation viewpoint, Timken seems fairly priced compared to both its industry and the wider market. Its forward price-to-earnings (P/E) ratio of 15.18 is lower than about 85% of its industry peers and is under the S&P 500 average. This indicates the stock is not priced too high, offering some safety for new investors. The main area to note is growth, the company’s revenue and earnings growth have been limited lately and are projected to stay that way in the short term. For a dividend investor, this is a balance to recognize: Timken provides stability and dependable income instead of high capital gains.

Conclusion

For an investor using a screen for high-quality dividend payers, Timken Co stands as a candidate that meets several important criteria. It joins a dependable and increasing dividend, supported by a low payout ratio and a long history, with the basic profitability and financial soundness needed to continue it. The valuation is not high, and the company’s solid position in industrial markets gives a level of cyclical durability. It illustrates the screen’s objective: to find companies where the dividend is not a showy but dangerous feature, but a lasting part of a healthy business.

Interested in reviewing other stocks that pass this disciplined dividend screen? You can see the complete list of qualifying companies by visiting the Best Dividend Stocks screen.

,

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The analysis is based on data provided and reflects conditions at a specific point in time, which are subject to change.