TJX COMPANIES INC (NYSE:TJX) stands out as a strong candidate for quality investors, according to our Caviar Cruise stock screener. The company demonstrates consistent growth, high profitability, and solid financial health, making it a compelling choice for long-term investors. Below, we examine why TJX meets the criteria for quality investing.

Revenue and Profit Growth

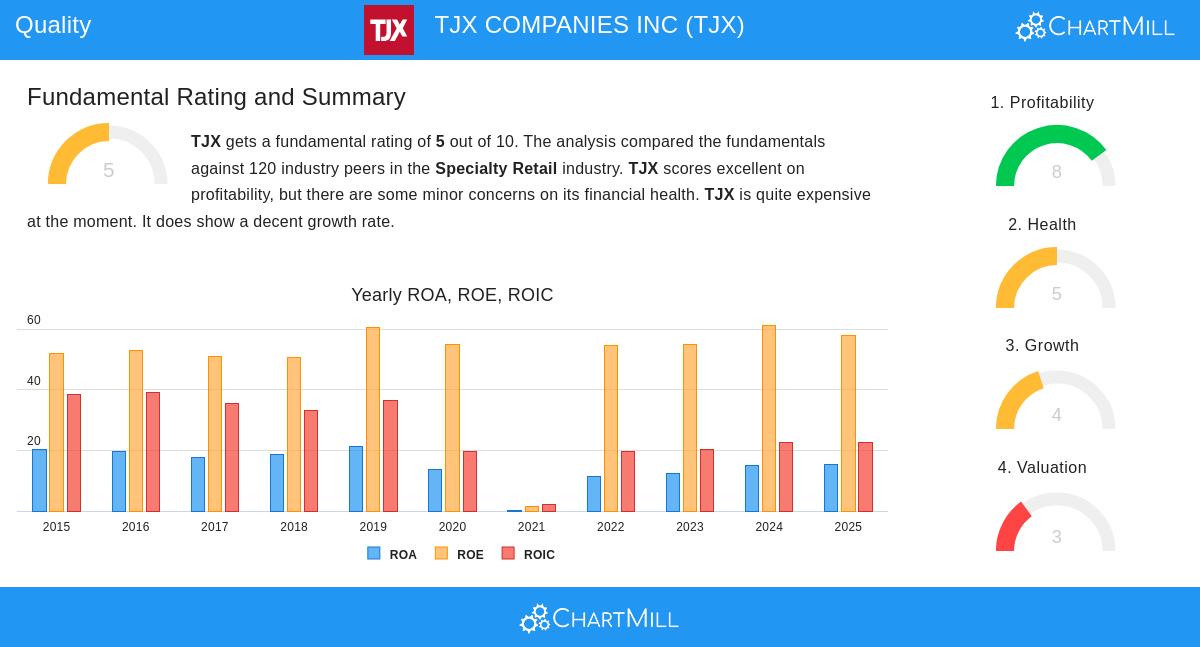

TJX has delivered steady growth, with a 5-year revenue CAGR of 5.59% and EBIT growth of 7.32%. The fact that EBIT growth outpaces revenue growth suggests improving operational efficiency and pricing power—key traits for a quality business.

High Return on Invested Capital (ROIC)

The company generates a strong ROIC of 28.23%, well above our 15% threshold. This indicates TJX effectively allocates capital to profitable investments, reinforcing its competitive position in the retail sector.

Strong Financial Health

TJX maintains a low debt-to-free cash flow ratio of 0.76, meaning it could repay all its debt in less than a year using current cash flows. This financial flexibility reduces risk and supports sustainable growth.

Profit Quality

The company excels in converting net income into free cash flow, with a 5-year average profit quality of 946.84%. This exceptional figure suggests TJX generates significant cash from operations, a hallmark of a well-run business.

Valuation and Dividend

While TJX trades at a premium with a P/E of 30.13, its strong fundamentals and consistent dividend growth (10.48% annual increase) justify the valuation for quality-focused investors.

Our Caviar Cruise screener identifies more quality stocks like TJX, updated daily. For a deeper dive, review the full fundamental analysis of TJX.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.