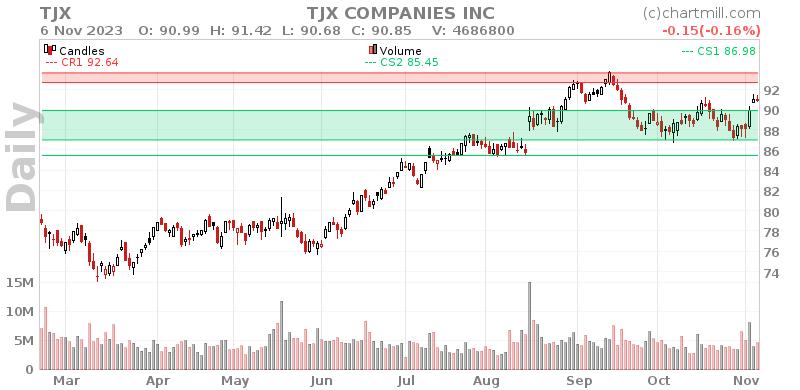

A possible breakout setup was detected on TJX COMPANIES INC (NYSE:TJX) by our stockscreener. A breakout pattern is formed when a stock consolidates after a strong rise up. We note that this pattern is detected purely based on technical analysis and whether the breakout actually materializes remains to be seen. It could be interesting to keep an eye on NYSE:TJX.

In-Depth Technical Analysis of NYSE:TJX

As part of its analysis, ChartMill provides a comprehensive Technical Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various technical indicators and properties.

We assign a technical rating of 9 out of 10 to TJX. This is due to a consistent performance in both the short and longer term time frames. Also compared to the overall market, TJX is showing a nice and steady performance.

- Both the short term and long term trends are positive. This is a very positive sign.

- When comparing the yearly performance of all stocks, we notice that TJX is one of the better performing stocks in the market, outperforming 90% of all stocks. We also observe that the gains produced by TJX over the past year are nicely spread over this period.

- TJX is part of the Specialty Retail industry. There are 132 other stocks in this industry. TJX outperforms 87% of them.

- TJX is currently trading in the upper part of its 52 week range. The S&P500 Index is also trading in the upper part of its 52 week range, so TJX is performing more or less in line with the market.

- In the last month TJX has a been trading in a tight range between 86.92 and 91.52.

Check the latest full technical report of TJX for a complete technical analysis.

How do we evaluate the setup for NYSE:TJX?

ChartMill also assign a Setup Rating to every stock. With this score it is determined to what extend the stock has been trading in a range in the recent days and weeks. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. NYSE:TJX scores a 8 out of 10:

TJX has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 92.64. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 89.88, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

How to trade NYSE:TJX?

One strategy to consider is waiting for the actual breakout to occur, where the stock breaks out above the current consolidation zone. Traders can then enter a buy position, anticipating further upward momentum. As a risk management measure, it is advisable to set a stop loss order below the consolidation zone.

Please note that this article should not be construed as trading advice. The information provided is solely based on automated technical analysis and serves to highlight technical observations. It is important to conduct your own analysis and make trading decisions based on your own judgment and responsibility.

Our Breakout screener lists more breakout setups and is updated daily.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.