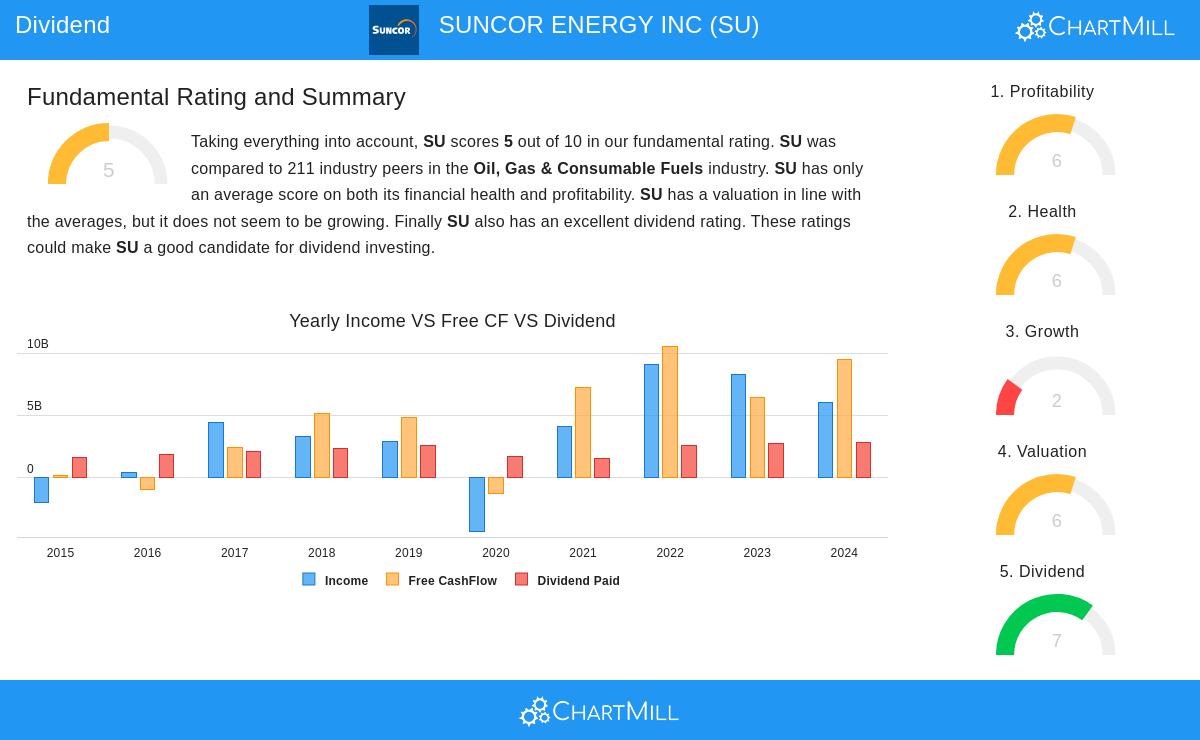

For investors looking for steady income, dividend investing is a fundamental method. The process includes finding companies with good dividend traits while keeping enough profitability and financial soundness to continue those distributions. Using ChartMill's filtering system, we can select for stocks with a Dividend Rating of 7 or more, a Profitability Rating of no less than 5, and a Health Rating of no less than 5. This mix helps find companies that not only have appealing dividends but also have the fundamental business capacity to support them. Suncor Energy Inc (NYSE:SU) appears as a candidate from this filter, justifying a more detailed examination for portfolios focused on income.

Dividend Profile

The main attraction for dividend investors is found in Suncor's solid dividend traits, which are key to the filtering rules that focus on lasting and appealing income.

- Appealing Yield: Suncor provides a yearly dividend yield of 4.02%, which gives a significant income flow that is notably higher than the S&P 500 average of about 2.44%.

- Dependable History: The company has built a dependable history by distributing dividends for a minimum of 10 years, giving investors a record of dedication to shareholder returns.

- Maintainable Growth: The dividend has a yearly growth rate of 5.68%, and significantly, this growth is backed by earnings that are increasing more quickly, showing the raises are maintainable and not pressuring the company's financials.

- Payout Factors: The payout ratio is at 49.55%, which is elevated but stays within a span that is usually viewed as acceptable, particularly considering the company's earnings path.

These elements together add to Suncor's good ChartMill Dividend Rating of 7. A high yield paired with a history of distributions and maintainable growth measures are precisely what the filtering system aims to find, as they lower the chance of a dividend reduction and supply a base for long-term income growth.

Profitability and Financial Health

While the dividend is the main feature, the filtering method correctly highlights that profitability and financial soundness are the foundations that support it. Suncor shows ability in these areas, which is essential for the lasting endurance of its dividend.

The company's profitability is sound, with a ChartMill Profitability Rating of 6. Important measures include a Return on Equity of 12.70% and a Profit Margin of 11.38%, both of which do better than a large part of its industry competitors. Also, its operating margin has displayed positive improvement in recent years. This steady profitability is critical for the filtering plan because it makes certain the company produces enough earnings to finance its dividend distributions without turning to debt or using up cash savings.

From a balance sheet viewpoint, Suncor receives a ChartMill Health Rating of 6. Its solvency is a specific positive, with a very good Debt-to-Free-Cash-Flow ratio of 1.69, showing it could settle all its debts fast with its present cash flow and doing better than most of its industry. The company has also been decreasing its count of shares outstanding, which is an action favorable to shareholders. While its liquidity ratios are more average, the complete financial soundness image indicates a company that is not excessively indebted and has the steadiness needed for a dividend investment plan. A sound company is much less probable to stop its dividend during economic declines.

Valuation and Growth Setting

Suncor presents an interesting valuation situation for investors looking for fairly priced assets. With a Price-to-Earnings ratio of 11.79, the stock is valued lower than the wider S&P 500 and a majority of its industry competitors. This valuation, when paired with its dividend yield, provides an appealing starting point for income investors. However, it is significant to see that the company's growth profile is more subdued, with a ChartMill Growth Rating of 2. While future earnings per share are anticipated to improve, revenue improvement has been and is forecast to be mostly level. For a dividend-centered plan, high improvement is frequently less important than steadiness and yield, but it stays a point for investors to weigh in their total evaluation.

A detailed summary of these fundamental ratings is provided in the full ChartMill Fundamental Analysis Report for SU.

Conclusion

Suncor Energy Inc stands as an interesting example of a stock that matches a systematic dividend investing plan. It effectively satisfies the central filtering requirements of a high dividend rating, backed by adequate profitability and financial soundness. The appealing yield, dependable distribution history, and maintainable payout ratio make it a candidate for income portfolios, while its fair valuation increases its appeal. Investors should note that the company works in the cyclical energy sector, which should be included in any lasting choice.

For investors aiming to perform their own research and find other companies that match this description, the Best Dividend Stocks screen on ChartMill offers a solid beginning for more study.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. All investment decisions should be based on your own research, risk tolerance, and financial objectives.