Investors looking for growth chances at fair prices often use screening methods that find companies with good expansion possibilities while keeping solid financial basics. The "Affordable Growth" method focuses on stocks showing strong growth paths, good profitability, and positive financial measures, all while being valued at prices that do not completely reflect future possibilities. This approach tries to find companies set for continued expansion without paying too high a price, mixing growth possibility with price awareness.

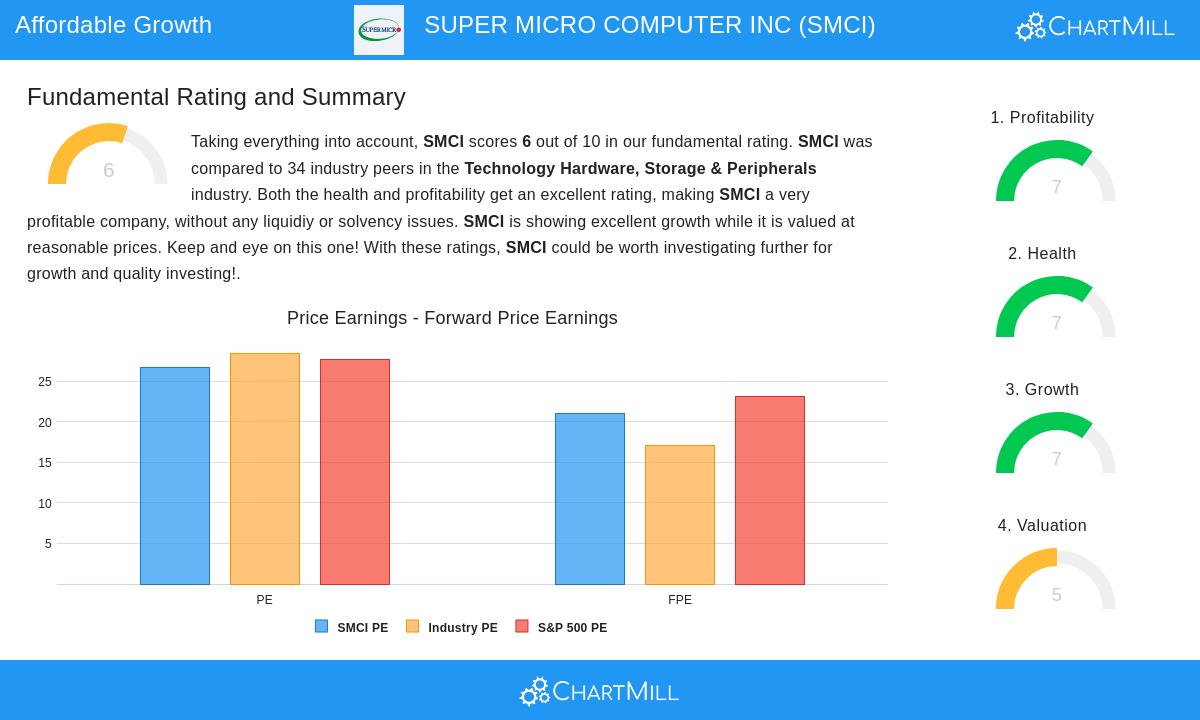

SUPER MICRO COMPUTER INC (NASDAQ:SMCI) appears as an interesting candidate under this investment structure, getting an overall fundamental score of 6 out of 10 based on ChartMill's detailed review. The company focuses on making and selling high-performance computing solutions, like rack-scale systems made for artificial intelligence, business data centers, and edge computing uses.

Growth Path

The company shows notable expansion numbers that fit well with affordable growth standards. Past performance shows large revenue rises, while future estimates suggest continued movement:

- Revenue jumped 46.59% over the last year, with a five-year average yearly growth rate of 45.76%

- Earnings per share have increased at an average yearly rate of 50.41% over several years

- Forward estimates predict 19.06% EPS growth and 19.86% revenue growth each year

While recent three-month EPS showed a small decrease of 5.89%, the long-term growth story stays in place. The mix of outstanding past growth and good forward estimates places SMCI well within the growth investing space, especially since future growth rates, though slowing from past highs, stay much higher than market averages.

Valuation Review

SMCI's valuation numbers show a detailed view that backs its grouping as fairly priced compared to growth outlooks:

- P/E ratio of 26.72 matches the S&P 500 average of 27.69 closely

- Forward P/E of 21.04 looks good next to both current market and past averages

- Enterprise Value to EBITDA ratio points to a less expensive valuation than 61.76% of industry peers

- Price/Free Cash Flow ratio is lower than 70.59% of similar companies

The PEG ratio, which changes the P/E multiple for expected growth, hints the stock might be priced low given its earnings expansion path. For growth investors, this valuation picture shows a good buying chance, as the market seems to be valuing the stock cautiously relative to its growth possibility.

Profitability and Financial Condition

Beyond growth and valuation, SMCI displays basic strengths that lower investment risk and support lasting expansion:

Profitability measures show working efficiency:

- Return on Assets of 7.48% beats 82.35% of industry rivals

- Return on Equity of 16.64% is more than 85.29% of similar companies

- Profit margin of 4.77% is higher than 73.53% of the industry

Financial condition signs give stability confidence:

- Current ratio of 5.25 shows strong short-term cash availability, better than 91.18% of peers

- Quick ratio of 3.25 shows very good immediate payment ability

- Altman-Z score of 5.60 suggests low bankruptcy risk, doing better than 82.35% of competitors

The combination of better-than-average profitability and strong financial condition builds a base that supports continued growth without too much risk, a key point for investors using the affordable growth plan.

Investment Points

SMCI stands as an interesting example in affordable growth investing, mixing solid expansion outlooks with fair valuation multiples. The company's place in high-growth computing areas, especially AI and business solutions, gives support for continued performance. While investors should watch gross margin pressures and share dilution points, the overall basic view supports the idea that SMCI provides growth at a fair price.

For investors looking for similar chances, more screening results can be found using the Affordable Growth Stock Screener, which finds companies matching these specific rules.

Disclaimer: This review is based on fundamental data and screening ways for information only. It does not make up investment advice, and investors should do their own research and think about their personal money situation before making investment choices. Past results do not promise future results, and all investments have built-in risks.