Our stock screener has spotted ROYAL GOLD INC (NASDAQ:RGLD) as a stocks which checks several boxes as specified by Mark Minervini. We will dive into an analysis below.

RGLD passes the Minervini Trend Template check!

The Minervini Trend Template is a set of technical criteria designed to identify stocks in strong uptrends. We can check all the boxes for RGLD:

- ✔ Relative Strength is above 70.

- ✔ Current price is within 25% of it's 52-week high.

- ✔ Current price is at least 30% above it's 52-week low.

- ✔ The current price is above the 50-, 150- and 200-day SMA price line.

- ✔ The SMA(200) is trending upwards.

- ✔ The SMA(150) is above the SMA(200)

- ✔ The SMA(50) is above the SMA(150) and the SMA(200)

Some of the high growth metrics of RGLD highlighted

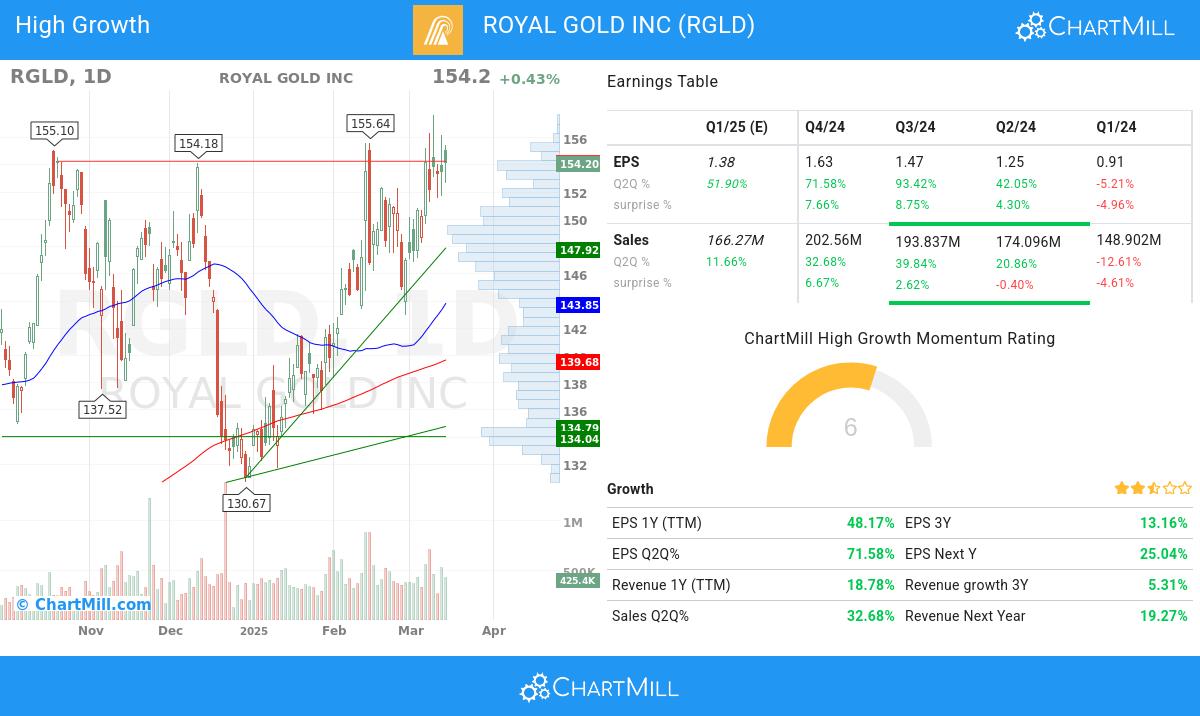

ChartMill employs its own High Growth Momentum Rating (HGM) system for all stocks. This score, ranging from 0 to 10, is derived by evaluating different growth and profitability factors, such as EPS and revenue growth, as well as accelleration, surprises and revision history. RGLD has earned a 6:

Explosive Earnings Growth

- RGLD has shown positive momentum in its earnings per share (EPS) on a quarter-to-quarter (Q2Q) basis, with a 71.58% increase. This reflects the company's successful execution of its business strategies and its commitment to delivering improved financial results.

- RGLD has achieved 48.17% growth in EPS over the past 12 months, reflecting a sustained improvement in earnings performance.

- RGLD has achieved 32.68% growth in its revenue over the previous quarter, signaling positive momentum in its financial performance and potential market opportunities.

- RGLD has a strong history of beating EPS estimates 3 times in the last 4 quarters, signaling its ability to consistently exceed market expectations. This indicates the company's strong financial performance and its potential for creating shareholder value.

Profitability & Financial Strength

- With a favorable trend in its operating margin over the past year, RGLD demonstrates its ability to enhance profitability through efficient operations. This growth reflects the company's focus on optimizing its cost structure.

- In the past year RGLD has expanded its Profit Margin, which demonstrates increasing profitability.

- RGLD demonstrates a strong Return on Equity(ROE) of 10.65%. This indicates the company's ability to generate favorable returns for shareholders and reflects its efficient utilization of capital. ROYAL GOLD INC shows promising potential for continued success.

- RGLD exhibits a favorable Debt-to-Equity ratio at 0.0. This highlights the company's ability to limit excessive debt levels and maintain a strong equity base, demonstrating its financial stability and risk management practices.

Institutional Confidence & Market Strength

- RGLD demonstrates a balanced ownership structure, with institutional shareholders at 88.27%. This indicates a diverse investor base, which can contribute to price stability and potential future growth.

- The Relative Strength (RS) of RGLD has consistently been strong, with a current 90.79 rating. This indicates the stock's ability to exhibit relative price outperformance and reflects its competitive strength.

How does the Setup look for RGLD

The Setup Rating of a stock determines to which extend the stock is consolidating. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. For RGLD this score is currently 8:

Besides having an excellent technical rating, RGLD also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is a resistance zone just above the current price starting at 154.21. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 147.92, a Stop Loss order could be placed below this zone.

Check the latest full technical report of RGLD for a complete technical analysis.

Final Thoughts

More ideas for high growth momentum stocks can be found on ChartMill in our High Growth Momentum + Trend Template screen.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.