DR. REDDY'S LABORATORIES-ADR (NYSE:RDY) emerged from our Peter Lynch-inspired screen as a potential fit for growth-at-a-reasonable-price (GARP) investors. The company combines steady earnings growth with sound financial health, trading at a valuation that may appeal to long-term investors.

Why RDY Fits the Peter Lynch Criteria

- Strong Earnings Growth: Over the past five years, RDY has delivered an average annual EPS growth of 23.5%, comfortably within Lynch’s preferred range of 15-30%.

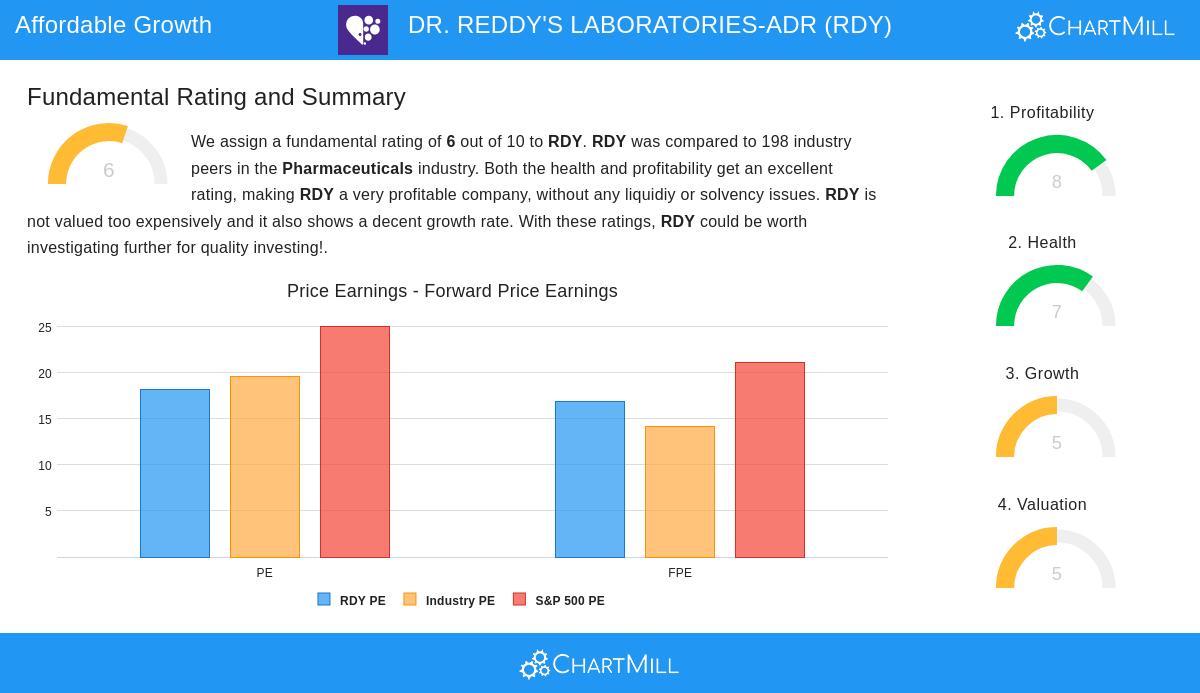

- Reasonable Valuation: While the PEG ratio (2.31) is slightly above Lynch’s ideal threshold of 1, the company’s P/E of 18.22 is below both the industry average (19.62) and the S&P 500 (25.05).

- Healthy Balance Sheet: With a Debt/Equity ratio of just 0.02, RDY is nearly debt-free, aligning with Lynch’s preference for conservatively financed businesses.

- Profitability: A Return on Equity (ROE) of 16.8% exceeds Lynch’s 15% benchmark, reflecting efficient use of shareholder capital.

- Liquidity: The Current Ratio of 1.92 indicates sufficient short-term financial flexibility.

Fundamental Strengths

Our fundamental analysis highlights RDY’s robust profitability metrics, including:

- Operating Margin of 21.3%, outperforming 86% of pharmaceutical peers.

- ROIC of 14.5%, signaling effective capital allocation.

- Consistent positive cash flow and earnings over the past five years.

Considerations

- Slowing Growth: Future EPS and revenue growth are projected to moderate, which may weigh on valuation if trends persist.

- Dividend Yield: At 0.65%, income-seeking investors may find the payout less attractive.

For investors seeking similar opportunities, our Peter Lynch Strategy screener updates daily with fresh ideas.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own research before making investment decisions.