QIFU TECHNOLOGY INC (NASDAQ:QFIN) stands out as a strong candidate for quality investors, meeting key criteria for revenue growth, profitability, and financial health. The company operates in China’s consumer finance sector, providing credit technology services with a focus on sustainable growth and operational efficiency.

Why QFIN Fits the Quality Investing Criteria

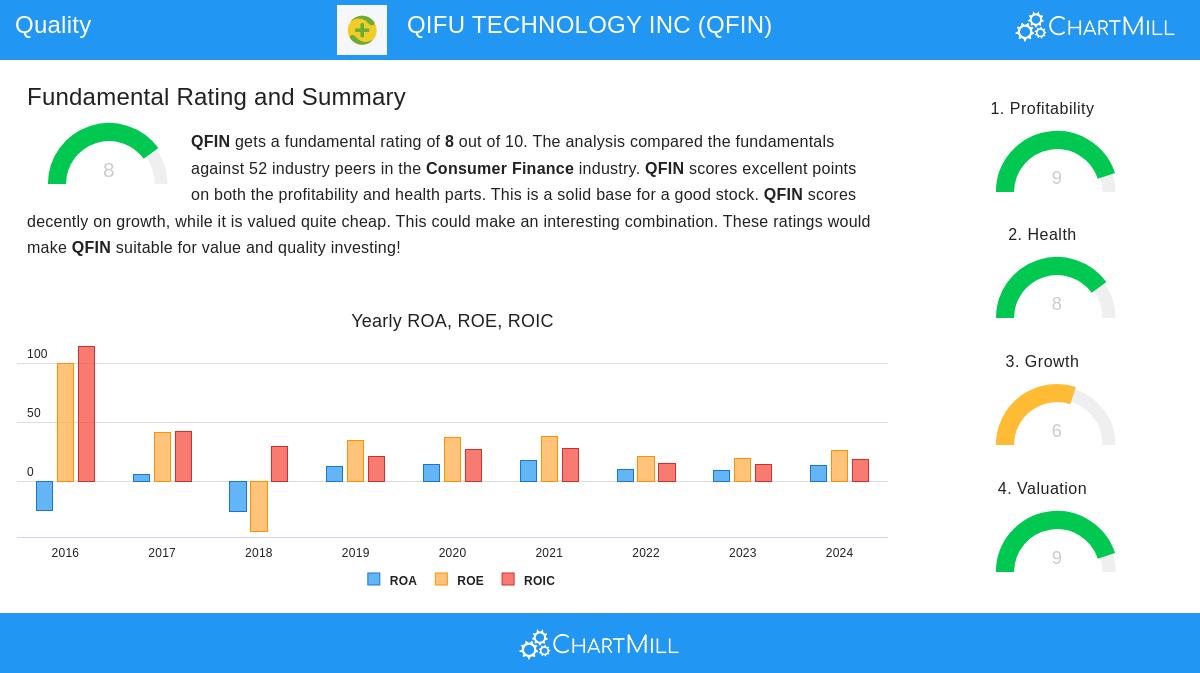

- Strong Revenue and EBIT Growth: Over the past five years, QFIN has delivered an annual revenue growth of 8.48% and EBIT growth of 21.07%, indicating not just top-line expansion but also improving operational efficiency.

- High Return on Invested Capital (ROIC): With an ROIC of 21.86%, the company demonstrates an ability to generate strong returns from its capital investments, well above the 15% threshold for quality stocks.

- Low Debt Burden: The Debt-to-Free Cash Flow ratio of 0.60 suggests QFIN can pay off its debt in less than a year using its current cash flow, reflecting a conservative balance sheet.

- Profit Quality: The company converts net income into free cash flow at an impressive rate, with a five-year average profit quality of 141.63%, far exceeding the 75% benchmark.

Valuation and Financial Health

QFIN trades at a P/E ratio of 6.60, well below both industry and S&P 500 averages, suggesting an attractive valuation. The company maintains solid liquidity, with a current ratio of 3.08, and has consistently reduced its share count over the past five years.

Analysts expect earnings to grow by 18.77% annually, reinforcing the case for long-term holding.

Final Thoughts

For investors seeking quality businesses with strong fundamentals, QFIN presents a compelling opportunity. Its combination of growth, profitability, and financial stability aligns well with the principles of quality investing.

Our Caviar Cruise screener lists more quality stocks and is updated daily.

For a deeper dive, review the full fundamental analysis of QFIN.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.