QIFU TECHNOLOGY INC (NASDAQ:QFIN) stands out as a strong candidate for quality investors, based on our Caviar Cruise screening methodology. The company demonstrates consistent growth, high profitability, and solid financial health, making it a noteworthy option for long-term investors. Below, we examine why QFIN meets the criteria for quality investing.

Key Strengths of QFIN

- Strong Revenue and EBIT Growth: Over the past five years, QFIN has delivered an annual revenue growth of 8.48% and EBIT growth of 21.07%, indicating not only expansion but also improving operational efficiency.

- High Return on Invested Capital (ROIC): With an ROIC of 26.0%, the company efficiently generates profits from its capital investments, placing it among the top performers in its industry.

- Low Debt and Strong Cash Flow: QFIN’s debt-to-free cash flow ratio is an exceptionally low 0.15, meaning it could repay all its debt in less than two months using current cash flows. This reflects a highly sustainable financial structure.

- Profit Quality: The company converts 141.6% of its net income into free cash flow, well above our 75% threshold, signaling strong earnings quality and efficient cash generation.

Valuation and Future Prospects

QFIN appears reasonably valued, with a P/E ratio of 7.6, below both industry and S&P 500 averages. Analysts expect continued earnings growth of 16.2% annually, reinforcing its appeal as a growth stock.

Fundamental Analysis Summary

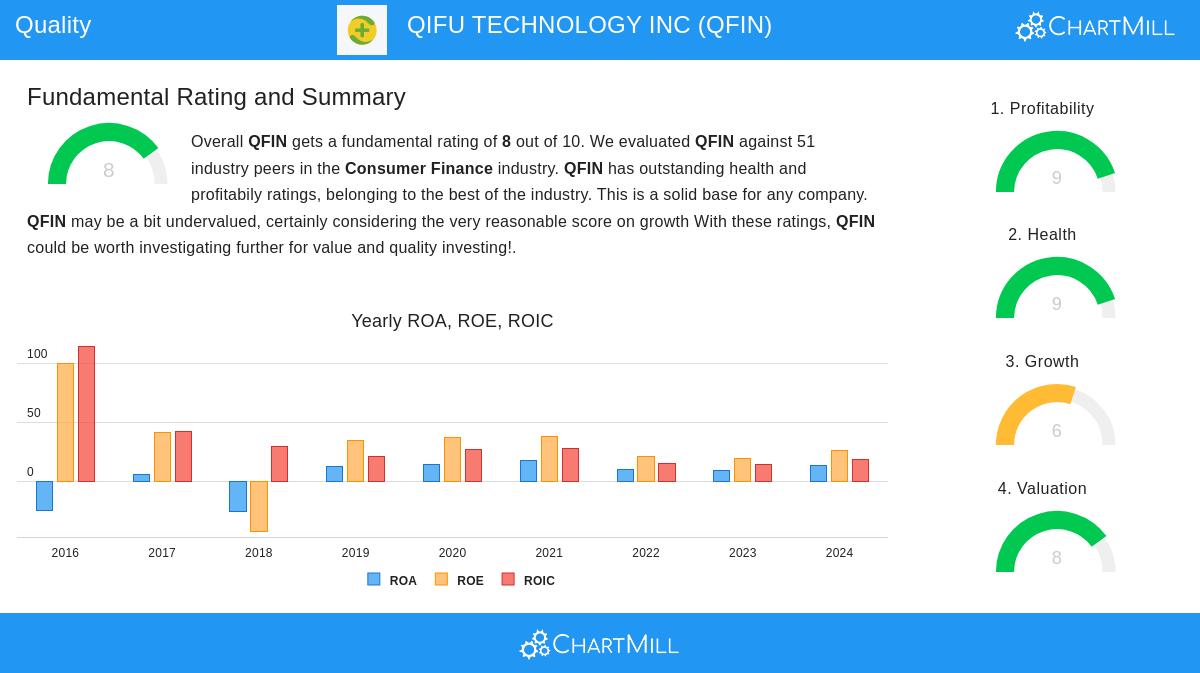

Our full analysis rates QFIN 8 out of 10, highlighting its outstanding profitability, financial health, and growth potential. The company outperforms most peers in key metrics like operating margin (43.9%) and return on equity (25.9%).

For more quality stock ideas, explore our Caviar Cruise screener.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.