Known for his philosophy of investing in what you know, Peter Lynch looked for companies with consistent earnings growth, low debt, and a competitive edge. Does QIFU TECHNOLOGY INC (NASDAQ:QFIN) meet these key criteria? Let’s find out.

Evaluating QIFU TECHNOLOGY INC (NASDAQ:QFIN) using Peter Lynch’s legendary strategy

- The Return on Equity (ROE) of QFIN stands at 25.9%, reflecting the company's strong profitability and effective utilization of shareholder equity. This metric signifies the company's ability to generate returns for its investors.

- A Debt/Equity ratio of 0.06 suggests that QFIN is managing its debt levels responsibly.

- The EPS of QFIN has shown consistent growth over a 5-year period, indicating the company's ability to generate increasing earnings over time.

- With a PEG ratio of 0.33, QFIN presents a compelling case for growth at a fair price.

- QFIN's Current Ratio of 2.45 reflects a strong ability to manage short-term financial commitments.

What is the full fundamental picture of QFIN telling us.

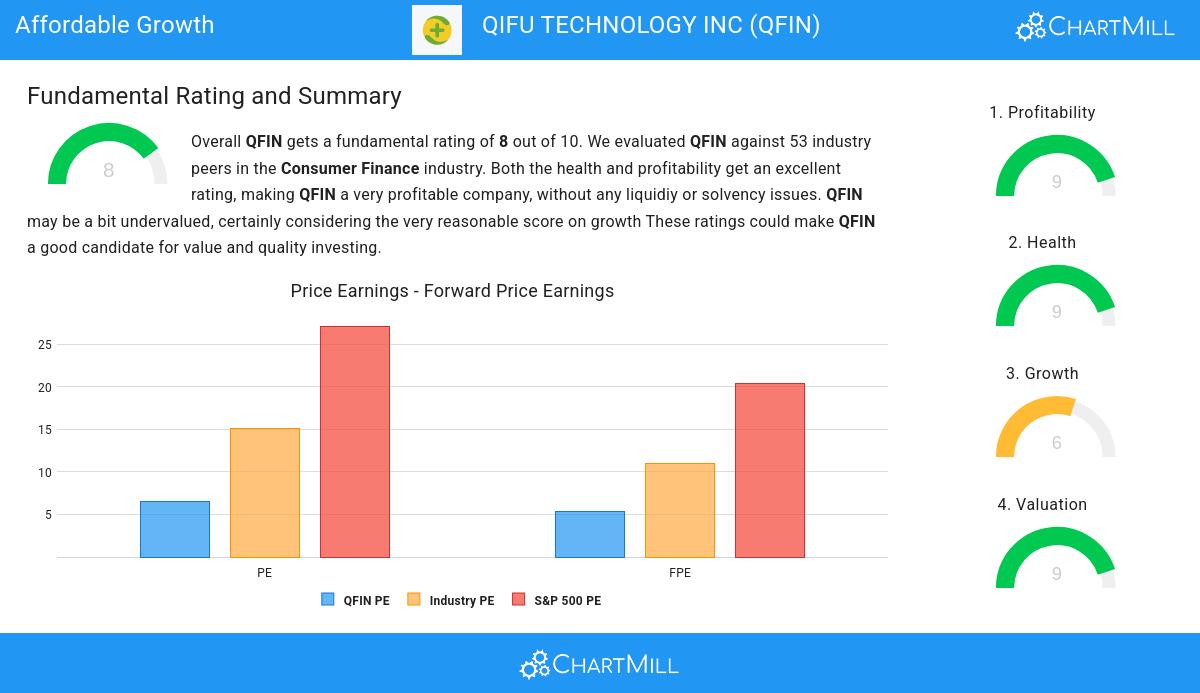

At ChartMill, a crucial aspect of their analysis is the assignment of a Fundamental Rating to each stock. This rating, ranging from 0 to 10, is calculated daily by considering numerous fundamental indicators and properties.

We assign a fundamental rating of 8 out of 10 to QFIN. QFIN was compared to 53 industry peers in the Consumer Finance industry. QFIN gets an excellent profitability rating and is at the same time showing great financial health properties. QFIN may be a bit undervalued, certainly considering the very reasonable score on growth With these ratings, QFIN could be worth investigating further for value and quality investing!.

Check the latest full fundamental report of QFIN for a complete fundamental analysis.

Our Peter Lynch screener lists more Affordable Growth stocks and is updated daily.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.