Investors looking for long-term growth chances at fair prices often use established methods like the Peter Lynch investment strategy. This method, explained in Lynch's book One Up on Wall Street, centers on finding companies with lasting earnings growth, good financial condition, and prices that do not exaggerate their future possibilities. The strategy focuses on fundamental review instead of market prediction, looking for businesses that are making money, have little debt, and are available at costs that match their growth ability without extreme guesswork. It is a structured system for growth at a fair price (GARP) investing, focusing on long-term ownership and a solid grasp of the main business.

Meeting the Lynch Criteria

Sprott Physical Gold Trust (NYSEARCA:PHYS) appears as a candidate from a screen created using Lynch's ideas. The strategy’s filters are made to find companies with a particular set of features for growth, price, and financial steadiness, and PHYS shows a match with a number of these important measures.

- Sustainable Earnings Growth: A key part of the Lynch method is a solid, but not extremely fast, increase in earnings per share (EPS). PHYS states a 5-year EPS growth rate of 18.47%, which easily meets the screen's 15% minimum level. More significantly, it is well under the 30% upper limit Lynch proposes, showing a speed of increase that is possibly more maintainable over many years, steering clear of the instability often linked with very fast growth.

- Attractive Valuation via PEG Ratio: Maybe the most interesting measure for a GARP investor is the Price/Earnings to Growth (PEG) ratio. Lynch liked companies with a PEG ratio of 1 or lower, indicating that the stock's cost is fair compared to its earnings growth. PHYS has a very low PEG ratio of 0.23, which implies the market might be setting a low value on its growth path. This directly meets the Lynch goal of locating growth without giving a high extra cost for it.

- Exceptional Financial Health: The strategy gives great importance to a company's financial standing to reduce risk.

- Debt/Equity Ratio: PHYS has a Debt/Equity ratio of 0.0, showing it functions with no debt. This is much better than the screen's need to be below 0.6 and matches Lynch's own liking for very little borrowed money, offering a large safety buffer.

- Current Ratio: The trust's Current Ratio is very high at over 39,482, greatly exceeding the requirement of being at least 1. This shows very high short-term cash availability and a strong ability to cover its responsibilities.

- Strong Profitability: Lynch looked for companies that effectively produce profits from money invested by shareholders. PHYS performs well here with a Return on Equity (ROE) of 26.73%, which is much higher than the 15% minimum filter, indicating good management and a money-making way of operating.

Fundamental Analysis Overview

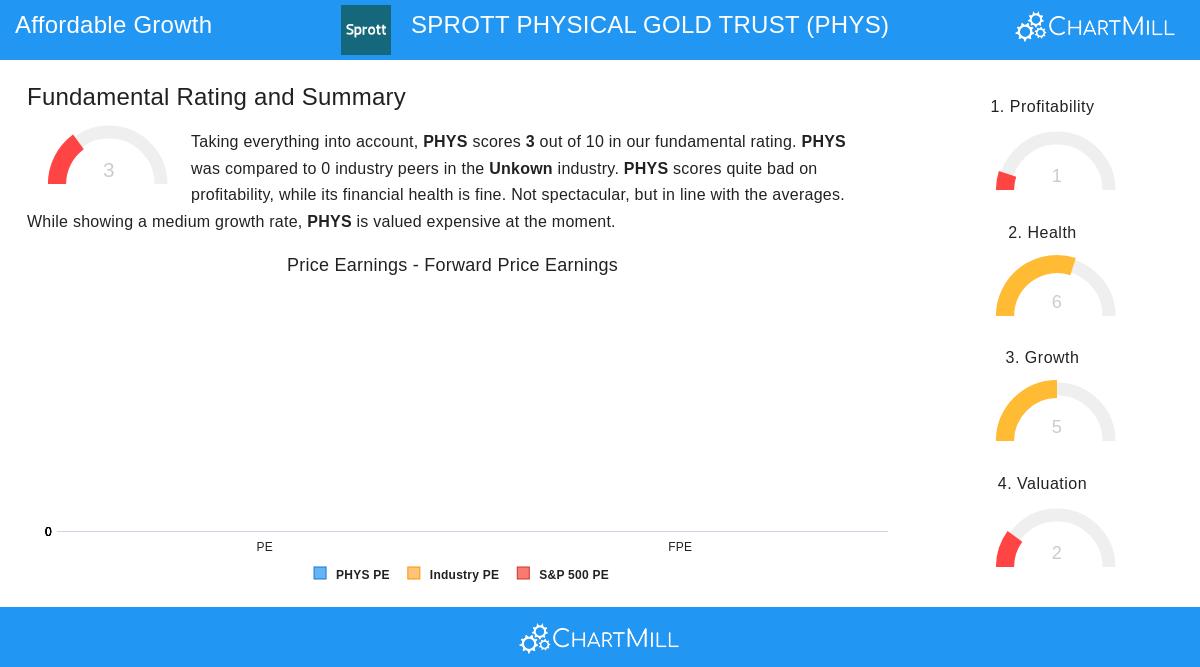

A detailed fundamental analysis for PHYS gives a varied but interesting view, receiving a total score of 3 out of 10. The trust's best features are in its growth and financial condition. The growth review points out notable recent results in both EPS and Revenue, while the health score is supported by the total lack of debt and outstanding cash ratios. However, the trust's profitability score is clearly poor, mainly because of a past of negative operational cash movements. Its valuation score is also low, but this is mostly because standard valuation measures can be hard to understand for a trust that keeps physical gold bars as its main holding.

A Unique Profile for Consideration

It is very important for investors to know the special character of Sprott Physical Gold Trust. Different from a typical operating company, PHYS is a closed-end fund made to hold physical gold bars. This setup means its "revenue" and "earnings" are mainly caused by movements in the market cost of gold and the creation of new trust shares. This background is necessary when judging its financial numbers, as they show the behavior of the gold market rather than sales of products. For an investor, PHYS represents a position on the long-term worth of gold with the ease of a stock, which might interest those looking for a physical item inside a GARP-focused collection.

For investors curious about finding other companies that pass this strict investment screen, you can review the complete list of results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented should not be used as the sole basis for any investment decision. Investors should conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.