Investors looking for growth possibilities often encounter the difficulty of finding companies with solid fundamental outlooks that are also set for short-term price gains. One technique that meets this two-part requirement involves filtering for stocks that display strong growth attributes while also showing positive technical breakout formations. This method joins the prospective quality of fundamental analysis, which evaluates a company's financial condition and growth possibilities, with the market timing understanding offered by technical analysis, which studies price trends and chart formations. The objective is to find companies where solid business fundamentals are starting to be acknowledged by the market through bettering price movement.

OLLIE'S BARGAIN OUTLET HOLDINGS (NASDAQ:OLLI) functions as a retailer of closeouts, surplus inventory, and salvage goods through more than 575 stores in 31 states. The company's business plan centers on purchasing overproduced, overstocked, and closeout goods from manufacturers, wholesalers, and other retailers, along with its own label items. This situation enables the company to provide brand-name goods at reduced prices in sections such as housewares, food, health and beauty aids, toys, and electronics.

Growth Fundamentals Evaluation

The fundamental examination shows why OLLIE'S BARGAIN OUTLET HOLDINGS meets the criteria as a solid growth candidate. The company displays quickening revenue and earnings growth, a vital trait for growth investors looking for companies growing more rapidly than others in their field. Based on the fundamental analysis report, OLLI presents:

- Revenue growth of 10.14% over the last year with an average yearly growth rate of 10.04% over recent years

- Anticipated revenue growth quickening to 13.55% each year according to forward estimates

- Earnings per share growth forecast at 16.42% each year in coming years

- Historical EPS growth of 10.78% yearly average with recent quickening trends

These growth measurements are especially significant for the screening technique because steady and quickening growth shows a company's capacity to broaden its market standing and produce rising profits over time. The growth rating of 7/10 mirrors this positive path, indicating the company is effectively carrying out its growth plan while preserving operational effectiveness.

Financial Condition and Profitability

Beyond growth possibility, the screening technique demands companies to keep sound financial bases and profitability. OLLI's financial condition rating of 7/10 shows a solid balance sheet with various positive aspects:

- Outstanding solvency position with an Altman-Z score of 6.68, doing better than 90% of industry peers

- Very small debt load with a Debt to Equity ratio of 0.00, superior to 83% of rivals

- Good current ratio of 2.63, showing sufficient short-term liquidity

- Positive operating cash flow steadily over the last five years

The profitability rating of 6/10 displays varied but generally positive results:

- Return on Assets of 7.61% does better than 77% of broadline retail peers

- Profit margin of 8.74% is higher than 80% of industry competitors

- Operating margin of 10.87% exceeds 77% of similar companies

These condition and profitability measurements supply the steadiness needed for maintainable growth, lowering investment risk while the company follows expansion.

Technical Formation and Breakout Possibility

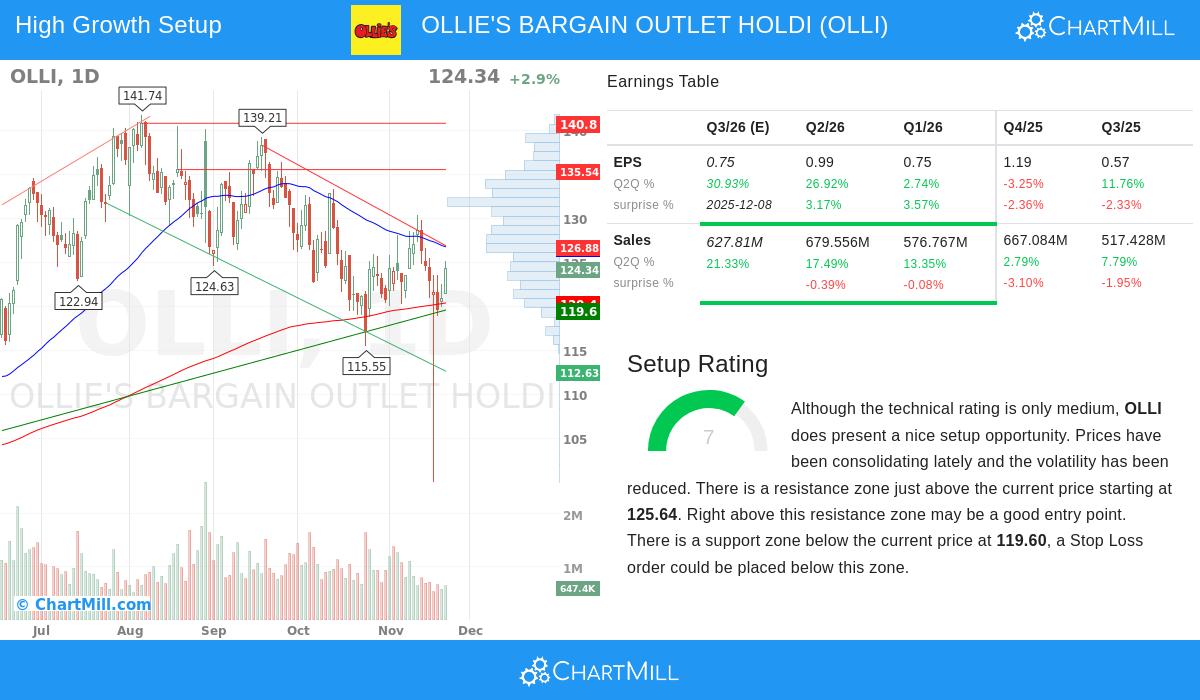

The technical analysis shows why OLLI offers an interesting formation for potential breakout. The stock currently displays consolidation inside a trading band between about $117 and $130, with several technical elements indicating possible upward movement:

- The formation rating of 7/10 shows positive technical circumstances for entry

- Lowered trading volume during recent consolidation indicates lessening selling pressure

- Current price location near the top part of its recent trading band

- Clear resistance area identified between $125.64 and $126.88

- Set support levels between $117.13 and $119.60 supplying sensible stop-loss zones

The technical formation is important for growth investors because breakouts from consolidation bands frequently come before notable price movements. When fundamentally solid stocks start technical breakouts, it can indicate that market players are acknowledging the company's growth narrative and bidding shares higher.

Valuation Factors

While growth and technical elements seem positive, valuation offers a more mixed image. The valuation rating of 3/10 mirrors premium pricing:

- Current P/E ratio of 35.53 is higher than the S&P 500 average of 25.47

- Forward P/E of 27.32 stays raised though under market average

- PEG ratio indicates more fair valuation when considering growth

For growth investors, increased valuations can be acceptable when backed by quickening growth rates and solid competitive positioning. The anticipated earnings growth of 16.42% gives some reasoning for the current premium, though investors should watch valuation levels relative to growth sustainability.

Investment Thesis Combination

The joining of OLLI's fundamental growth attributes and technical formation creates an interesting possibility for growth-focused investors. The company displays quickening revenue and earnings growth while keeping financial condition adequate to fund continued expansion. The technical formation indicates the stock might be getting ready for a breakout from its consolidation band, possibly offering positive entry timing.

The technique of joining solid growth fundamentals with technical breakout formations seeks to find companies where business achievement might be close to changing into market price acknowledgment. OLLI's profile, with its growing store presence, steady revenue growth, clear balance sheet, and constructive chart formation, matches this method.

For investors curious about similar possibilities, other stocks meeting these standards can be located through our Strong Growth Stocks with Good Technical Setup Ratings screen. This screening technique keeps finding companies where solid business fundamentals align with bettering technical formations.

Disclaimer: This examination is for informational purposes only and does not form investment advice, recommendation, or endorsement of any security. Investors should perform their own investigation and consult with financial advisors before making investment choices. Past performance does not assure future outcomes, and all investments carry risk including possible loss of principal.