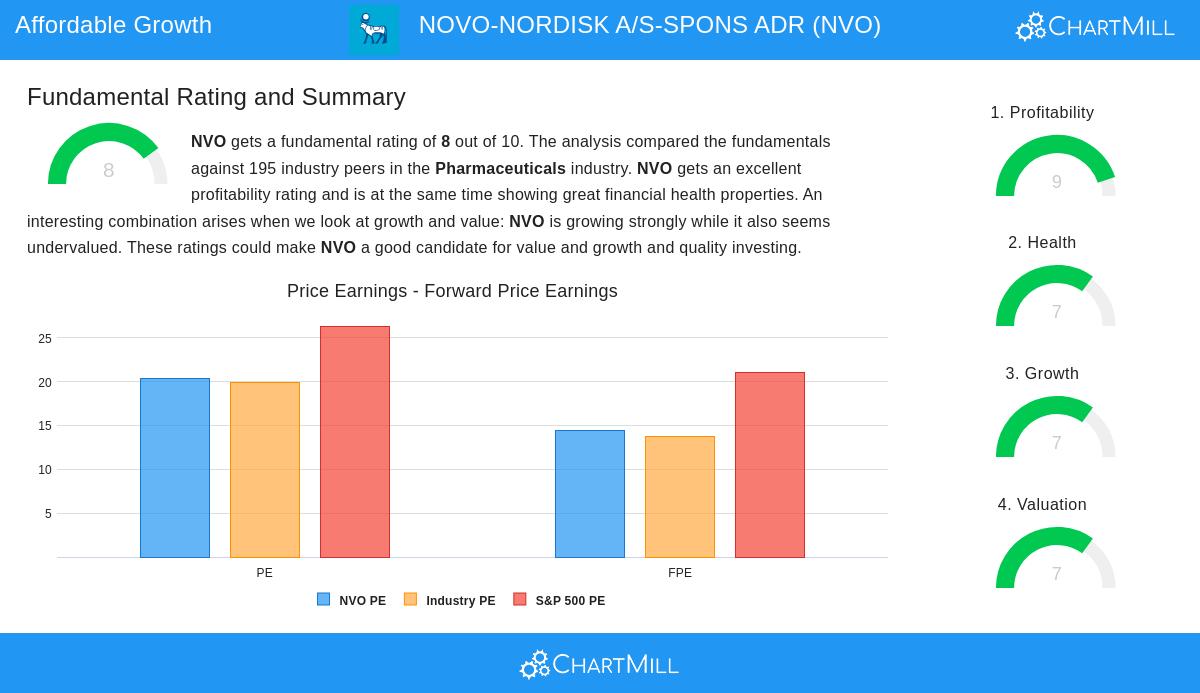

NOVO-NORDISK A/S-SPONS ADR (NYSE:NVO) was identified as an affordable growth stock by our screener. The company combines solid growth with strong profitability and financial health, while trading at a reasonable valuation.

Growth Prospects

- Revenue grew by 24.11% over the past year, with an annualized growth rate of 18.94% over the last several years.

- Earnings per share (EPS) increased by 17.96% in the last year, with expected future growth of 14.29%.

- The company’s growth is accelerating, supported by strong demand in its diabetes and obesity care segments.

Valuation

- The stock trades at a P/E ratio of 20.32, below the industry average of 19.95 and the S&P 500 average of 26.34.

- Its forward P/E of 14.38 is also favorable compared to broader market multiples.

- The Enterprise Value/EBITDA and Price/Free Cash Flow ratios indicate NVO is priced attractively relative to peers.

Profitability & Financial Health

- Profitability score: 9/10 – High margins, with a 34.51% net profit margin and 46.51% operating margin.

- Return on Equity (75.51%) and Return on Invested Capital (44.39%) are among the best in the industry.

- Health score: 7/10 – Strong solvency with a low Debt/FCF ratio (1.60), though liquidity ratios are weaker.

Our Affordable Growth screener lists more stocks with similar characteristics.

For a deeper look, review the full fundamental analysis of NVO.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.