Investors looking for opportunities in today's market often face a difficult environment, especially when trying to match company fundamentals with technical price patterns. One method that tries to connect these areas involves filtering for solid growth stocks that are also showing favorable technical breakout formations. This tactic joins the forward-looking possibility of fundamental growth with the timing indications given by technical analysis. The aim is to find companies that are not only increasing their earnings and revenue at a fast rate but are also near a possible price increase as shown by their chart formations. This combined assessment can help locate stocks where solid business performance might soon be acknowledged by the wider market.

NATIONAL FUEL GAS CO (NYSE:NFG) presents an interesting case for this tactic. As a diversified energy company involved in the production, transportation, storage, and distribution of natural gas, its recent fundamental performance matches the requirements for a solid growth stock, while its present chart formation indicates a possible technical change.

Fundamental Growth Strength

The base of this tactic depends on finding companies with solid and speeding up business measures. NATIONAL FUEL GAS CO's fundamental report shows a company in a strong growth period, which is important for the "solid growth" part of the filter. A company's capacity to grow earnings and sales is a main force behind long-term stock price increase, making it a key part of this investment method.

- Earnings Per Share (EPS) Growth: The company has shown notable EPS growth of 37.92% over the last year, with a 5-year average yearly growth rate of 18.56%.

- Revenue Expansion: Revenue has grown significantly, rising by 110.24% in the last year, while also keeping a good 8.05% average yearly growth rate over a longer time.

- Future Outlook: Analyst projections suggest continued strength, with expected average yearly EPS growth of 10.81% and revenue growth of 15.80% for the next years.

This outstanding growth is joined by high profitability, with a ChartMill Profitability Rating of 8 out of 10. The company has margins that are some of the best in its field, including a Return on Equity of 30.04% and an Operating Margin of 42.33%. This shows that the growth is not just revenue expansion but is changing effectively into net profits. You can see the complete information in the fundamental analysis report for NFG.

Attractive Valuation and Financial Health

While growth is very important, it must be viewed together with valuation and financial soundness to prevent paying too much for that growth. NATIONAL FUEL GAS CO trades at a Price-to-Earnings (P/E) ratio of 11.59, which is not only sensible compared to the S&P 500 average of 25.47 but also less expensive than most of its industry competitors. This mix of high growth and a low valuation is an uncommon and frequently desired profile. The company's financial health, with a ChartMill Health Rating of 5, displays a varied situation. It has a strong ability to pay long-term debts relative to its industry but has some small short-term cash concerns, a detail investors should watch. The existence of a steady, increasing dividend also adds a component of shareholder return and income steadiness.

Technical Breakout Setup

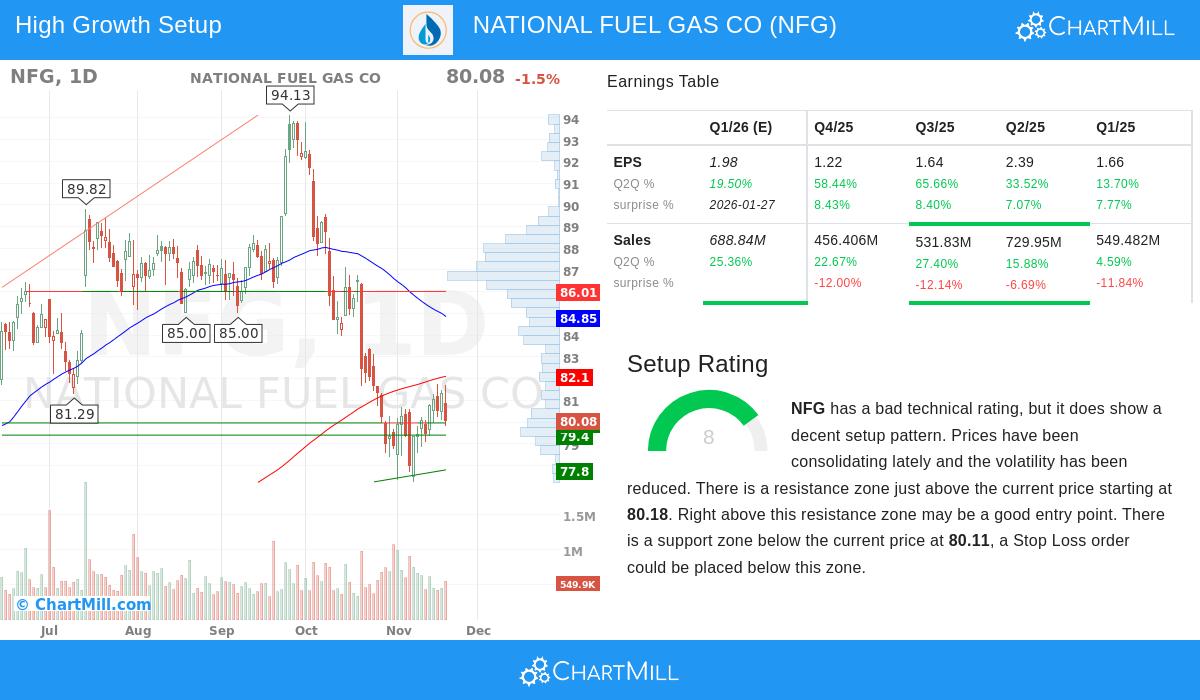

The technical analysis part is what gives the possible entry timing for a growth stock. According to the technical analysis report for NFG, the stock currently shows a favorable formation, getting a Setup Rating of 8 out of 10. This rating finds stocks where price stability and lower instability may be coming before a major price change.

- Consolidation Pattern: The stock has been trading in a set area between about $77.22 and $83.40 over the last month, and is now placed in the middle of this area. This kind of stability often happens before a clear breakout.

- Clear Resistance and Support: The technical analysis finds a main resistance area just above the present price, beginning around $80.18. A clear move above this level could indicate the beginning of a new upward direction. On the other hand, a support area exists below, giving a sensible level for a stop-loss order to control risk.

- Market Context: While both the short and long-term directions for NFG are now negative, the stock has displayed relative strength on a yearly basis, doing better than 75% of all stocks. This recent stability could represent a foundation pattern before its next step up.

This technical formation is important for the tactic because it tries to find the exact moment when market feeling may be changing to acknowledge the basic fundamental value, letting investors place themselves before a large price change.

A Converging Opportunity

NATIONAL FUEL GAS CO represents a interesting opportunity where solid fundamental growth measures and a positive technical formation meet. The company's strong earnings and sales speed, joined with a pleasing valuation, give a firm base. The technical view suggests the stock is tightening within a stability pattern, possibly preparing for a breakout. For investors using a growth-with-timing tactic, NFG justifies closer inspection as a stock that meets strict fundamental requirements while appearing technically ready for a move.

This assessment was based on a particular filter for "Strong Growth Stocks with good Technical Setup Ratings." If this method matches your investment approach, you can find more possible choices using this filter on ChartMill.com.

Disclaimer: This article is for informational purposes only and does not constitute a recommendation to buy or sell any security. All investment decisions carry risk, and you should conduct your own research and consult with a qualified financial advisor before making any investment decisions.