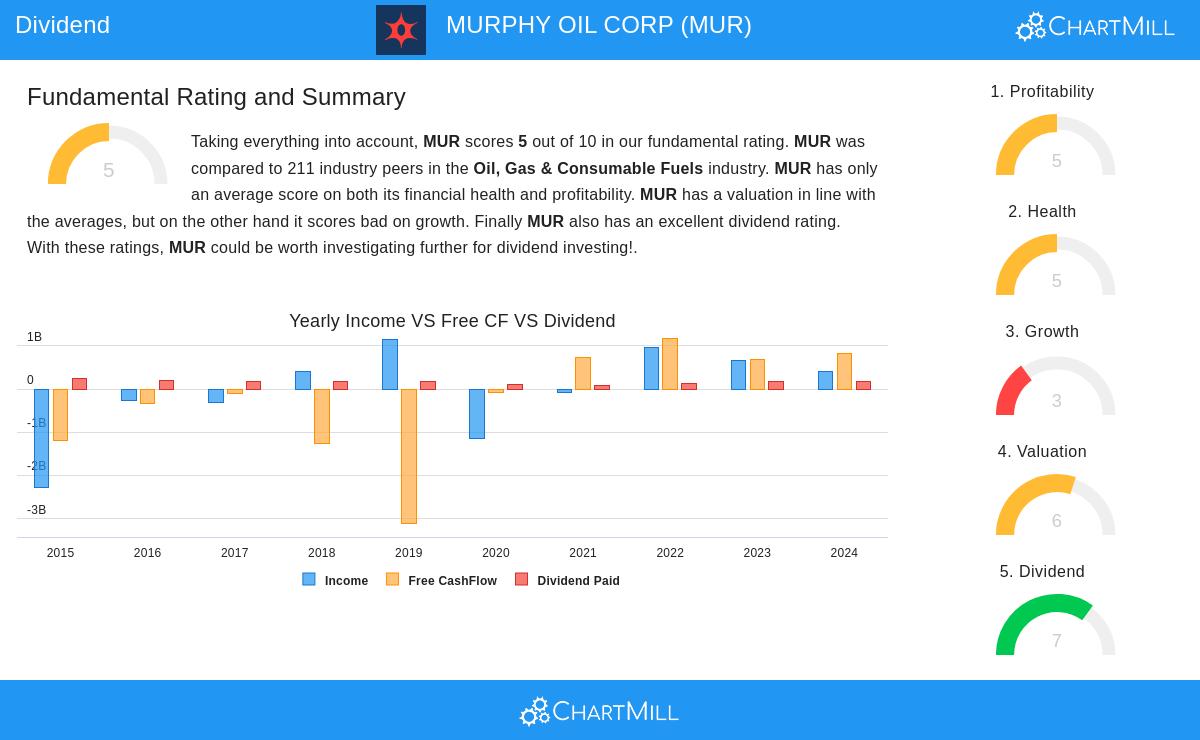

MURPHY OIL CORP (NYSE:MUR) was identified as a strong dividend candidate by our screening process, which looks for stocks with high dividend ratings while maintaining solid profitability and financial health. The company’s fundamentals suggest it could be an attractive option for income-focused investors.

Dividend Strength

- High Yield: MUR currently offers a dividend yield of 5.62%, well above the S&P 500 average of 2.42%.

- Reliable Track Record: The company has paid dividends for at least 10 years, demonstrating consistency.

- Sustainable Payout: While the payout ratio is somewhat elevated at 46.44%, earnings growth supports the dividend’s sustainability.

Profitability & Financial Health

- Solid Margins: MUR maintains a 22.39% operating margin and a 68.43% gross margin, outperforming many industry peers.

- Reasonable Valuation: With a P/E ratio of 9.67, the stock trades below both industry and S&P 500 averages.

- Manageable Debt: A debt-to-equity ratio of 0.29 indicates a conservative capital structure.

Areas to Monitor

- Liquidity Concerns: The current ratio of 0.76 suggests potential short-term liquidity challenges.

- Earnings Volatility: Recent earnings declines highlight exposure to commodity price fluctuations.

For a deeper dive into MUR’s financials, review the full fundamental report.

Our Best Dividend Stocks screener provides more high-quality dividend ideas.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.