Balancing Dividends and Fundamentals: The Case of MARATHON PETROLEUM CORP (NYSE:MPC).

By Mill Chart

Last update: May 9, 2025

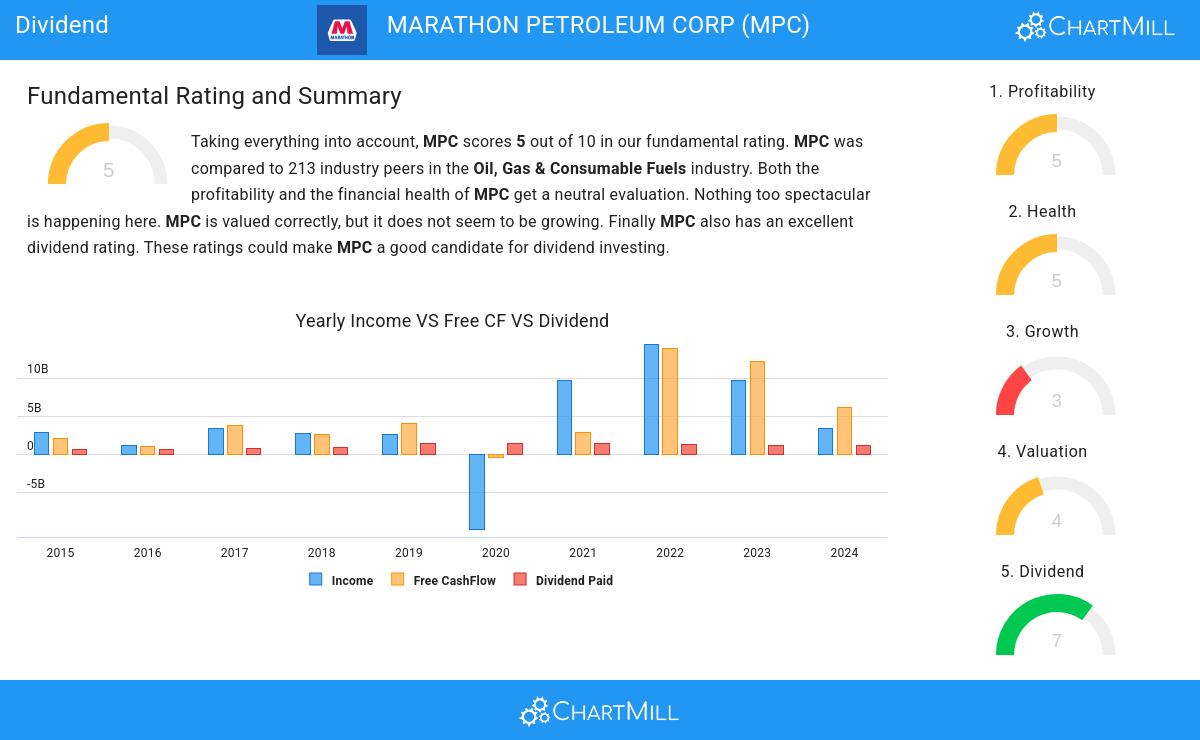

MARATHON PETROLEUM CORP (NYSE:MPC) has caught the attention of dividend investors as a stock worth considering. MPC excels in profitability, solvency, and liquidity, all while providing a decent dividend. Let's delve into the details.

Dividend Insights: MPC

ChartMill assigns a Dividend Rating to every stock. This score ranges from 0 to 10 and evaluates the different dividend aspects, including the yield, the growth and sustainability. MPC scores a 7 out of 10:

- On average, the dividend of MPC grows each year by 9.91%, which is quite nice.

- MPC has paid a dividend for at least 10 years, which is a reliable track record.

- MPC has not decreased their dividend for at least 10 years, which is a reliable track record.

- 25.95% of the earnings are spent on dividend by MPC. This is a low number and sustainable payout ratio.

- The dividend of MPC is growing, but earnings are growing more, so the dividend growth is sustainable.

Deciphering MPC's Health Rating

Every stock is evaluated by ChartMill, receiving a Health Rating on a scale of 0 to 10. This assessment considers different health aspects, including liquidity and solvency, both in absolute terms and relative to industry peers. MPC has achieved a 5 out of 10:

- MPC has an Altman-Z score of 3.31. This indicates that MPC is financially healthy and has little risk of bankruptcy at the moment.

- Looking at the Altman-Z score, with a value of 3.31, MPC belongs to the top of the industry, outperforming 84.04% of the companies in the same industry.

- Looking at the Debt to FCF ratio, with a value of 5.30, MPC is in the better half of the industry, outperforming 64.32% of the companies in the same industry.

Profitability Insights: MPC

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of MPC, the assigned 5 is noteworthy for profitability:

- MPC has a Return On Assets of 5.66%. This is in the better half of the industry: MPC outperforms 61.50% of its industry peers.

- The Return On Equity of MPC (23.88%) is better than 85.92% of its industry peers.

- MPC has a Return On Invested Capital of 11.14%. This is in the better half of the industry: MPC outperforms 77.00% of its industry peers.

- The last Return On Invested Capital (11.14%) for MPC is well below the 3 year average (17.20%), which needs to be investigated, but indicates that MPC had better years and this may not be a problem.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

Check the latest full fundamental report of MPC for a complete fundamental analysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

177.59

-3.5 (-1.93%)

Find more stocks in the Stock Screener