The investment philosophy supported by Peter Lynch highlights finding companies with good growth potential that are available at fair prices, a method known as GARP, or Growth at a Reasonable Price. Lynch's framework, explained in his book One Up on Wall Street, centers on consistent earnings growth, sound financial condition, and profit generation, while steering clear of companies with growth speeds that are too fast to be lasting. This method values fundamental soundness over trying to time the market for quick gains, looking for enterprises an investor can comprehend and own for many years.

Lululemon athletica Inc (NASDAQ:LULU) shows up as a result from a screen built on this method, justifying a more detailed examination from investors looking for good growth without an extreme price.

Alignment with Lynch's Main Rules

The screen uses particular criteria to locate companies that match Lynch's ideas. Lululemon's financials show a good match with these rules.

- Lasting Earnings Growth: Lynch wanted companies with solid but not excessive growth. The screen looks for a 5-year earnings per share (EPS) growth between 15% and 30%. Lululemon's EPS has increased at a notable yearly speed of 24.37% over this time, putting it directly within this target range and pointing to a good, and possibly maintainable, growth path.

- Fair Valuation using PEG Ratio: A key part of Lynch's method is the PEG ratio, which compares the price-to-earnings ratio to earnings growth. A PEG ratio at or under 1 implies a stock could be fairly valued for its growth. Lululemon's PEG ratio of 0.46 is well under this level, suggesting the market might be pricing its growth potential too low when assessed this way.

- Strong Financial Condition: Lynch preferred companies with good balance sheets. The screen requires a Debt-to-Equity ratio under 0.6 and a Current Ratio of at least 1. Lululemon performs well here, stating no debt (a Debt/Equity ratio of 0) and a Current Ratio of 2.27, indicating sufficient cash to cover immediate needs. This financial strength matches well with Lynch's liking for companies with little debt and good funding.

- Strong Profit Generation: To confirm effective use of investor money, the screen demands a Return on Equity (ROE) above 15%. Lululemon's ROE of 40.70% is much higher than this standard, putting it with the best in its field and showing very good profit generation.

Summary of Fundamental Review

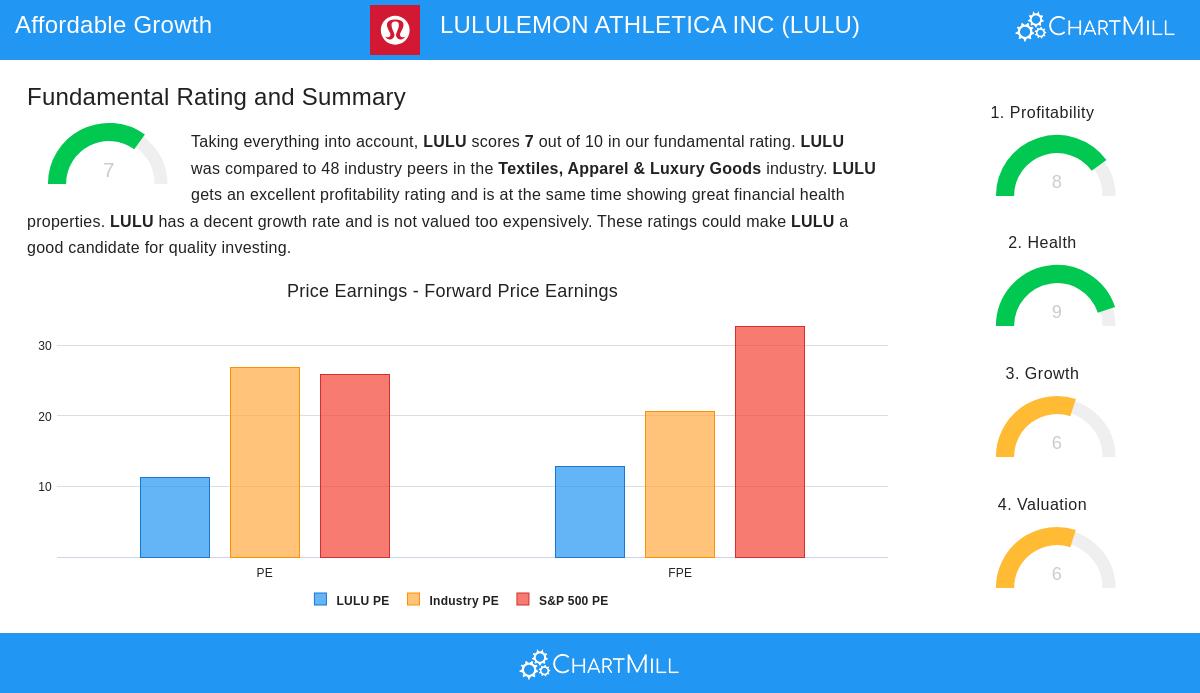

A detailed fundamental review of Lululemon gives it a good score of 7 out of 10, showing its positive points and items to think about. The company's profile is marked by very good health and profit generation scores, which create a good base for any long-term holding. Its price is mostly seen as fair, trading at a P/E ratio that is sensible next to both its industry competitors and the wider S&P 500.

The main point for attention is its growth forecast. While the company's past growth has been good, expert estimates for future sales and earnings growth have settled to a more measured speed. This change from high to more average growth is an important item for investors to watch, although the company's very good profit generation and clean balance sheet offer a good buffer.

A Result for More Investigation

For investors who follow the Peter Lynch method, Lululemon offers a strong example. It shows the signs of a "growth at a reasonable price" result: a past record of good, lasting earnings growth, a price that seems interesting when considering that growth, and a very sound financial base with strong profit generation. While future growth is predicted to become more standard, the company's quality features are clear.

This review of Lululemon athletica Inc was found using a stock screen based on the Peter Lynch method. You can find more companies that pass this screen here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.