Logitech International SA (NASDAQ:LOGI) appears as a noteworthy option for investors using a quality investing strategy. This approach centers on finding outstanding companies with lasting competitive strengths, sound financial condition, and a record of profitable expansion, with the plan of keeping them for an extended period. The "Caviar Cruise" screen, based on the ideas of quality investing, uses a strict group of numerical criteria to find these businesses. These criteria are made to locate companies that not only have a good history but also have the financial control and operational skill to continue that performance going forward.

Matching the Main Quality Investing Standards

Logitech's financial picture matches well with the basic criteria of the Caviar Cruise screen. The method favors companies that show a steady capacity to expand and produce high returns on capital, and Logitech meets these points.

- Past Expansion: The screen calls for at least 5% yearly expansion in both revenue and EBIT (Earnings Before Interest and Taxes) over a five-year span. Logitech easily passes this, with a revenue CAGR of 6.43% and a strong EBIT CAGR of 19.03%. Importantly, its EBIT expansion is much greater than its revenue expansion, showing better operational effectiveness and possible price strength.

- Outstanding Profitability: A central idea of quality investing is a high return on invested capital (ROIC), which gauges how well a company makes profits from its capital base. The screen requires a ROIC (leaving out cash, goodwill, and intangibles) over 15%. Logitech's number of about 98.66% is remarkable, putting it in the highest group of its industry and pointing to a very effective and profitable business model.

- Financial Strength: Quality companies are known for good balance sheets. The Caviar Cruise screen applies a Debt-to-Free Cash Flow ratio under 5 to find companies that can easily handle or remove debt. Logitech is notable with a ratio of 0.0, showing it has no net debt. This gives major financial room and lowers risk.

- High-Grade Earnings: The screen looks for a 5-year average Profit Quality—the change of net income into free cash flow—over 75%. Logitech's number of 120.4% shows it is making more cash than its reported profits indicate, a good signal of financial condition and the grade of its earnings.

Fundamental Analysis Summary

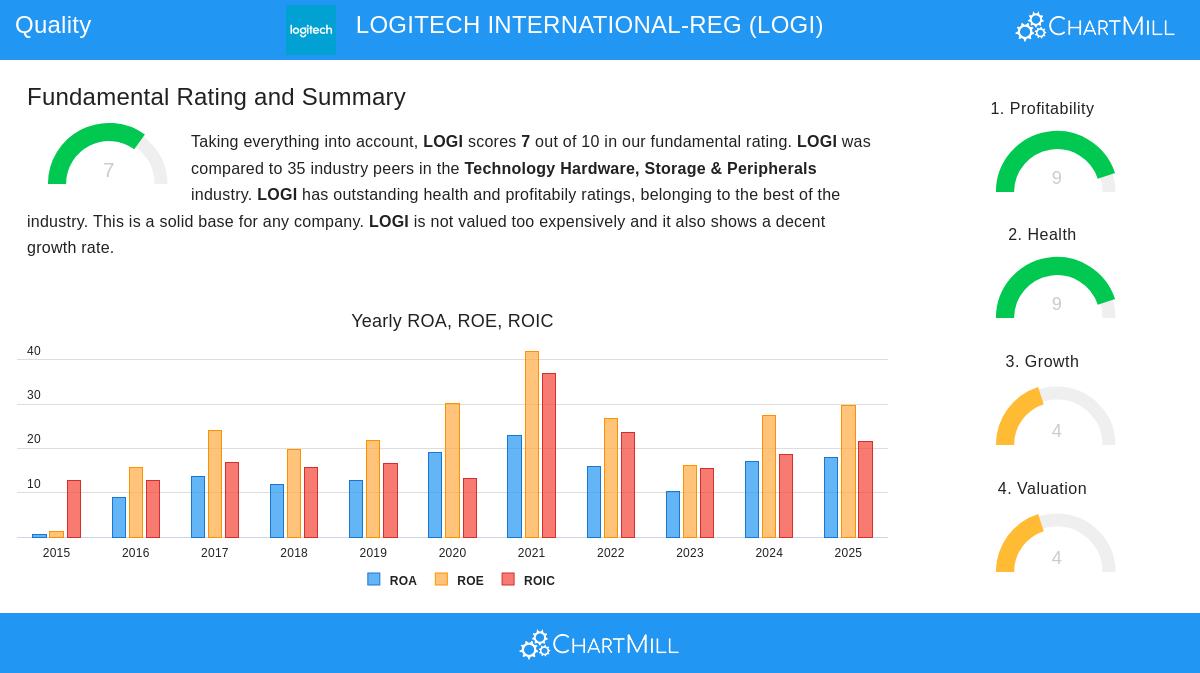

A thorough fundamental analysis report gives Logitech a good rating of 7 out of 10. The report points out the company's very good profitability, with top-level returns on assets, equity, and invested capital that do better than most of its competitors in the Technology Hardware sector. Its financial condition is also rated well, supported by the total lack of debt and good liquidity ratios. While its price is seen as reasonable instead of very low, and its future expansion is expected to be good though at a somewhat slower rate compared to its past performance, the overall view is of a fundamentally healthy and well-run company.

Fit for Quality Investors

For an investor following a quality idea, Logitech stands for the kind of business that makes up the base of a long-term portfolio. Its capacity to steadily grow revenue and profits, along with its top-level returns on capital, points to a good competitive place in the market for computer accessories and video collaboration products. The clean balance sheet, with no debt, removes a main source of financial risk and gives a safety net in economic slowdowns. Also, the high grade of its earnings, shown by its better free cash flow generation, means the reported profits are supported by actual cash coming into the business. These traits, lasting expansion, high profitability, and financial strength, are exactly what quality investors look for when making long-term investments.

Finding Other Quality Options

The Caviar Cruise screen is a useful tool for locating companies with quality features. Logitech is only one instance of the kind of business this method can find. Investors curious to see the whole, present list of companies that meet these strict criteria can run the Caviar Cruise screen themselves.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.