Kodiak Gas Services Inc (NYSE:KGS) presents a strong case for investors using a high growth momentum strategy joined with technical breakout analysis. This method centers on finding companies showing solid earnings acceleration, good sales growth, and positive estimate revisions, all while displaying constructive chart patterns that indicate possible upward price movement. The strategy uses ChartMill’s proprietary ratings, including the High Growth Momentum Rating, Technical Rating, and Setup Quality Rating, to filter for stocks that fit both fundamental momentum and technical timing criteria.

Fundamental Growth Momentum Kodiak Gas Services is notable with a High Growth Momentum Rating of 6, indicating good underlying business trends. Several factors build this score:

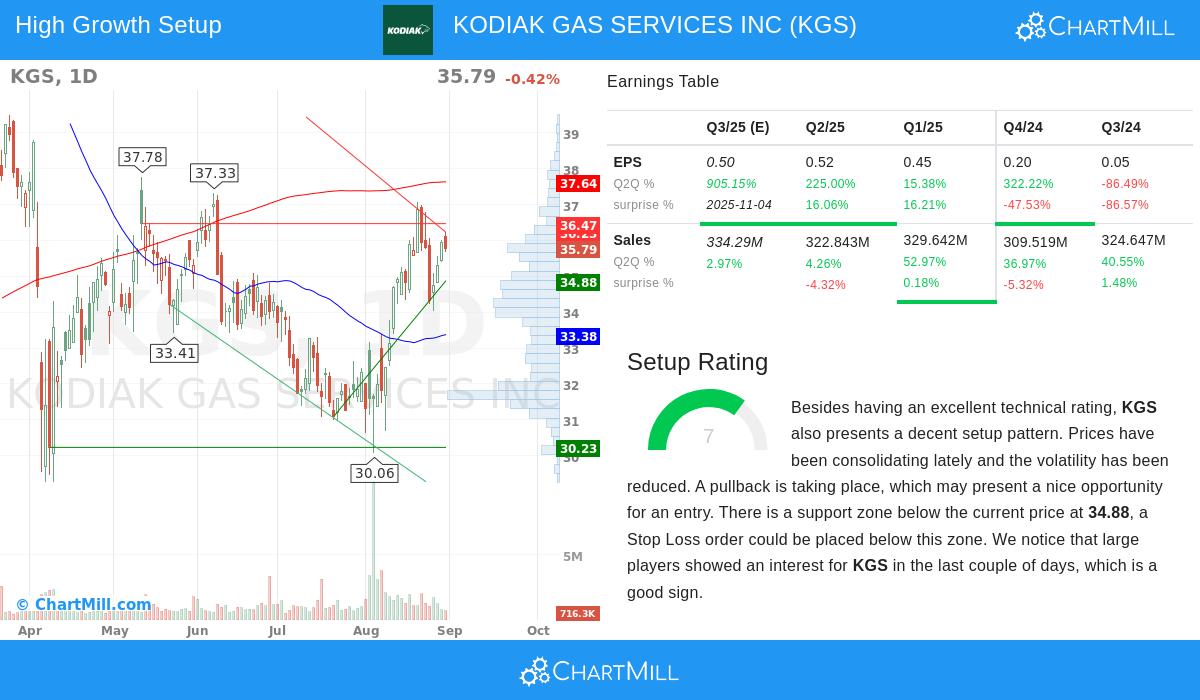

- Exceptional EPS Growth: The company reported a 225% year-over-year increase in earnings per share for the most recent quarter, with sequential acceleration visible in prior periods. This kind of powerful growth is a key trait of momentum stocks and points to strong operational execution.

- Revenue Expansion: Sales growth remains solid, with a 31% increase over the trailing twelve months and consistent double-digit growth across recent quarters. This shows the company’s capacity to scale while keeping demand for its compression and gas treatment services.

- Analyst Confidence: Positive revisions to future earnings estimates, with next year’s EPS projections rising over 10% in the last three months, signal that professionals are growing more optimistic about Kodiak’s profit potential.

- Margin Improvement: The profit margin has grown significantly, from 6.17% two quarters ago to 12.05% in the most recent quarter, showing better efficiency and pricing power despite the capital-intensive nature of the energy services industry.

These fundamental traits are vital for high growth momentum investing because they show not just past performance but current operational momentum. Companies displaying acceleration in key measures like EPS, sales, and margins tend to draw institutional interest and can maintain price appreciation over time.

Technical Strength and Setup Quality From a technical view, Kodiak shows positive signs that support its fundamental story. The stock gets a Technical Rating of 7, indicating better-than-average health in its price trends and market relative strength. According to the detailed technical report, KGS shows a positive short-term trend while trading near the upper end of its one-month range. More importantly, it has a Setup Rating of 7, suggesting the stock is consolidating within a defined range with lower volatility, a common precursor to possible breakout moves.

The technical analysis finds multiple support levels between $30.23 and $34.88, offering a clear risk framework for traders. Meanwhile, resistance sits near the $36.88 level, which if broken, could activate more upside momentum. The stock’s recent behavior shows consolidation after previous gains, which frequently lets the stock build energy for its next move higher. This pairing of technical health and consolidation is just what breakout traders seek, as it provides both trend confirmation and a clear entry point.

Strategic Implications For investors following high growth momentum strategies, Kodiak represents an uncommon find where fundamental acceleration matches technical readiness. The company’s exposure to energy infrastructure provides cyclical tailwinds, while its notable earnings growth and margin expansion indicate company-specific execution quality. The technical setup offers a tactical chance to enter at a point where risk can be clearly measured against nearby support levels.

Those interested in finding comparable opportunities can see more screening results through this High Growth Momentum Breakout Setups Screen, which filters for stocks showing strong growth metrics alongside constructive technical patterns.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.