Our stock screener has singled out HUNT (JB) TRANSPRT SVCS INC (NASDAQ:JBHT) as a promising choice for dividend investors. JBHT not only scores well in profitability, solvency, and liquidity but also offers a decent dividend. We'll explore this further.

How We Gauge Dividend for JBHT

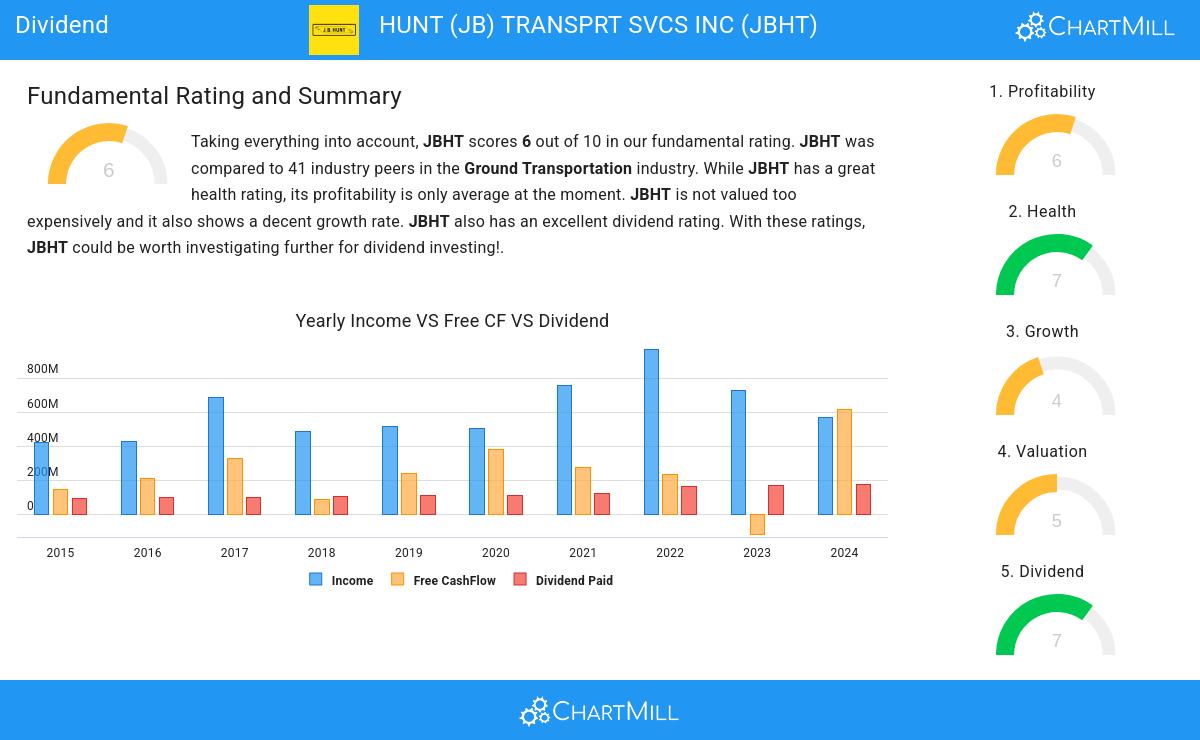

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. JBHT has achieved a 7 out of 10:

- Compared to an average industry Dividend Yield of 1.67, JBHT pays a bit more dividend than its industry peers.

- On average, the dividend of JBHT grows each year by 10.61%, which is quite nice.

- JBHT has paid a dividend for at least 10 years, which is a reliable track record.

- JBHT has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

- JBHT pays out 30.75% of its income as dividend. This is a sustainable payout ratio.

- JBHT's earnings are growing more than its dividend. This makes the dividend growth sustainable.

Exploring JBHT's Health

ChartMill assigns a proprietary Health Rating to each stock. The score is computed by evaluating various liquidity and solvency ratios and ranges from 0 to 10. JBHT was assigned a score of 7 for health:

- An Altman-Z score of 4.85 indicates that JBHT is not in any danger for bankruptcy at the moment.

- JBHT has a better Altman-Z score (4.85) than 85.37% of its industry peers.

- JBHT has a debt to FCF ratio of 2.39. This is a good value and a sign of high solvency as JBHT would need 2.39 years to pay back of all of its debts.

- With an excellent Debt to FCF ratio value of 2.39, JBHT belongs to the best of the industry, outperforming 82.93% of the companies in the same industry.

- A Debt/Equity ratio of 0.24 indicates that JBHT is not too dependend on debt financing.

- JBHT has a better Debt to Equity ratio (0.24) than 63.41% of its industry peers.

Profitability Assessment of JBHT

ChartMill's Profitability Rating offers a unique perspective on stock analysis, providing scores from 0 to 10. These ratings consider a wide range of profitability metrics and margins, both in comparison to industry peers and on their own merits. For JBHT, the assigned 6 is a significant indicator of profitability:

- The Return On Assets of JBHT (6.87%) is better than 68.29% of its industry peers.

- JBHT's Return On Equity of 14.22% is fine compared to the rest of the industry. JBHT outperforms 65.85% of its industry peers.

- JBHT's Return On Invested Capital of 9.59% is fine compared to the rest of the industry. JBHT outperforms 78.05% of its industry peers.

- The Average Return On Invested Capital over the past 3 years for JBHT is above the industry average of 8.12%.

- Looking at the Profit Margin, with a value of 4.72%, JBHT is in the better half of the industry, outperforming 68.29% of the companies in the same industry.

- Looking at the Operating Margin, with a value of 6.88%, JBHT is in the better half of the industry, outperforming 63.41% of the companies in the same industry.

Every day, new Best Dividend stocks can be found on ChartMill in our Best Dividend screener.

Check the latest full fundamental report of JBHT for a complete fundamental analysis.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.