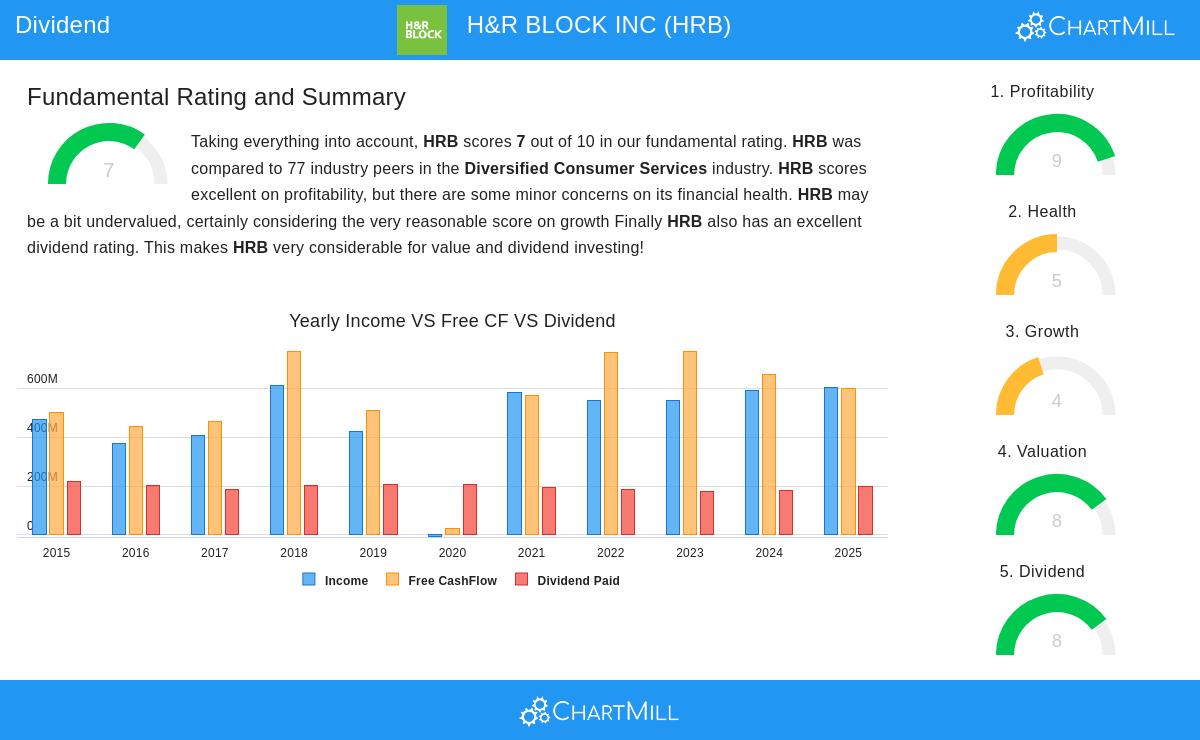

Using a methodical system for dividend investing involves filtering for companies that show lasting payout abilities together with solid business results. The "Best Dividend" filter finds stocks with strong dividend scores while keeping acceptable profit and financial condition measures. This system aids investors in steering clear of high-yield situations where unmaintainable payouts can hide basic company problems. H&R BLOCK INC (NYSE:HRB) appears as an interesting option from this filtering process, showing traits that match orderly dividend investment plans.

Dividend Sustainability and Performance

H&R Block's dividend outline shows a number of favorable qualities that dividend investors usually look for. The company keeps a measured method between income and longevity, with its present dividend income of 3.27% surpassing both sector and S&P 500 norms. Very importantly, the company has built a dependable history of steady dividend payments and increases.

Important dividend measures consist of:

- Dividend income of 3.27%, doing better than 98.70% of sector companies

- Five-year dividend increase rate of 6.79% per year

- Steady dividend payments for more than ten years with no decreases

- Payout percentage of 32.86%, showing maintainable distribution levels

The middle-ground payout percentage is especially important as it implies the company keeps enough profits to put back into business activities while compensating shareholders. This middle ground between distribution and keeping matches the filtering system's focus on maintainable dividend rules instead of pursuing the largest incomes, which frequently carry more danger.

Profitability Supporting Dividend Dependability

H&R Block's excellent profitability supplies the base for its dependable dividend payments. The company reaches returns that notably beat sector norms, creating large earnings to assist both business activities and shareholder returns.

Profitability features:

- Return on Equity of 675.51%, doing better than all sector rivals

- Return on Invested Capital of 32.95%, beating 98.70% of sector companies

- Operating Margin of 22.01%, placed in the leading group of the sector

- Steady profitability over the last five years with positive cash movements

These profitability measures directly assist the filtering rules' concentration on companies with solid earnings ability. High profitability not only allows present dividend payments but also gives a buffer during economic declines, lowering the chance of dividend decreases that can badly affect income-centered investors.

Financial Condition Factors

While H&R Block shows some financial positives, investors should observe specific parts needing watching. The company's total condition score shows a varied image with good solvency measures but some cash availability worries.

Financial condition review:

- Altman-Z score of 3.22 shows no close bankruptcy danger

- Debt to Free Cash Flow percentage of 2.49 years shows solid debt handling ability

- Current Ratio of 0.90 hints at possible near-term cash availability limits

- Debt/Equity percentage of 12.86 shows greater borrowing than sector companies

The filtering system includes condition measures to find companies able to maintain dividends across different market situations. While H&R Block's cash availability measures deserve notice, its strong cash movement creation and solvency position give confidence about its ability to continue dividend payments.

Valuation and Growth Background

H&R Block displays a pleasing valuation picture that adds to its dividend attraction. The company sells at levels under market norms while keeping sensible growth outlooks.

Valuation traits:

- Price/Earnings level of 11.07 next to sector norm of 27.27

- Forward P/E of 10.52 compared to S&P 500 norm of 22.94

- Expected EPS increase of 12.47% per year

- Enterprise Value/EBITDA level under 79.22% of sector companies

The sensible valuation levels give some room for error for dividend investors, while the expected earnings increase assists future dividend raises. This pairing meets the filtering system's goal of finding companies where dividend longevity is strengthened by both present valuation and future growth possibilities.

For investors looking to find comparable dividend chances, the Best Dividend Stocks filter gives more choices meeting these orderly standards. The complete fundamental analysis report for HRB gives more detailed views into the company's financial placement and dividend longevity measures.

Disclaimer: This examination rests on fundamental information and filtering systems for educational reasons only. It does not form investment guidance or suggestions. Investors should do their own investigation and think about their personal financial situations before making investment choices. Past results do not assure future outcomes, and dividend payments depend on company choice and market situations.