For investors looking for companies with lasting competitive strengths and reliable growth, quality investing gives a structure for finding businesses made to last through economic ups and downs. This method concentrates on firms showing high profitability, effective capital use, and steady cash flow creation instead of just searching for cheap assets. The Caviar Cruise screening process uses measurable filters to find these companies, focusing on long-term business strength over short-term price changes. This organized method helps investors create a list of fundamentally healthy companies that deserve more investigation.

Meeting the Core Quality Criteria

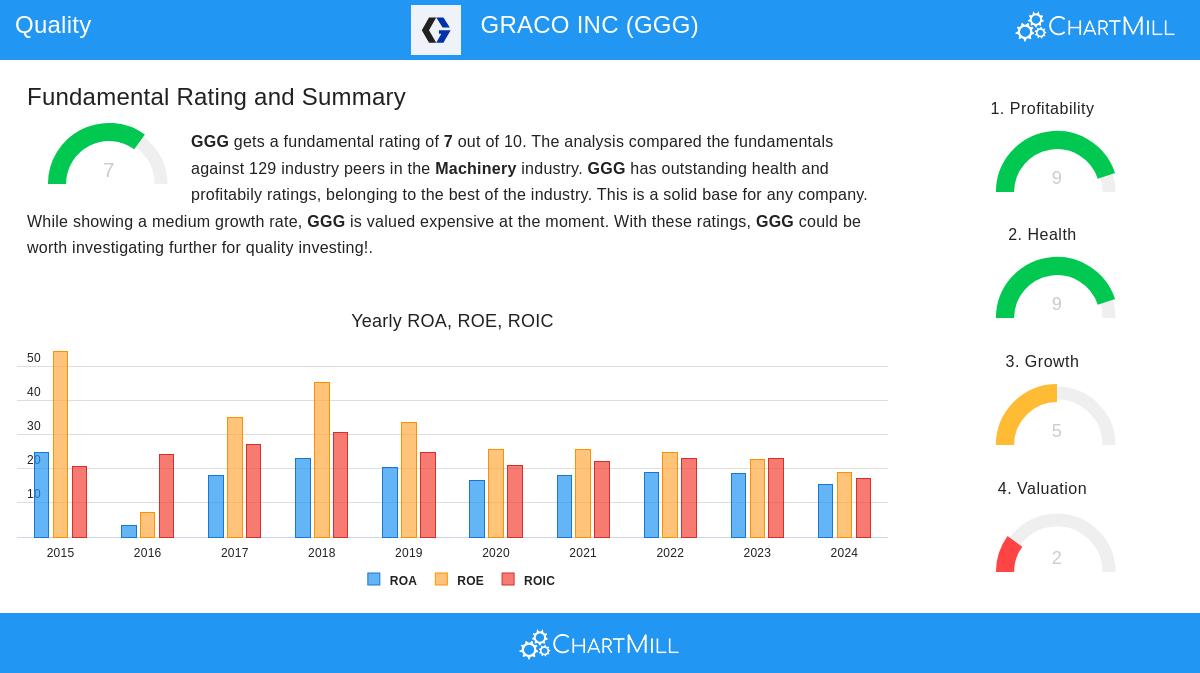

Graco Inc. (NYSE:GGG) shows good alignment with the basic ideas of the Caviar Cruise screen. The screen's filters are made to find companies with a confirmed history of growth, high returns on capital, and financial strength.

- Historical Growth: The screen asks for at least a 5% compound annual growth rate (CAGR) for both revenue and EBIT over five years. Graco goes beyond these levels, with a revenue CAGR of 9.34% and an EBIT CAGR of 6.08%. This shows the company has capably increased its sales and enhanced its operational profitability over a long time.

- Profitability Expansion: A main idea of quality investing is getting better efficiency, where profit increases faster than sales increases. The screen specifically searches for EBIT growth to be higher than revenue growth, pointing to economies of scale or pricing strength. While Graco's revenue growth was high, its EBIT growth was good, showing a concentration on keeping solid margins.

- Outstanding Capital Efficiency: Maybe the most important measure for quality investors is Return on Invested Capital (ROIC), which checks how well a company creates profits from its capital base. The screen sets a high level of 15%. Graco greatly exceeds this with an ROIC (leaving out cash, goodwill, and intangibles) of 34.35%, putting it in the top group of its industry and showing a very efficient and profitable business model.

- Financial Health: To make sure the company is not using too much debt, the screen uses a Debt-to-Free Cash Flow ratio of under 5. Graco's ratio is a very small 0.05, meaning it could pay off all its debt with less than one month's worth of free cash flow. This very high financial strength gives important stability and options.

- Earnings Quality: The screen looks for a Profit Quality (5-year average Free Cash Flow/Net Income) over 75%. Graco has a score of 81.48%, showing that its accounting profits are regularly turned into real, usable cash—a mark of high-quality earnings and careful financial management.

Fundamental Analysis Overview

A look at Graco's detailed fundamental analysis report supports the results from the screen. The company gets a high total fundamental rating of 7 out of 10, with especially high scores in Health (9/10) and Profitability (9/10). Its margins are some of the best in the machinery industry, and its balance sheet is very strong with little debt and high liquidity. The main point for investors is valuation, where the stock scores lower (2/10), trading at a high price compared to the market and its own history. However, this is common for high-quality companies, as the market is ready to pay more for their stability and predictable growth. Future growth expectations are good, with analysts predicting a speed-up in both revenue and earnings per share.

Investment Considerations for Quality Portfolios

For an investor using a buy-and-hold plan, Graco offers an interesting profile. The company's main business—making equipment to move, measure, and spray fluids—gains from a wide moat through its specialized technology and high brand recognition. Its worldwide operations and contact with different industrial and commercial end-markets give variety. The company’s capability to keep and increase its high margins suggests important pricing strength and a competitive edge that is hard to copy. While the current price may make some value-focused investors wait, a quality investor might see the high cost as a fair price for owning a top-level operator with a long path for steady growth.

The Caviar Cruise screen is a useful tool for finding companies that fit with a quality investing view. To see other companies that pass this strict screening process, you can view the complete list of results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy, sell, or hold any security, or an endorsement of any investment strategy. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.