The CAN SLIM investment strategy, created by William O'Neil, joins fundamental and technical analysis to find high-growth stocks that have solid momentum potential. This methodical process assesses companies using seven main factors represented by the acronym CAN SLIM, concentrating on earnings growth, institutional sponsorship, market leadership, and the general market direction. Investors applying this method look for companies showing increasing quarterly earnings, solid annual growth patterns, and technical signs pointing to continued upward momentum.

GENERAL ELECTRIC (NYSE:GE) appears as a noteworthy candidate for CAN SLIM investors after a methodical screen of the market. The aerospace and defense company, which functions through Commercial Engines & Services and Defense & Propulsion Technologies segments, displays agreement with several parts of the CAN SLIM method through both fundamental and technical traits.

Earnings and Sales Momentum

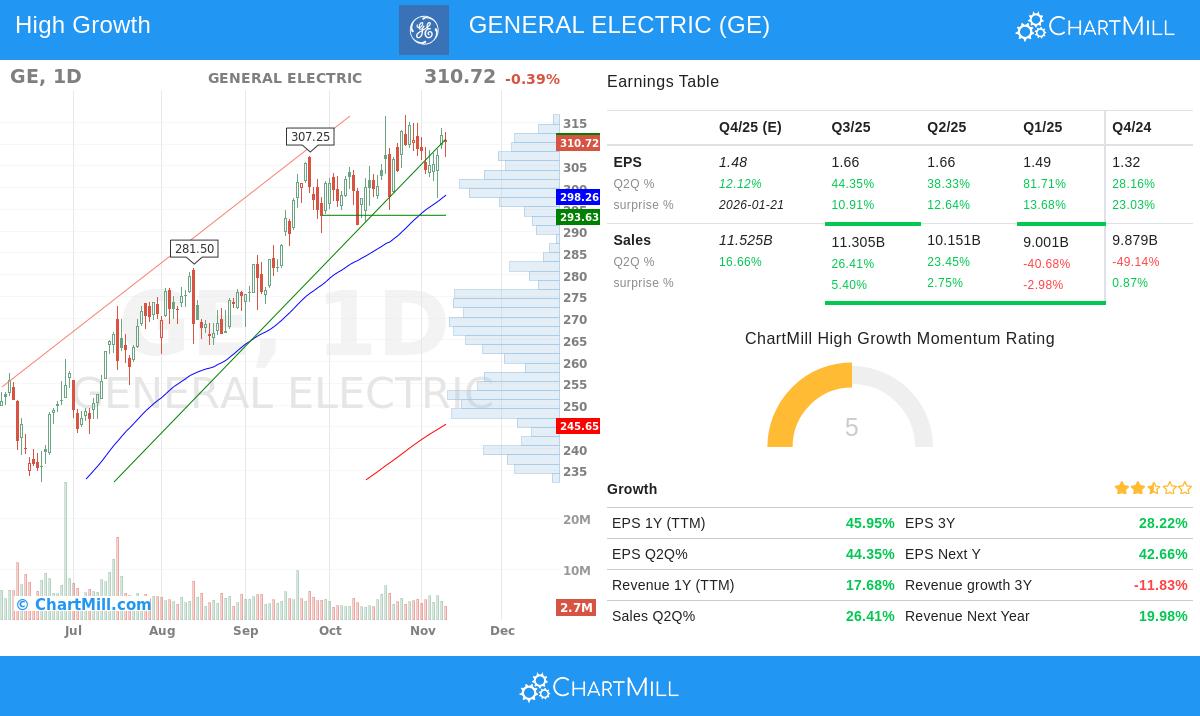

The "C" in CAN SLIM highlights current quarterly earnings and sales acceleration, which GE displays convincingly:

- Quarterly EPS growth of 44.35% year-over-year is much greater than the 20-25% minimum level suggested in the system

- Revenue growth of 26.41% quarter-over-quarter is above the 25% benchmark

- These increasing growth rates show the company is going through solid operational momentum

This earnings acceleration is especially important in the CAN SLIM structure as it indicates the company is in a period of growing profitability rather than showing isolated quarterly strength.

Annual Growth and Profitability

The "A" factor concentrates on annual earnings increases and general profitability, where GE displays varied but mostly positive outcomes:

- Three-year EPS growth of 28.22% is above the 25% minimum requirement

- Return on Equity of 42.86% is significantly higher than the 10% level and is one of the best in the aerospace industry

- Despite some past instability in revenue growth, current forecasts show bettering patterns

The outstanding ROE is important in the CAN SLIM view as it shows efficient use of shareholder capital and lasting competitive benefits within the industry.

Technical Strength and Market Leadership

The technical parts of CAN SLIM agree strongly with GE's present chart picture:

- Relative strength of 91.48 shows the stock performs better than over 91% of the market, meeting the "L" factor for leadership

- Both short-term and long-term patterns are positive based on the technical analysis

- The stock trades close to 52-week highs, confirming institutional interest and momentum

This technical leadership is important in the CAN SLIM method because it verifies that the fundamental strengths are being acknowledged by the wider market, generating the momentum needed for continued price appreciation.

Institutional Sponsorship and Financial Health

The institutional ownership and financial measurements complete the CAN SLIM picture:

- Institutional ownership of 80.56% is within the acceptable range below 85%, showing space for more institutional accumulation

- Debt-to-equity ratio of 1.00 stays below the 2.0 level suggested in the system

- The company keeps positive cash flow and profitability across recent periods

These elements satisfy the "I" and "S" factors by displaying sufficient but not extreme institutional sponsorship while maintaining sensible financial leverage.

Fundamental and Technical Assessment

GE's fundamental analysis report shows a varied but bettering profile with outstanding profitability measurements balanced by some valuation questions. The company's technical picture looks more consistently positive according to the technical analysis report, which mentions solid relative performance, positive patterns across multiple timeframes, and constructive chart formations. The mix of increasing fundamental measurements and technical strength creates the kind of alignment CAN SLIM investors usually look for.

Market Context and Outlook

With the S&P500 displaying a positive short-term pattern and neutral long-term pattern, the present situation gives adequate market direction ("M" in CAN SLIM) for thinking about positions in leading stocks like GE. The company's position in the aerospace industry, joined with its operational recovery and technical breakout traits, indicates it deserves consideration for investors using growth and momentum strategies.

For investors wanting to find more companies that meet CAN SLIM factors, the screening configuration used to identify GE can work as a beginning for more research. Regular screening using these settings may show more opportunities as market situations and company fundamentals change.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.