An investment strategy outlined in Louis Navellier's "The Little Book That Makes You Rich" focuses on identifying companies exhibiting strong, multi-faceted growth. The methodology is built on eight specific rules designed to pinpoint stocks with solid earnings momentum, accelerating sales, increasing profitability, and sound financials. The goal is to find companies that are not just growing, but whose growth is accelerating and being confirmed by upward revisions from analysts, signaling a potential for superior returns.

Futu Holdings Ltd.,ADR (NASDAQ:FUTU) appears as a notable candidate when evaluated against this framework. The Hong Kong-based digital brokerage platform demonstrates the kind of explosive, high-quality growth that the strategy seeks to capture.

Earnings Revisions and Surprises

A key part of the strategy is positive analyst sentiment, which is a strong indicator of future performance. The approach looks for significant upward revisions to earnings estimates and a history of companies surpassing those estimates.

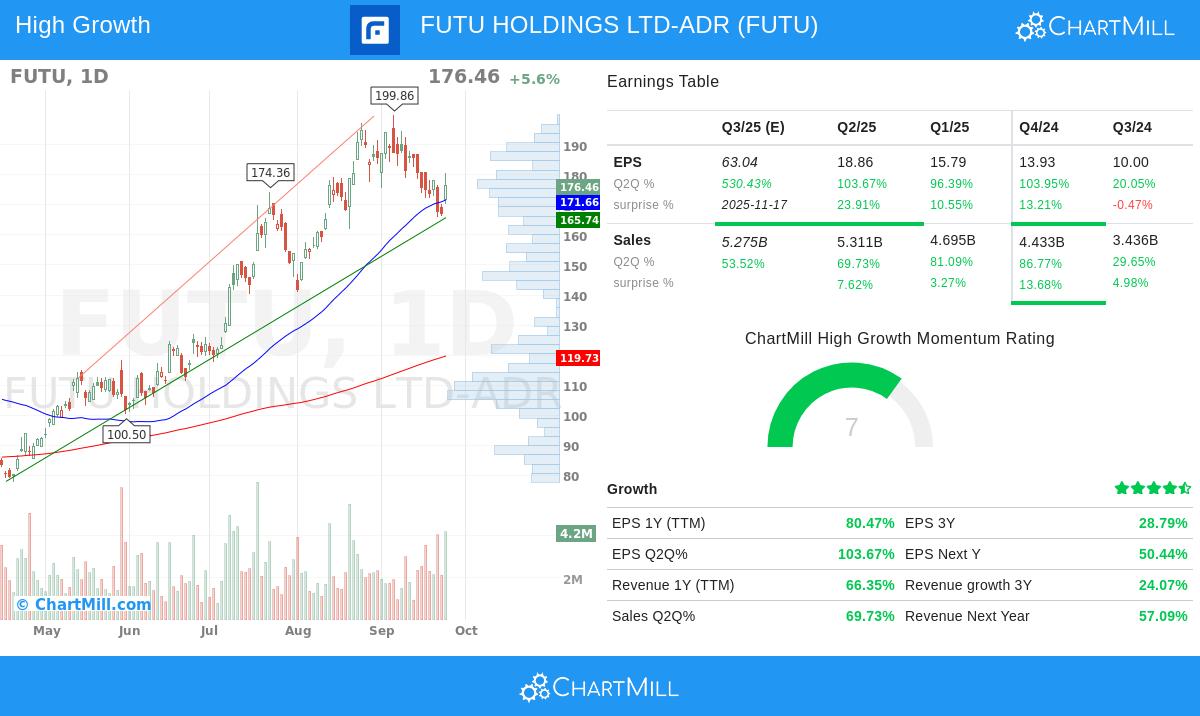

- EPS Estimate Revision: Analysts have revised their earnings estimates for Futu's next quarter upward by a significant 459% over the last three months. This large revision indicates solid confidence in the company's near-term prospects.

- Earnings Surprises: Futu has beaten analyst EPS estimates in three of the last four quarters, with an average surprise of 11.8%. Consistently exceeding expectations forces the market to re-evaluate the company’s value, a key part of Navellier's method.

Explosive Sales and Earnings Growth

The strategy demands concrete evidence of growth in both top-line revenue and bottom-line earnings. Futu’s metrics here are particularly solid.

- Revenue Growth (TTM): 66.4%

- Quarter-over-Quarter Revenue Growth: 69.7%

- Earnings Per Share Growth (TTM): 80.5%

- Quarter-over-Quarter EPS Growth: 103.7%

These figures illustrate a company experiencing hyper-growth. The large quarter-over-quarter increases are especially important, as they suggest the growth is not just sustained but accelerating, which fits well with the strategy's focus on positive earnings momentum.

Increasing Profitability and Strong Cash Flow

Simply growing sales is not enough; the strategy requires that growth to be highly profitable and to generate real cash. Futu is good at translating its revenue surge into improved margins and cash generation.

- Operating Margin Growth: Futu's operating margin increased by 19.6% over the past year. This increase means the company is becoming more efficient, keeping a larger portion of each dollar of sales as profit.

- Free Cash Flow Growth: The company's free cash flow grew by a notable 580.6% over the past year. Solid and increasing cash flow provides Futu with the financial flexibility to invest in future growth without relying heavily on external financing.

High Return on Equity

The final rule emphasizes efficiency. A high Return on Equity (ROE) indicates that a company is generating solid profits from the equity invested by its shareholders. Futu’s ROE of 23.8% is not only high in absolute terms but also places it in the top tier of its industry, demonstrating good management effectiveness in deploying capital.

Fundamental Analysis Overview

A review of Futu’s detailed fundamental analysis report provides a broader context for these growth figures. The report gives Futu a solid rating, highlighting its high profitability and very good growth profile. While there are some minor notes on financial health, the overall picture is one of a company with best-in-industry margins and a solid growth trajectory that may justify its current valuation levels when compared to the S&P 500.

Finding Similar Investment Opportunities

Futu Holdings Ltd. presents a solid case study of a company that aligns with the disciplined growth investing principles from "The Little Book That Makes You Rich." For investors interested in discovering other companies that meet these strict criteria, the screen used to identify Futu is publicly available. You can view and customize this screen to find more potential growth stocks here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The analysis presented is based on data believed to be reliable, but its accuracy cannot be guaranteed. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.