FORTINET INC (NASDAQ:FTNT) stands out as a compelling candidate for quality investors, according to our Caviar Cruise stock screener. The company’s strong fundamentals, consistent growth, and efficient capital allocation make it a noteworthy pick in the cybersecurity sector.

Why FTNT Fits the Quality Investing Criteria

-

Revenue and EBIT Growth: FTNT has delivered a 5-year revenue CAGR of 13.7%, exceeding the minimum 5% threshold for quality stocks. More impressively, its EBIT growth over the same period stands at 39.2%, indicating improving profitability and operational efficiency.

-

High Return on Invested Capital (ROIC): With an ROIC (excluding cash and goodwill) of 315.2%, FTNT demonstrates exceptional efficiency in generating returns from its capital investments. This far surpasses the 15% minimum required by the screen.

-

Strong Free Cash Flow Conversion: The company’s 5-year average profit quality (free cash flow to net income) is 164.4%, well above the 75% benchmark. This suggests FTNT effectively converts earnings into cash, a key trait for sustainable businesses.

-

Low Debt Burden: FTNT’s debt-to-free cash flow ratio is just 0.48, meaning it could theoretically pay off all its debt in less than six months using current cash flows. This reflects a conservative financial structure.

Fundamental Strengths

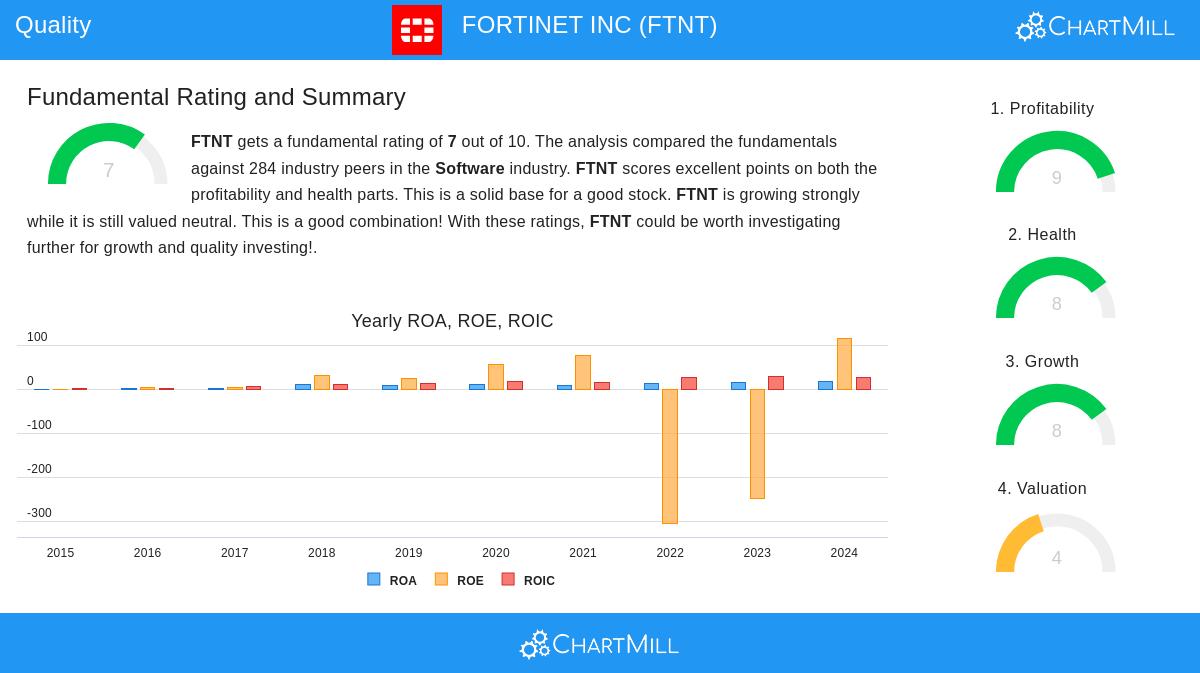

Our fundamental analysis report assigns FTNT a rating of 7 out of 10, highlighting:

- Profitability: Scores 9/10, with industry-leading margins (31.7% operating margin) and high returns on equity (95.7%).

- Financial Health: Scores 8/10, supported by a strong balance sheet and manageable debt levels.

- Growth: Scores 8/10, with consistent revenue and earnings expansion, though future EPS growth is expected to moderate.

While FTNT’s valuation appears elevated (P/E of 41.5), its premium may be justified by its growth trajectory and competitive position in cybersecurity.

For more quality stock ideas, explore our Caviar Cruise screener, updated regularly.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should always conduct your own research before making investment decisions.