A strategy that combines basic strength with technical momentum offers investors a full method for spotting possible opportunities in the equity markets. This methodology focuses on companies showing sound underlying business health and profitability, which are then filtered for stocks displaying favorable technical breakout patterns. The goal is to find securities where strong business fundamentals are being acknowledged by the market through positive price action, potentially indicating the beginning of a sustained upward trend. This dual analysis approach aims to confirm investment candidates through both quantitative business measures and market timing indicators.

Fabrinet (NYSE:FN) provides optical packaging and electronic manufacturing services to original equipment manufacturers, specializing in low-volume production of high-complexity products. The company offers full manufacturing capabilities including process design, supply chain management, and advanced packaging across the entire production process.

Fundamental Strength Assessment

Fabrinet's fundamental profile reveals several characteristics that align with the criteria for strong growth companies. The company displays exceptional financial health and operational efficiency, which provides a solid base for sustained growth.

- Outstanding Financial Health: Fabrinet earns a remarkable Health Rating of 9/10, supported by zero outstanding debt and sound liquidity metrics including a Current Ratio of 3.00 and Quick Ratio of 2.28

- Superior Profitability: With a Profitability Rating of 8/10, the company shows excellent returns including ROA of 11.74%, ROE of 16.78%, and ROIC of 12.73%, all ranking in the top quartile of its industry

- Consistent Growth Trajectory: The Growth Rating of 7/10 reflects strong historical performance with EPS growing at 22.15% annually and revenue increasing at 15.80% per year over recent periods

These fundamental characteristics are crucial for the screening methodology because companies with sound financial health and profitability are better positioned to maintain growth and handle market volatility. The absence of debt removes interest burden and bankruptcy risk, while strong profitability metrics indicate efficient capital allocation and competitive advantages within their industry.

View Fabrinet's complete fundamental analysis report

Technical Setup Analysis

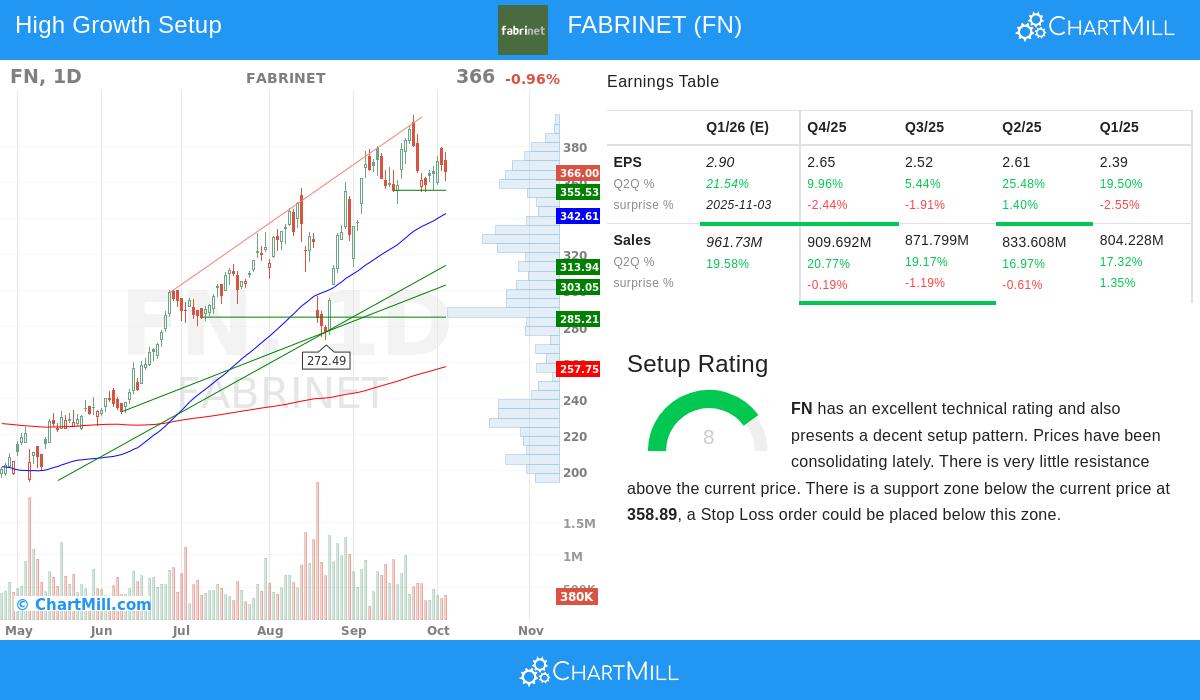

The technical picture for Fabrinet complements its fundamental strength, showing patterns that often come before significant price movements. The stock currently presents an interesting technical setup that suggests potential for continued upward momentum.

- Trend Alignment: Both short-term and long-term trends are positive, creating favorable conditions for breakout continuation

- Consolidation Pattern: The stock has been trading in a defined range between $348.01 and $397.26 over the past month, with current prices positioned in the middle of this range

- Support Structure: Multiple support levels exist below current prices, with the nearest significant support zone between $355.52 and $358.89

- Moving Average Alignment: The stock trades above all key moving averages (20, 50, 100, and 200-day), indicating sustained bullish momentum

The technical breakout pattern is significant within this screening methodology because it represents the market's acknowledgment of the company's fundamental strength. When a stock breaks out from a consolidation pattern with sound fundamentals supporting the move, it often indicates the beginning of a new leg higher as more investors take notice of the opportunity.

Review Fabrinet's detailed technical analysis

Valuation Considerations

While Fabrinet displays strong growth and operational characteristics, its valuation requires careful consideration. The company trades at premium multiples that reflect market expectations for continued growth.

- Current Multiples: P/E ratio of 35.99 and Forward P/E of 29.19, both above S&P 500 averages

- Growth Justification: Expected EPS growth of 20.45% annually may support current valuation levels

- Profitability Premium: Outstanding profitability ratings could justify higher multiples compared to industry peers

For growth investors, premium valuations are often acceptable when supported by strong growth trajectories and exceptional operational metrics. The key consideration is whether the company can continue delivering growth that eventually brings valuations back to more reasonable levels through earnings expansion.

Investment Context

Fabrinet operates in the electronic manufacturing services sector, focusing on high-complexity optical and electro-mechanical products. This positioning in technologically advanced manufacturing provides natural barriers to entry and potential for sustained growth as demand for sophisticated electronic components continues growing across multiple industries including telecommunications, healthcare, and industrial applications. The company's specialization in low-volume, high-complexity production differentiates it from standard electronics manufacturers and may provide more stable pricing power.

The combination of Fabrinet's fundamental strength and technical setup presents a case where business performance and market acknowledgment appear to be aligning. The company's debt-free balance sheet, strong profitability, and consistent growth create a foundation that supports further price appreciation if execution remains strong.

Discover more stocks matching the Strong Growth Stocks with Good Technical Setup criteria

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results, and all investments carry risk including potential loss of principal.