In the field of growth investing, few methods have the lasting attraction of the organized system described by Louis Navellier in his 2007 book, The Little Book That Makes You Rich. The plan is formed on eight basic rules meant to find companies with excellent growth traits, concentrating on earnings momentum, sales growth, profit gains, and solid financial returns. The aim is to locate stocks where business fundamentals are speeding up, a state that frequently comes before notable stock price gains. A recent filter using these particular rules has identified one company that seems to meet almost every requirement: Comfort Systems USA Inc (NYSE:FIX).

A Solid Fit for Navellier's Growth Rules

The center of Navellier's plan is a multi-factor list. Comfort Systems USA, a national supplier of mechanical and electrical contracting services, makes a strong argument based on the most current data.

-

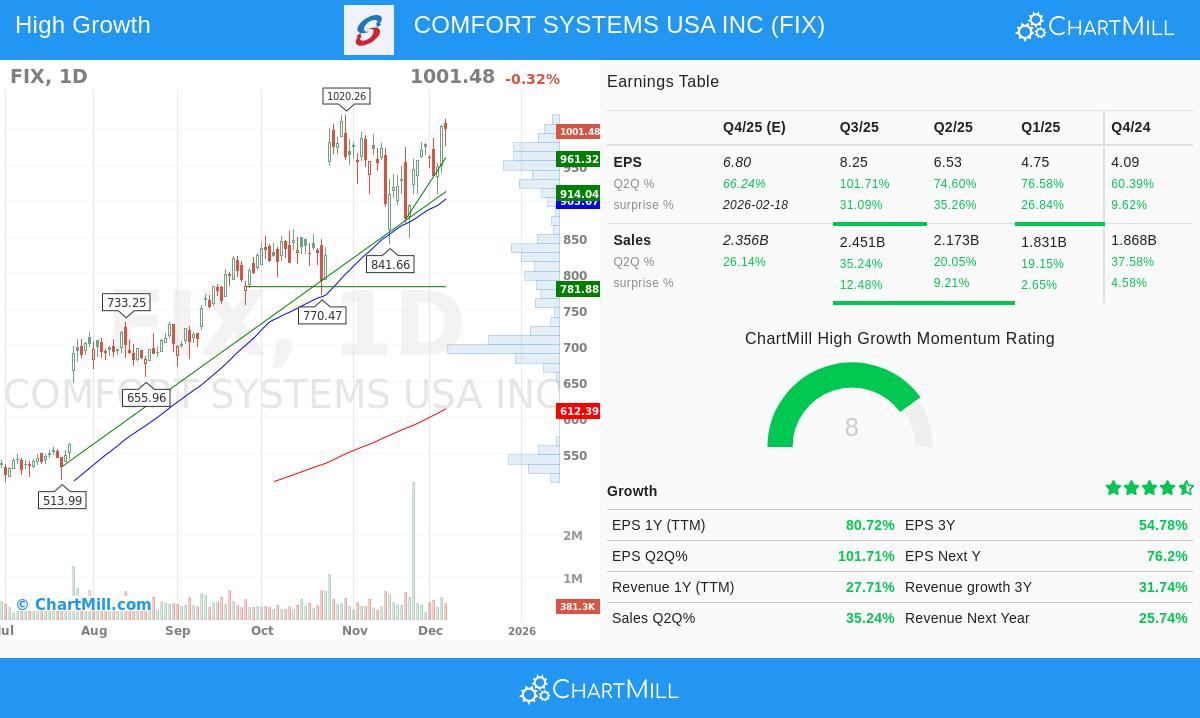

Positive Earnings Revisions & Surprises: The plan gives great weight to analyst opinion and a company's capacity to regularly beat forecasts. For FIX, the average EPS estimate for the coming quarter has been increased by more than 20% in the past three months. More notably, the company has reported a positive earnings surprise in all of the last four quarterly statements, with an average beat of 25.7%. This series of beating estimates is an important sign that basic business force may be underrated by the market.

-

Solid and Speeding Growth: Navellier looks for companies that are not only expanding, but where the speed of expansion is itself rising. Comfort Systems does very well here:

- Sales increased 27.7% year-over-year (TTM), with an even greater 35.2% increase in the latest quarter.

- Earnings expansion is even more marked, with EPS up 80.7% over the previous year. Importantly, the quarterly EPS increase sped up to 101.7%, much greater than the 49.3% increase recorded in the similar quarter a year before. This "earnings momentum" is a main part of the plan.

-

Growing Profitability and Cash Flow: Expansion is most useful when it leads to better profits and cash production. FIX shows this plainly:

- The company's operating margin grew by over 36% in the past year, showing it is turning higher sales into profits at a rising rate.

- Free cash flow, a vital sign of a sound business, increased by a remarkable 55% over the same time. Good cash flow supports internal spending, debt payment, and shareholder rewards without needing outside funding.

-

High Return on Equity: The last rule requires a high return on equity (ROE), calculating how well a company creates profits from shareholder money. With an ROE of 37.5%, Comfort Systems is notable, showing very efficient use of its equity base.

Basic Soundness and Price Context

Beyond the particular filter rules, a wider view of the company's basics, as explained in its detailed fundamental analysis report, supports the investment argument. The report gives FIX a high total fundamental score of 8 out of 10, noting very good profitability and financial soundness. The company has industry-best returns on assets, equity, and invested capital, while keeping a careful balance sheet with little debt reliance.

The main point of thought for investors is price. The stock sells at a high level, with a P/E ratio above both the industry and S&P 500 averages. Yet, this is partly reasonable given the company's outstanding growth path and high quality measures. The price score in the report states that the low PEG ratio and exceptional profitability may balance the high earnings multiple.

Is FIX a "Little Book" Choice?

For investors using the system from The Little Book That Makes You Rich, Comfort Systems USA offers a clear model of a company performing very well across all areas. It shows forceful sales and earnings speed, positive earnings surprises, growing margins, solid cash flow production, and excellent returns on capital. These are exactly the numerical signals Navellier's plan aims to find. While the present market price requires notice, the basic fundamental speed is clear.

This single stock was found using a set filter based on Navellier's eight rules. Investors curious about finding other companies that currently satisfy these strict growth rules can view the full filter and its outcomes here.

Disclaimer: This article is for information only and does not form financial guidance, a support, or a suggestion to buy, sell, or hold any security. Investing carries risk, including the possible loss of original money. Readers should do their own study and talk with a qualified financial advisor before making any investment choices.