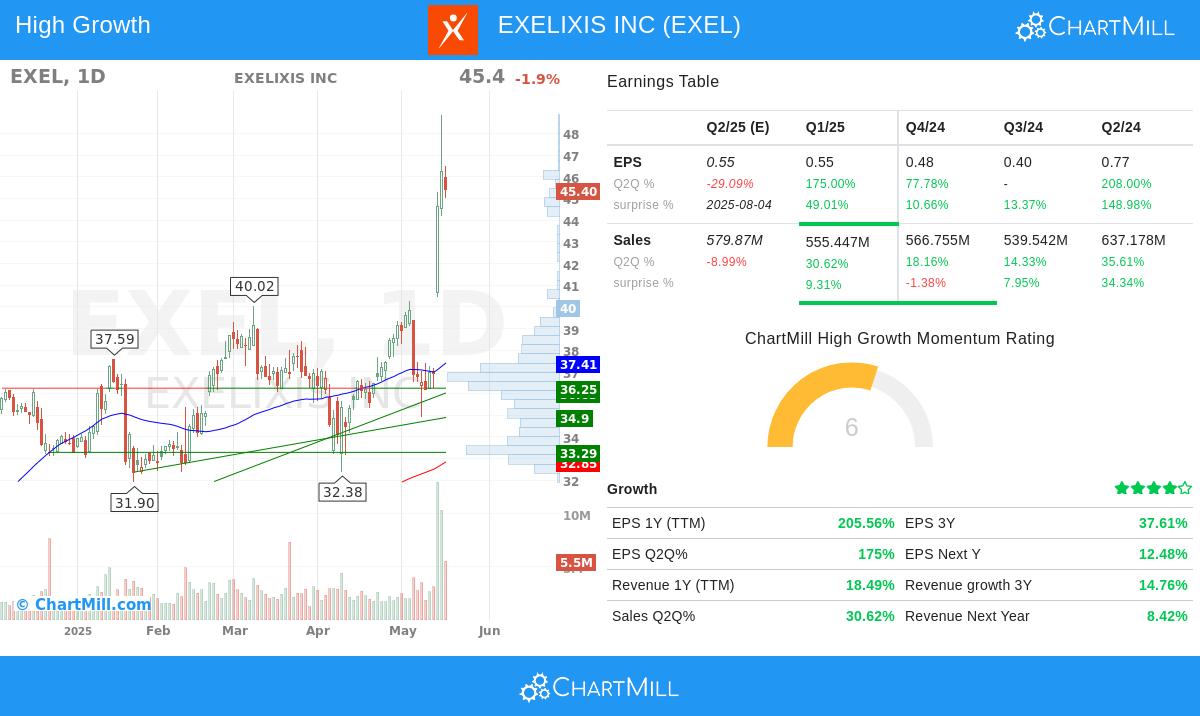

EXELIXIS INC (NASDAQ:EXEL) has been identified as a high-growth momentum stock that also aligns with Mark Minervini’s Trend Template criteria. The company, focused on developing oncology treatments, demonstrates both technical strength and robust fundamental growth, making it a compelling candidate for investors seeking high-growth opportunities.

Why EXEL Fits Minervini’s Trend Template

Minervini’s strategy emphasizes stocks in strong uptrends with clear technical strength. EXEL meets these criteria:

-

Price Above Key Moving Averages:

- Current price ($45.40) is above the 50-day ($37.41), 150-day ($35.13), and 200-day ($32.85) moving averages.

- The 50-day MA is above both the 150-day and 200-day MAs, confirming bullish alignment.

-

Upward-Trending Moving Averages:

- The 200-day MA is rising, reinforcing long-term strength.

-

Strong Relative Strength:

- EXEL outperforms 97% of all stocks, with a relative strength score of 97.66.

-

Price Near 52-Week High:

- Trading at $45.40, EXEL is within 7% of its 52-week high ($48.85) and 125% above its 52-week low ($20.14).

High Growth Momentum Fundamentals

Beyond technicals, EXEL exhibits strong growth metrics:

-

Earnings Growth:

- EPS (TTM) grew 205.6% year-over-year.

- Quarterly EPS growth surged 175% in the most recent quarter.

-

Revenue Expansion:

- Revenue (TTM) increased 18.5% year-over-year.

- Quarterly sales rose 30.6% compared to the same quarter last year.

-

Profitability Improvements:

- Profit margins expanded to 24.7% in the latest quarter, up from 21.9% in the prior quarter.

- Free cash flow per share grew 129.3% year-over-year.

-

Analyst Confidence:

- EPS and revenue estimates for next year have been revised upward by 5.1% over the past three months.

Technical Outlook

EXEL’s technical rating of 10/10 reflects its strong uptrend, high relative strength, and consistent performance. However, the setup rating of 2/10 suggests the stock may be extended in the short term, indicating a potential consolidation before another breakout.

For a deeper technical analysis, review the full EXEL technical report.

Our High Growth Momentum + Trend Template screener lists more stocks meeting these criteria.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.