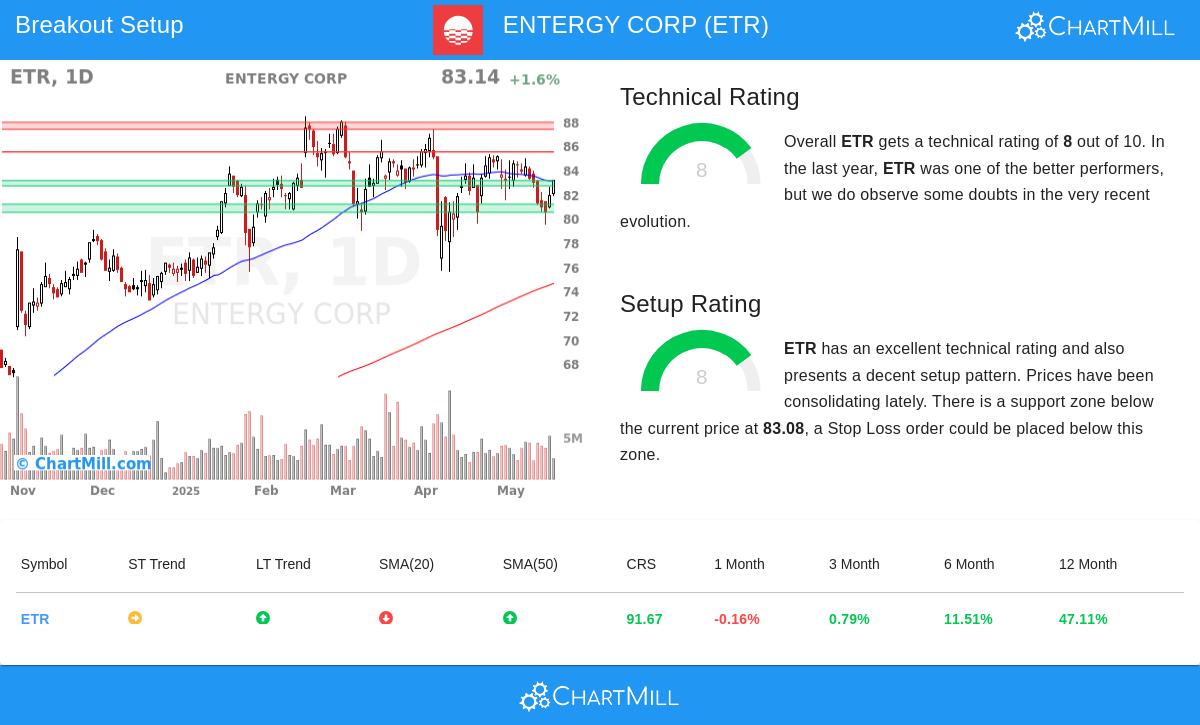

ENTERGY CORP (NYSE:ETR) has been identified as a potential breakout candidate by our technical screening process. The stock shows strong technical health and a well-defined setup pattern, making it worth a closer look for traders focused on momentum and consolidation breakouts.

Technical Strength

- Rating of 8/10: ETR’s technical score reflects a healthy trend, with long-term momentum remaining positive.

- Strong Relative Performance: Over the past year, the stock has outperformed 91% of the market, demonstrating consistent upward movement.

- Sector Leadership: Within the Electric Utilities industry, ETR ranks in the top 14%, indicating relative strength against peers.

- Support Levels: Multiple support zones exist between $77.62 and $83.08, providing a cushion against downside risk.

Setup Quality

- Consolidation Pattern: Prices have been trading in a range between $79.40 and $85.26 over the past month, showing a tightening formation.

- Breakout Potential: Resistance sits near $85.45, and a move above this level could signal the next leg higher.

- Tight Stop-Loss Zone: The nearest support at $83.08 allows for a well-defined exit point if the breakout fails.

- Volume Stability: Average daily volume of 4.4 million shares ensures liquidity for entry and exit.

Our Technical Breakout Setups screener provides more breakout candidates updated daily. For a deeper technical review, see the full ETR technical report.

Disclaimer

This is not investment advice. Always conduct your own analysis and consider risk management before making trading decisions.