EOG RESOURCES INC (NYSE:EOG) stands out as a compelling pick for investors seeking growth at a reasonable price (GARP). The company, an independent oil and gas producer, meets key criteria from Peter Lynch’s investment strategy, balancing solid growth with sound financial health and an attractive valuation.

Why EOG Fits the GARP Approach

- Sustainable Growth: EOG has delivered a 5-year average EPS growth of 18.45%, aligning with Lynch’s preference for companies growing at a sustainable pace (15-30%).

- Reasonable Valuation: With a PEG ratio of 0.53 (well below Lynch’s threshold of 1), the stock is priced attractively relative to its growth. The P/E ratio of 9.78 also suggests undervaluation compared to industry peers.

- Strong Profitability: The company boasts a return on equity (ROE) of 20.59%, exceeding Lynch’s 15% benchmark, and operates with healthy margins, including a 34.82% operating margin.

- Financial Health: EOG maintains a conservative debt profile, with a debt-to-equity ratio of 0.12, far below the 0.6 limit in our screen. Its current ratio of 1.87 reflects ample liquidity to cover short-term obligations.

Fundamental Snapshot

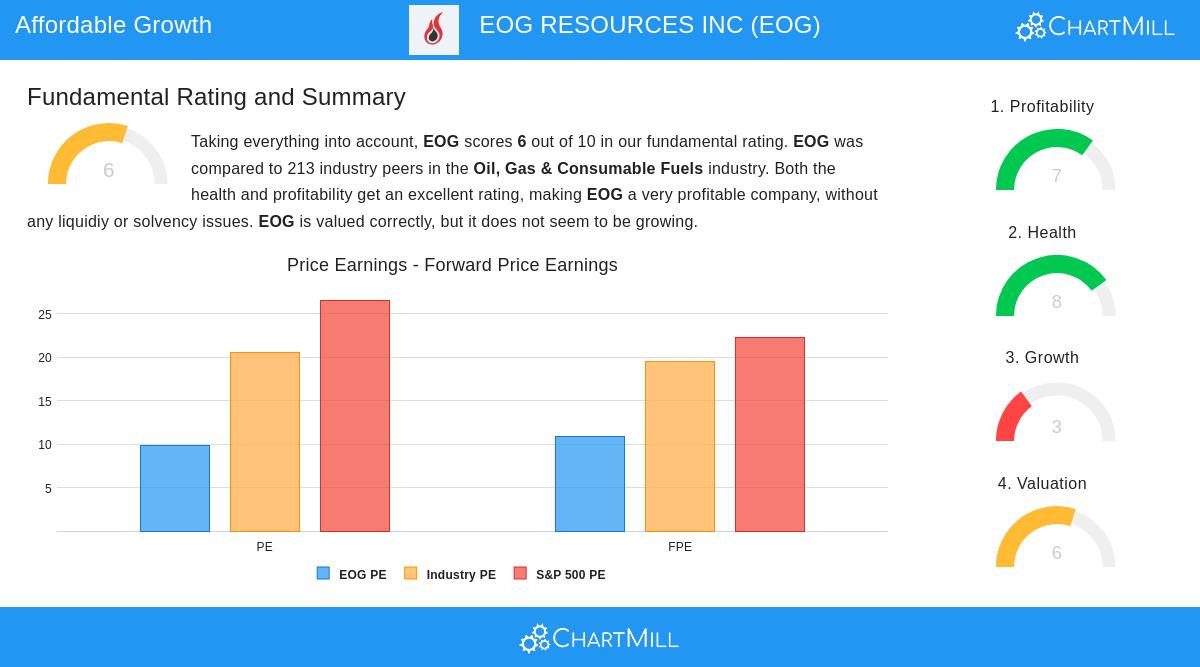

Our fundamental analysis report rates EOG a 6/10, highlighting its strong profitability and financial health. Key takeaways:

- Profitability: High ROE and industry-leading margins.

- Dividend: A 3.67% yield with a 10-year payment history, though future growth may slow.

- Valuation: Priced below peers on earnings and cash flow metrics.

For investors building a long-term portfolio, EOG’s combination of growth, value, and stability makes it worth further research.

Our Peter Lynch Strategy screener lists more stocks matching these criteria and is updated daily.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should always conduct your own analysis before making investment decisions.