EnerSys (NYSE:ENS) emerged from our Peter Lynch-inspired stock screen as a potential fit for growth-at-a-reasonable-price (GARP) investors. The company, a provider of stored energy solutions for industrial applications, demonstrates solid historical growth, strong profitability, and an attractive valuation.

Why EnerSys Fits the GARP Criteria

- Sustainable Growth: ENS has delivered a 5-year average EPS growth of 16.8%, aligning with Lynch’s preference for companies growing between 15% and 30%. This suggests manageable, long-term expansion rather than overheated growth.

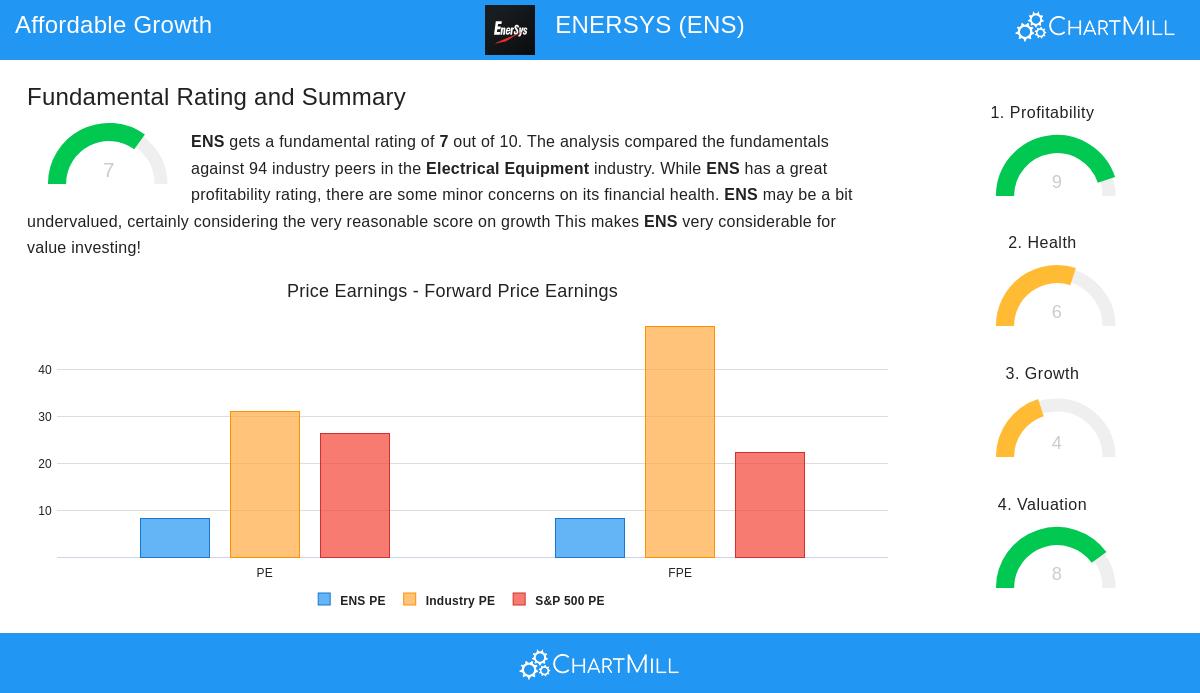

- Attractive Valuation: With a PEG ratio (past 5 years) of 0.49, well below Lynch’s threshold of 1, the stock appears undervalued relative to its earnings growth. The P/E ratio of 8.24 further supports this, as it sits below both industry and S&P 500 averages.

- Strong Profitability: ENS boasts an ROE of 18.98%, exceeding Lynch’s 15% benchmark, indicating efficient use of shareholder equity. Margins are also healthy, with a 10.05% net profit margin outperforming 86% of industry peers.

- Financial Health: The company maintains a conservative debt profile (Debt/Equity of 0.57) and a robust current ratio of 2.70, ensuring liquidity to meet short-term obligations.

Key Considerations

While ENS excels in profitability and valuation, its revenue growth has been modest (3.22% annualized over 5 years), and future EPS growth is projected to slow to 2.26%. Investors should weigh this against the company’s strong cash flow generation and dividend track record (10+ years of consistent payouts).

For a deeper dive, review the full fundamental analysis of ENS.

Our Peter Lynch Strategy screener lists more stocks meeting these criteria and is updated daily.

Disclaimer

This is not investing advice. The observations here are based on data available at the time of writing. Always conduct your own research before making investment decisions.