DR Horton Inc (NYSE:DHI) stands out as a potential candidate for long-term investors following Peter Lynch’s growth-at-a-reasonable-price (GARP) approach. The company, one of the largest homebuilders in the U.S., meets several key criteria from Lynch’s investment philosophy, including sustainable earnings growth, reasonable valuation, and strong financial health.

Why DHI Fits the Peter Lynch Strategy

- Strong Historical Growth: DHI has delivered an impressive 5-year average EPS growth of 27.63%, well above Lynch’s minimum threshold of 15%. While recent earnings have softened, the long-term trend remains solid.

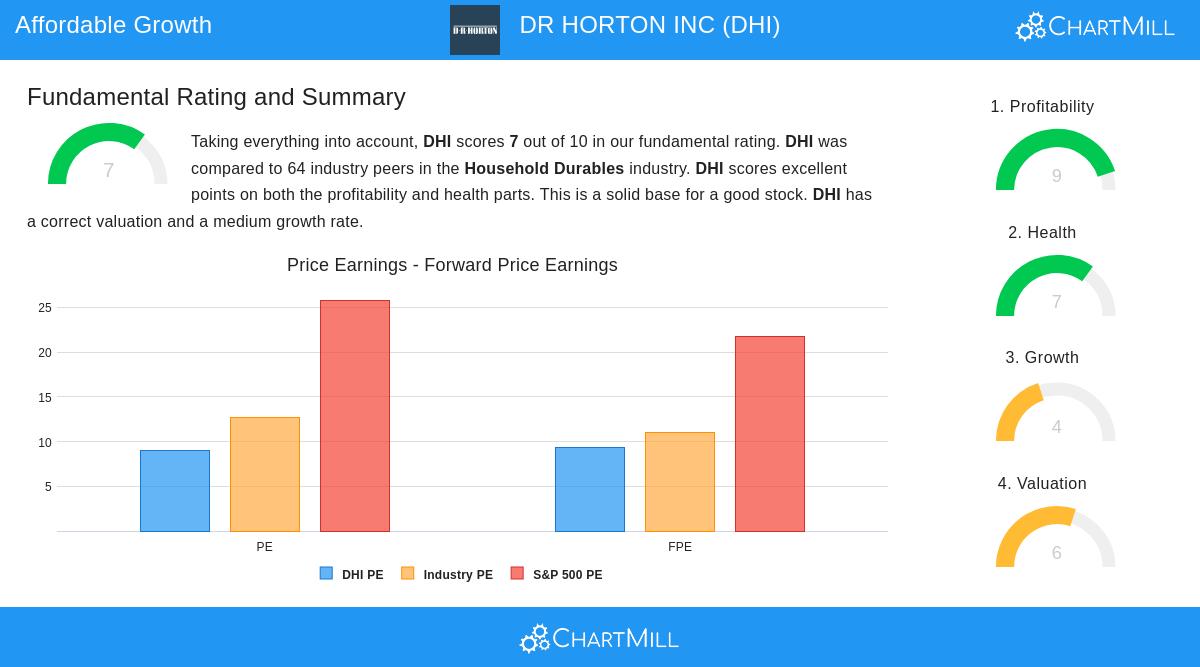

- Reasonable Valuation: The stock trades at a P/E ratio of 8.98, below both the industry average and the S&P 500. Its PEG ratio (factoring in past growth) is low, suggesting the market may not fully price in its historical performance.

- Healthy Balance Sheet: With a debt-to-equity ratio of 0.27, DHI maintains a conservative capital structure, aligning with Lynch’s preference for financially stable companies.

- High Profitability: The company’s return on equity (ROE) of 17.64% exceeds Lynch’s 15% benchmark, reflecting efficient use of shareholder capital.

- Liquidity Strength: A current ratio of 6.71 indicates ample short-term financial flexibility, reducing liquidity risks.

Fundamental Strengths

DHI’s financial health is robust, with high marks for profitability and solvency. The company generates strong operating margins (16.26%) and has consistently grown revenue at an annualized rate of 15.91% over the past five years. While near-term headwinds have impacted earnings, analysts expect EPS to rebound with 10.77% annual growth in the coming years.

For a deeper dive into DHI’s fundamentals, review the full analysis here.

Our Peter Lynch Strategy screener highlights more stocks that fit this disciplined investment approach.

Disclaimer

This is not investing advice. The observations here are based on available data at the time of writing. Always conduct your own research before making investment decisions.