CALLON PETROLEUM CO (NYSE:CPE) was identified as a Technical Breakout Setup Pattern by our stockscreener. Such a pattern occurs when we see a pause in a strong uptrend: after a strong rise the stock is consolidating a bit and at some point the trend may be continued. Whether this actually happens can not be predicted of course, but it may be a good idea to keep and eye on NYSE:CPE.

What is the technical picture of NYSE:CPE telling us.

ChartMill assigns a Technical Rating to every stock. This score ranges from 0 to 10 and is updated daily. The score is determined by evaluating multiple technical indicators and properties.

We assign a technical rating of 7 out of 10 to CPE. Although CPE is only a medium performer in the overall market, the technical picture looks good in both the medium and short term time frames.

- The long term trend is positive and the short term trend is neutral. The long term trend gets the benefit of the doubt for now.

- When compared to the yearly performance of all other stocks, CPE outperforms 58% of them, which is more or less in line with the market.

- CPE is part of the Oil, Gas & Consumable Fuels industry. There are 217 other stocks in this industry, CPE did better than 45% of them.

- CPE is currently trading in the middle of its 52 week range. The S&P500 Index however is trading in the upper part of its 52 week range, so CPE is lagging the market slightly.

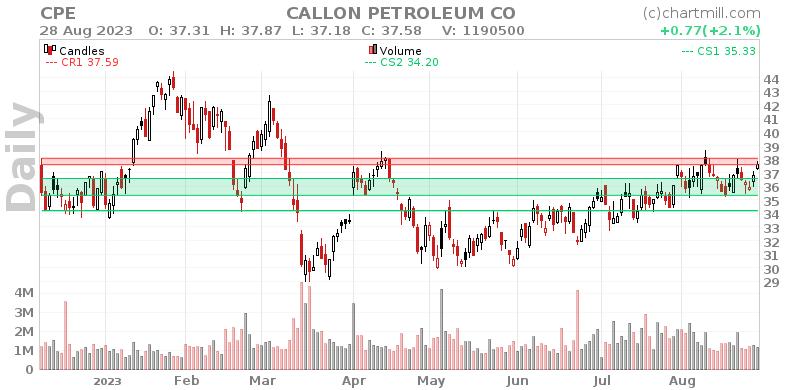

- In the last month CPE has a been trading in the 35.10 - 38.70 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

For an up to date full technical analysis you can check the technical report of CPE

Why is NYSE:CPE a setup?

Next to the Technical Rating, the Setup Rating of a stock determines to which extend the stock is consolidating. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. For NYSE:CPE this score is currently 9:

CPE has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 37.59. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 36.57, a Stop Loss order could be placed below this zone. We notice that large players showed an interest for CPE in the last couple of days, which is a good sign.

How can NYSE:CPE be traded?

One strategy to consider is waiting for the actual breakout to occur, where the stock breaks out above the current consolidation zone. Traders can then enter a buy position, anticipating further upward momentum. As a risk management measure, it is advisable to set a stop loss order below the consolidation zone.

Please note that this article should not be construed as trading advice. The information provided is solely based on automated technical analysis and serves to highlight technical observations. It is important to conduct your own analysis and make trading decisions based on your own judgment and responsibility.

Every day, new breakout setups can be found on ChartMill in our Breakout screener.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.