For investors looking for a dependable source of passive income, a methodical process for choosing dividend stocks is important. One good technique involves searching for companies that provide an appealing dividend and also show the basic financial capacity to maintain and possibly raise those payments over time. This approach emphasizes quality and durability over seeking the largest available yield, which can sometimes indicate hidden business problems. A practical first step is to find stocks with high marks in detailed dividend evaluations, while also confirming they hold good scores for earnings and balance sheet soundness. This layered check aids in finding companies that are benefiting shareholders now and are set to continue.

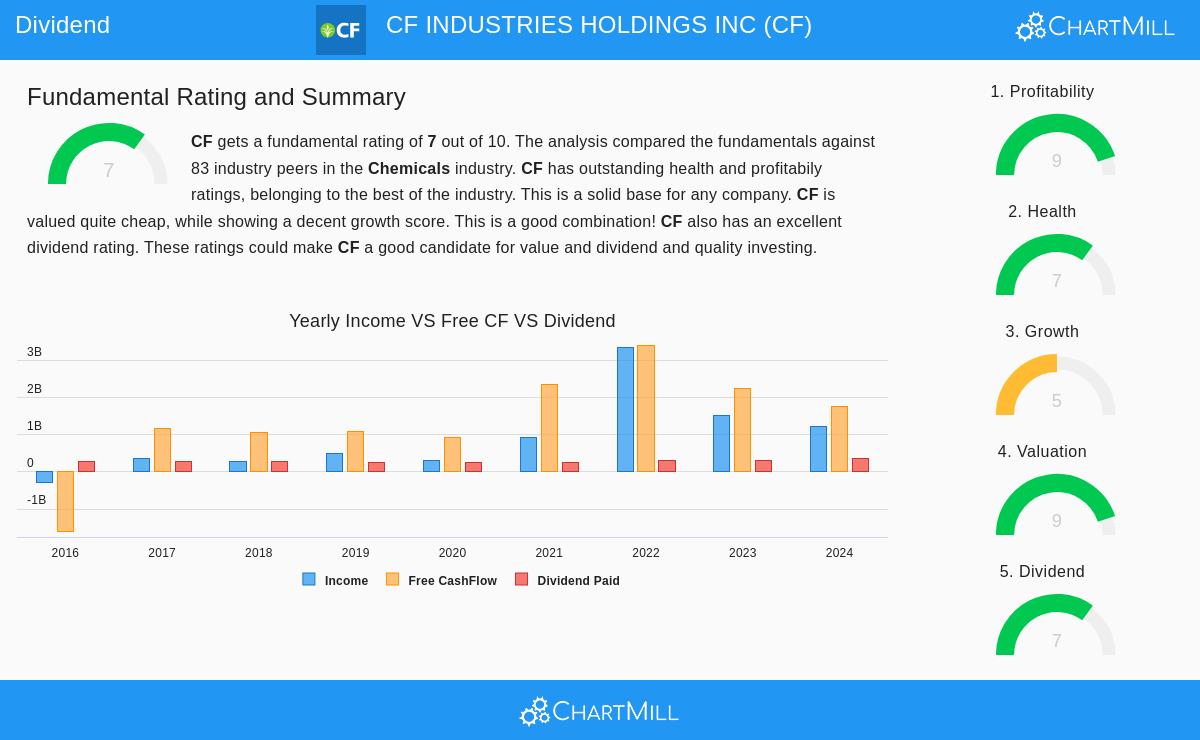

One company that appears from this careful search process is CF Industries Holdings Inc. (NYSE:CF), a top worldwide producer of nitrogen fertilizer. The company's basic financial picture indicates it deserves more examination by dividend-oriented investors.

A Good Dividend Picture

Central to the review is CF Industries' dividend, which receives a firm ChartMill Dividend Rating of 7 out of 10. This score combines a number of important elements dividend investors consider:

- Appealing and Increasing Yield: The stock provides a yearly dividend yield of 2.59%, which is higher than both the sector average (2.47%) and the wider S&P 500 average (about 1.94%). Significantly, this is not a fixed amount. The company has raised its dividend at a notable yearly pace of almost 11% over the last five years, showing a dedication to giving more capital back to shareholders.

- Dependable History: Steadiness creates trust in dividend investing. CF has built a dependable history by distributing a dividend for at least ten straight years without a cut. This record offers a degree of assurance in management's dividend approach.

- Maintainable Payout: The maintainability of a dividend is likely more critical than its present amount. CF's payout ratio—the part of profits given as dividends—is at a very comfortable 24.22%. This low figure shows the company keeps most of its earnings to put back into the business, reduce debt, or finance future dividend raises, all while having a wide buffer against profit swings.

The Base: Earnings and Balance Sheet Soundness

A good dividend cannot stand alone; it needs to be backed by a profitable and financially stable business. This is exactly why searching for satisfactory earnings and soundness ratings is a key stage in the method. CF performs well in these areas, offering a solid base for its shareholder payments.

The company has a very good ChartMill Profitability Rating of 9. This is fueled by better margins and returns on capital that exceed many others in the chemicals sector. For example:

- Its Operating Margin is over 31%, placing it in the best group of the sector.

- Return on Equity is a firm 28.44%, showing good use of shareholder capital.

These high earnings measures are vital because they produce the cash needed to pay the dividend without pressuring the company's finances.

Also, CF has a good ChartMill Health Rating of 7, showing a steady financial setup. Important details involve:

- Good Liquidity: With a Current Ratio of 2.27, the company has ample immediate assets to meet its immediate liabilities.

- Controlled Debt: While the company has some debt, its Debt-to-Free-Cash-Flow ratio is a very good 1.74. This indicates it could pay off all its debt with under two years of its present free cash flow, meaning the debt level is comfortably handled by its business activities.

Valuation Setting

For investors thinking about a purchase price, valuation is relevant. CF seems to be valued fairly, particularly relative to its profits. With a Price-to-Earnings (P/E) ratio of 9.75 and a Forward P/E of 11.19, the stock is valued lower than both the S&P 500 and most of its sector competitors. This mix of an appealing dividend, sound basics, and a fair price can be interesting for cost-aware income investors.

A Point on Expansion and Cycles

It is important for investors to understand the complete view. The company's expansion rating is more average, as experts forecast slower profit and sales growth in the next few years compared to its solid recent performance. This is a typical factor for established companies in cyclical fields like commodities. The priority for dividend investors here is on the steadiness and maintainability of the cash flows that back the dividend, more than fast expansion.

For a complete look at all these basic factors, you can see the full ChartMill Fundamental Analysis Report for CF.

Locating Comparable Possibilities

CF Industries shows the kind of company a quality dividend search can find: one with a satisfactory and rising yield, supported by high earnings and careful financial stewardship. This process helps remove companies where a high yield could be an illusion hiding business trouble.

If you want to investigate other stocks that fit similar standards for good dividends, earnings, and balance sheet soundness, you can perform the same search. Click here to view the "Best Dividend Stocks" screen and see the current results. Keep in mind, a search gives a first list of options; additional study into each company's business, sector trends, and future outlook is always suggested.

,

Disclaimer: This article is for informational and educational purposes only and does not form investment advice, financial advice, or a suggestion to buy or sell any security. The review uses present data and ratings, which can change. Investors should perform their own research and think about their personal financial situation and risk appetite before making any investment choice.