Known for his philosophy of investing in what you know, Peter Lynch looked for companies with consistent earnings growth, low debt, and a competitive edge. Does CF INDUSTRIES HOLDINGS INC (NYSE:CF) meet these key criteria? Let’s find out.

Does CF INDUSTRIES HOLDINGS INC (NYSE:CF) meet Peter Lynch’s stock-picking criteria?

- With a favorable Return on Equity (ROE) of 24.43%, CF demonstrates its ability to deliver attractive returns for shareholders. This metric highlights the company's effective management of assets and its profitability.

- CF has a Debt/Equity ratio of 0.6, indicating a balanced approach to financing growth.

- Over the past 5 years, CF has demonstrated 24.81 growth in EPS, signifying its positive financial trajectory and potential for future profitability.

- A PEG ratio of 0.46 positions CF as a well-valued growth stock in today’s market.

- CF’s Current Ratio of 3.08 highlights its ability to sustain day-to-day operations without liquidity concerns.

Zooming in on the fundamentals.

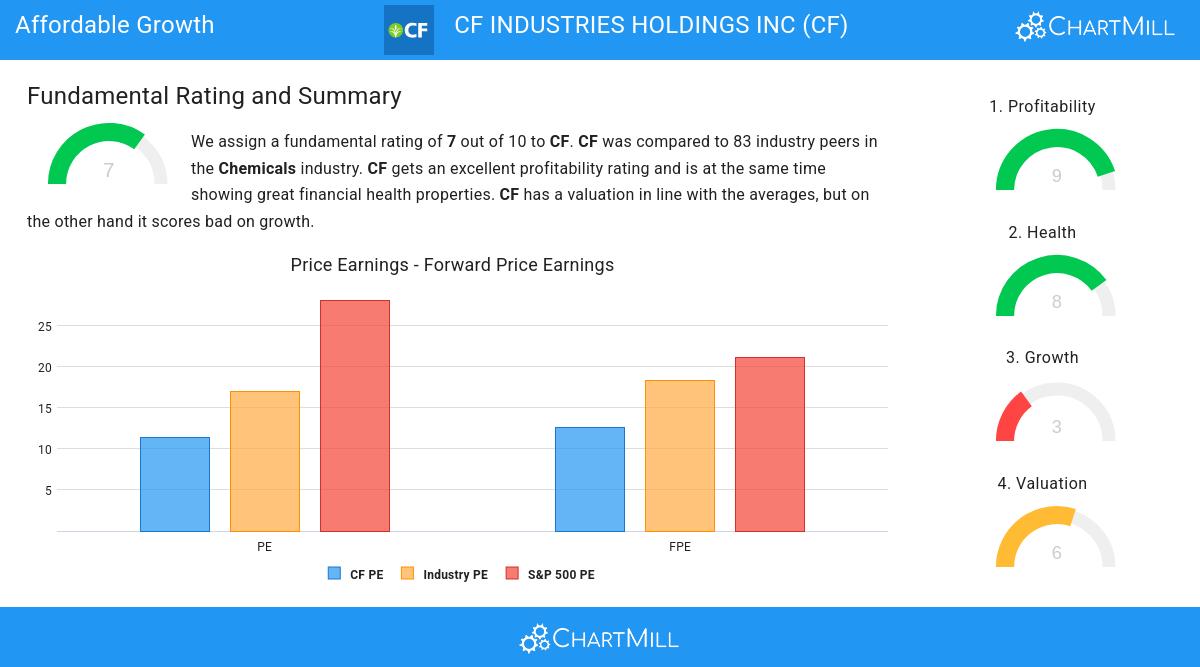

At ChartMill, a crucial aspect of their analysis is the assignment of a Fundamental Rating to each stock. This rating, ranging from 0 to 10, is calculated daily by considering numerous fundamental indicators and properties.

Overall CF gets a fundamental rating of 7 out of 10. We evaluated CF against 83 industry peers in the Chemicals industry. CF has outstanding health and profitabily ratings, belonging to the best of the industry. This is a solid base for any company. CF has a valuation in line with the averages, but on the other hand it scores bad on growth.

Our latest full fundamental report of CF contains the most current fundamental analsysis.

Our Peter Lynch screener lists more Affordable Growth stocks and is updated daily.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.