For investors looking for dependable income, dividend investing is a key method for creating lasting wealth. The process includes finding companies with reliable payment policies, sound finances, and steady earnings, qualities that help dividends continue through different economic periods. Using organized filtering systems helps investors sort through many stocks to find those that meet strict dividend standards. One example is the Best Dividend Stocks screen, which finds companies with solid ChartMill Dividend Ratings while also having sufficient profitability and financial soundness scores. This multi-step method helps steer clear of high-yield situations where unmaintainable payments hide basic business problems.

Dividend Reliability and Sustainability

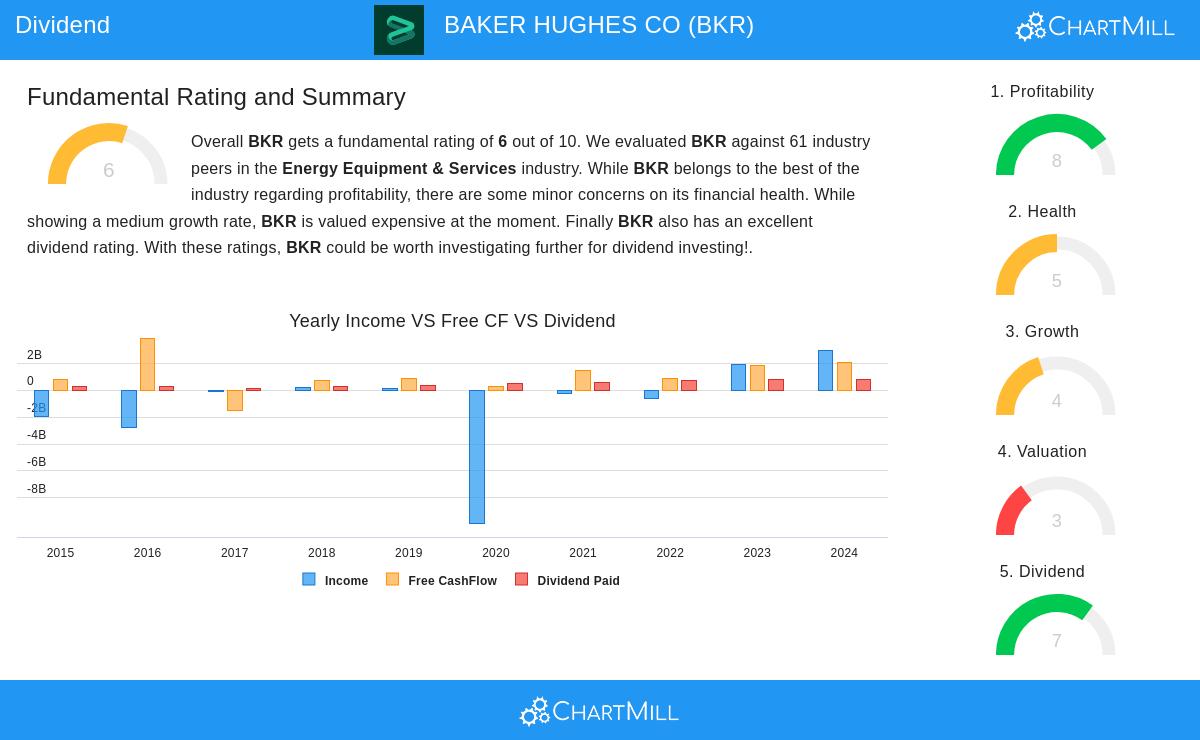

Baker Hughes Co (NASDAQ:BKR) offers a strong example for dividend-oriented investors, receiving a ChartMill Dividend Rating of 7/10. The company shows careful capital return policies with several favorable traits:

- Sustainable Payout Ratio: BKR uses 28.64% of its income for dividends, significantly under the 80% caution level that usually suggests payment risk

- Reliable History: The company has kept and not reduced its dividend for a minimum of 10 years, giving assurance of its dedication to shareholders

- Reasonable Yield: Having a 2.06% dividend yield, BKR provides income higher than the S&P500 average while staying away from very high yields that can indicate money troubles

- Steady Growth: The dividend has increased at a 4.36% yearly rate, indicating management's belief in future cash flows

These dividend features match well with the screening system's emphasis on maintainable income instead of pursuing the highest yields, which frequently carry significant risk.

Profitability Supporting Dividend Payments

Baker Hughes receives a good ChartMill Profitability Rating of 8/10, offering fundamental backing for its dividend program. The company's profitability numbers show its ability to continue payments:

- Strong Returns: BKR delivers a 17.22% Return on Equity and 11.38% Return on Invested Capital, doing better than about 82-84% of similar companies

- Improving Margins: Both operating and profit margins have displayed steady gains in recent years, with present profit margins of 11.04% higher than 82% of rivals

- Cash Flow Production: The company keeps positive operating cash flow each year, supplying the needed liquidity for dividend payments

This profitability base is important for dividend continuity, as it confirms the company can finance payments from actual business results instead of borrowing or selling assets.

Financial Health Considerations

With a ChartMill Health Rating of 5/10, Baker Hughes displays acceptable financial soundness with some points to watch. The company's solvency numbers give confidence:

- Controlled Debt: A Debt/Equity ratio of 0.34 shows limited use of borrowing, while the Debt to FCF ratio of 2.79 implies the company could settle debts in less than three years using cash flow

- Industry Standing: BKR's Altman-Z score of 2.28 puts it in the better half of its industry for bankruptcy risk evaluation

- Liquidity Notes: The company's current and quick ratios show some softness in immediate liquidity compared to industry counterparts, although they stay within workable levels

While not outstanding, this health picture meets the screening requirements for "acceptable health," confirming the company is not under immediate financial pressure that could endanger dividend payments.

Valuation and Growth Context

Baker Hughes trades at a P/E ratio of 18.00, placing it similarly to industry peers but under the S&P500 average. The company shows good historical growth with EPS increasing at 23.35% per year over recent years, but future growth estimates have slowed to about 7.64% EPS growth. This growth slowdown deserves attention but does not directly endanger the dividend considering the company's low payout ratio and good profitability.

Investment Considerations for Income Seekers

For dividend investors, Baker Hughes presents a measured chance providing acceptable yield with good sustainability features. The company's energy technology focus gives involvement in both conventional and new energy markets, possibly offering steadiness across energy cycles. While the average health rating implies investors should watch liquidity numbers, the mix of very good profitability and careful payment policies creates a strong income investment example.

Explore more dividend stock ideas using the Best Dividend Stocks screen to find other companies meeting these strict dividend, profitability, and health requirements.

Disclaimer: This analysis is based on fundamental data and screening systems for information only. It does not form investment advice, and investors should perform their own research and think about their personal money situation before making investment choices. Past performance and current numbers do not assure future outcomes, and dividend payments may be changed or stopped at any time by company management.