Investors looking for companies with outstanding growth paths often deal with the difficulty of finding not only firms with good fundamental outlooks but also those whose stock charts indicate the time could be suitable for purchase. A method that merges these two fields looks for stocks showing solid growth, profitability, and financial condition, which are also creating technical breakout formations. This method tries to capture companies with firm core business momentum just as their share prices start a new phase of increase. Arista Networks Inc (NYSE:ANET) recently appeared from a screen made to find such chances, presenting a strong case for review.

Strong Fundamental Growth Profile

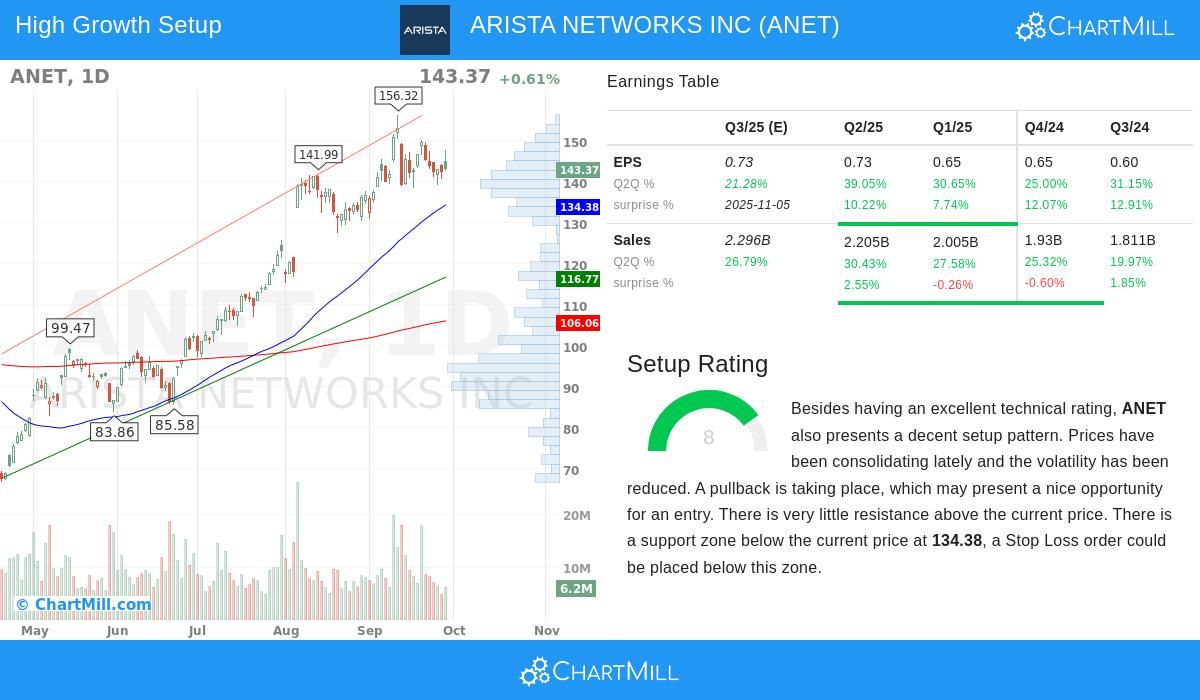

The foundation of this method is finding companies with clear and maintainable growth, a main sign of a business increasing its market position and profitability. Arista Networks does very well in this field, as shown by its high Growth Rating of 8 out of 10 in its fundamental analysis report. The company's financial results show a solid growth driver.

- Revenue Growth: Over the last year, revenue rose by 25.97%, adding to a good five-year average yearly growth rate of 23.77%.

- Earnings Per Share (EPS) Growth: EPS growth is also notable, going up by 31.50% in the last year and by an average of 30.17% each year over recent years.

- Future Outlook: This solid past performance is forecast to keep going, with analysts estimating yearly EPS and revenue growth of about 20% in the next few years.

This steady and solid growth across main financial measures is exactly what growth investors look for, as it indicates the company is effectively taking advantage of demand for its cloud networking products.

Outstanding Profitability and Financial Health

While growth is important, it must be backed by efficient operations and a strong balance sheet to be lasting. A company can increase revenues quickly but struggle if it is not profitable or is weighed down by debt. Arista Networks shows notable strength in these areas, getting a first-class Profitability Rating of 9 and a Health Rating of 9.

- Profitability Measures:

- The company has a Profit Margin of 40.89% and an Operating Margin of 43.14%, doing better than most of its industry competitors.

- Its Return on Invested Capital (ROIC) of 23.84% is much higher than its cost of capital, showing it is producing real value for shareholders.

- Financial Health Signs:

- A notable aspect is the company's balance sheet, which has no debt. This gives great financial room and lowers risk.

- High Altman-Z and Current Ratios further highlight the company's ability to pay debts and manage short-term needs without trouble.

This mix of high profitability and excellent financial health gives a firm base for the company's growth story, lowering the dangers usually linked with high-growth investments.

Technical Breakout Setup

A good fundamental story is most effective when it is joined by a positive price direction. The technical view for Arista Networks suggests the stock is in a good position for a possible continuation of its upward movement. The stock has a perfect Technical Rating of 10 and a Setup Rating of 8 from its technical analysis report.

- Trend Strength: Both the short-term and long-term directions are clearly positive, matching the company's good fundamental performance.

- Consolidation and Breakout: After a large increase, the stock has been moving within a range over the last month. This time of lower volatility often comes before a new directional move.

- Support and Resistance: The review finds a clear support area below the current price, giving a sensible level for a stop-loss order. With almost no resistance right above, the way for a possible breakout seems clear.

This technical formation is what the method specifically looks for: a fundamentally good growth stock that is pausing after a strong direction, possibly giving a new entry point before its next rise.

A Cohesive Investment Thesis

The case for Arista Networks is built on the connection between its fundamental strengths and its technical position. The company works in the growing market for cloud and AI networking products, giving it a large target market with important growth potential, a main qualitative factor for growth stocks. Its numerical results confirm it is taking advantage of this chance with outstanding revenue and earnings growth, all while keeping top-level profitability and a debt-free balance sheet. Technically, the stock is in a confirmed upward direction and is currently forming a pattern that often comes before more gains. This match of a solid business momentum with a positive chart formation makes it a notable candidate for investors using a growth-and-breakout method.

To see more stocks that fit this method of good growth fundamentals combined with positive technical formations, you can check the full screen results here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice of any kind. All data and analysis referenced are based on publicly available information and should be independently verified. Investing in stocks involves risk, including the potential loss of principal. Always conduct your own research and consider your financial situation and risk tolerance before making any investment decisions.