Arista Networks Inc (NYSE:ANET) stands as a notable option for high growth momentum investors looking for technically solid breakout chances. The company’s mix of strong fundamental growth measures and good technical placement fits well with strategies that focus on earnings momentum, increasing sales, and good entry points, central ideas of methods like CANSLIM and Minervini. This method favors stocks showing both forceful basic business momentum and positive chart formations, making sure investors are not only purchasing growth, but purchasing it at an opportune moment.

Fundamental Growth Momentum

A detailed look into Arista’s finances shows a profile full of the traits sought by high growth momentum screens. The company’s High Growth Momentum Rating of 6 shows good performance over several important growth areas:

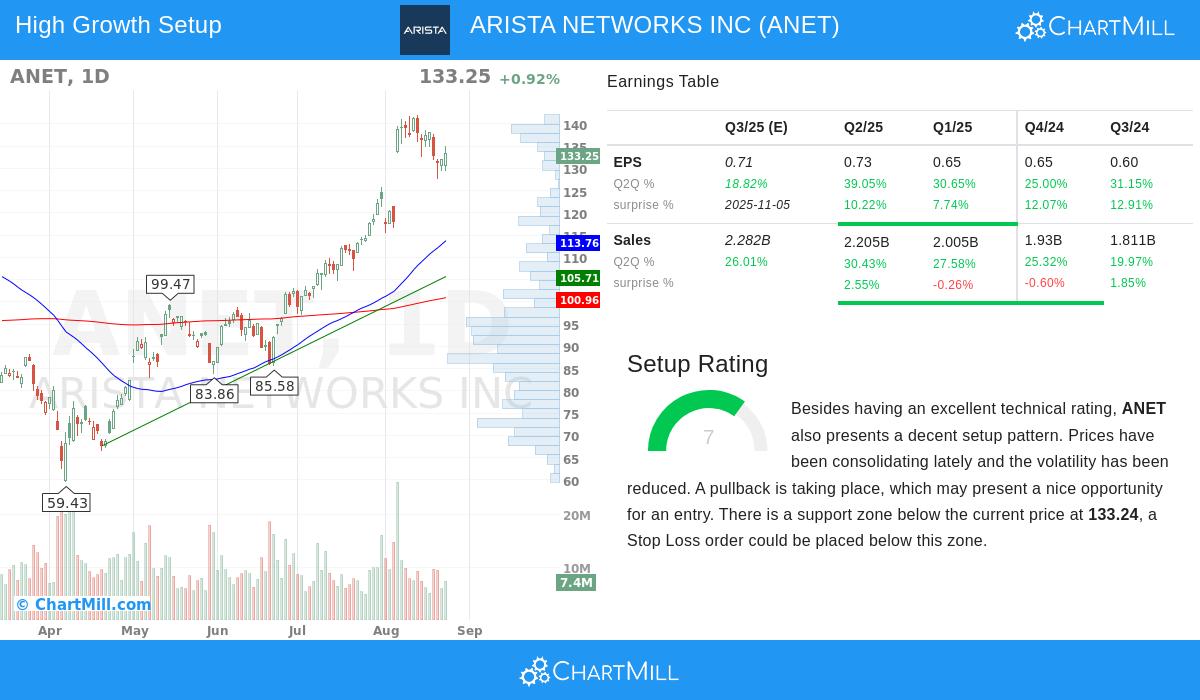

- Earnings and Sales Acceleration: Arista displays notable quarterly momentum, with the latest quarter showing EPS growth of 39.05% and sales growth of 30.43% year-over-year. This increase is important, as steady sequential improvement frequently points to growing market share and operational effectiveness.

- Estimate Revisions and Surprises: Positive analyst feeling is clear, with next-year EPS estimates adjusted upward by 0.46% over the last three months. Also, the company has a flawless history of exceeding EPS estimates in every one of the previous four quarters, with an average surprise of 10.73%, showing a pattern to under-promise and over-deliver.

- Profit Margin Expansion: A sign of a high-caliber growth company is the capacity to not only increase revenue, but to do so with profit. Arista’s net profit margin has grown considerably, from 28.52% three years ago to 40.31% in the most recent quarter. This growth indicates pricing strength, expense management, and scalable operations.

- Strong Cash Flow Generation: The company’s free cash flow per share has risen by over 320% in the past year, offering financial freedom to fund innovation, seek strategic options, and give capital back to shareholders.

These elements together create an image of a company not just expanding, but doing so with rising efficiency and force, making it a leading option for investors concentrated on earnings momentum.

Technical Strength and Setup Quality

Apart from the fundamentals, Arista’s stock chart shows a technically appealing image. According to its detailed technical analysis report, the stock receives a high Technical Rating of 9, indicating outstanding technical condition. The long and short-term trends are both positive, and the stock is doing better than 76% of its peers in the Communications Equipment industry. It is presently trading in the higher part of its 52-week range, showing relative strength.

Importantly for timing an entry, the stock also shows a positive setup, with a Setup Rating of 7. The analysis notes prices have been consolidating recently, with lower volatility, creating a bull flag formation. This formation often happens as a short break after a strong upward movement and can come before another step up. The report finds a defined support area between $130.65 and $133.24, giving a sensible level for a stop-loss order to control risk, while resistance is close to $141.26, marking a possible breakout level.

This pairing, a high technical rating confirming the stock is in a solid uptrend and a good setup rating emphasizing a low-risk entry point, is exactly what the method aims to find. It lets investors join a high-growth story at a time when the technicals imply the chance of a continued rise is greater.

For investors wanting to find other stocks that match this strict combination of high growth momentum and technical breakout setups, more study can be done using this specialized stock screen.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. The analysis presented is based on current data and is subject to change. All investing involves risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial professional before making any investment decisions.