It seems that Wall Street still isn’t ready to let go of its “buy the dip” mantra.

After Tuesday’s sell-off, fueled by cautious comments from top bank CEOs, investors turned optimistic again on Wednesday. A better-than-expected U.S. employment report and solid results from AMD and McDonald’s helped ease the market’s fear of heights.

A Calm Return to Green

The Nasdaq climbed 0.7%, recovering part of Tuesday’s 2% drop, while the Dow Jones and S&P 500 added 0.5% and 0.4%, respectively.

The ADP employment report showed a gain of 42,000 private-sector jobs in October, reversing September’s decline. Investors took this as a sign that the labor market is cooling but not collapsing, keeping hopes alive for a soft economic landing.

The ISM services index also delivered a pleasant surprise, pointing to stronger new orders and overall resilience in the services sector.

Meanwhile, the euro/dollar pair remained stable around 1.1488, and oil prices fell roughly 1%.

AMD Wins the Quarter, But Not All Hearts

Chipmaker AMD (AMD | +2.51%) beat expectations across the board, posting 36% revenue growth to $9.25 billion and earnings per share of $1.20, ahead of forecasts.

Yet, not everything sparkled, analysts at Citi pointed to slowing AI growth and slightly weaker margins as reasons for early selling pressure. Still, investors eventually rewarded the stock, sending it higher in line with the broader chip sector.

Big Mac Delivers

Fast-food giant McDonald’s (MCD | +2.16%) served up a stronger-than-expected third quarter, with global comparable sales up 3.6% and U.S. comps rising 2.4%, a sharp improvement from last year’s meager 0.3%.

Growth in Germany, Australia, and Japan also helped drive results. For a company often criticized for being “boring but reliable,” this report was anything but dull.

Mixed Flavors Elsewhere

Restaurant chain Cava Group (CAVA | –2.57%) saw revenue jump 20% year-over-year to $289.8 million, but same-store sales growth slowed dramatically to 1.9%, well below the expected 2.7%.

The company also trimmed its full-year outlook, now forecasting 3–4% comparable growth instead of 4–6%. Investors weren’t exactly thrilled, especially after last year’s impressive 18% growth pace.

Among other notable movers:

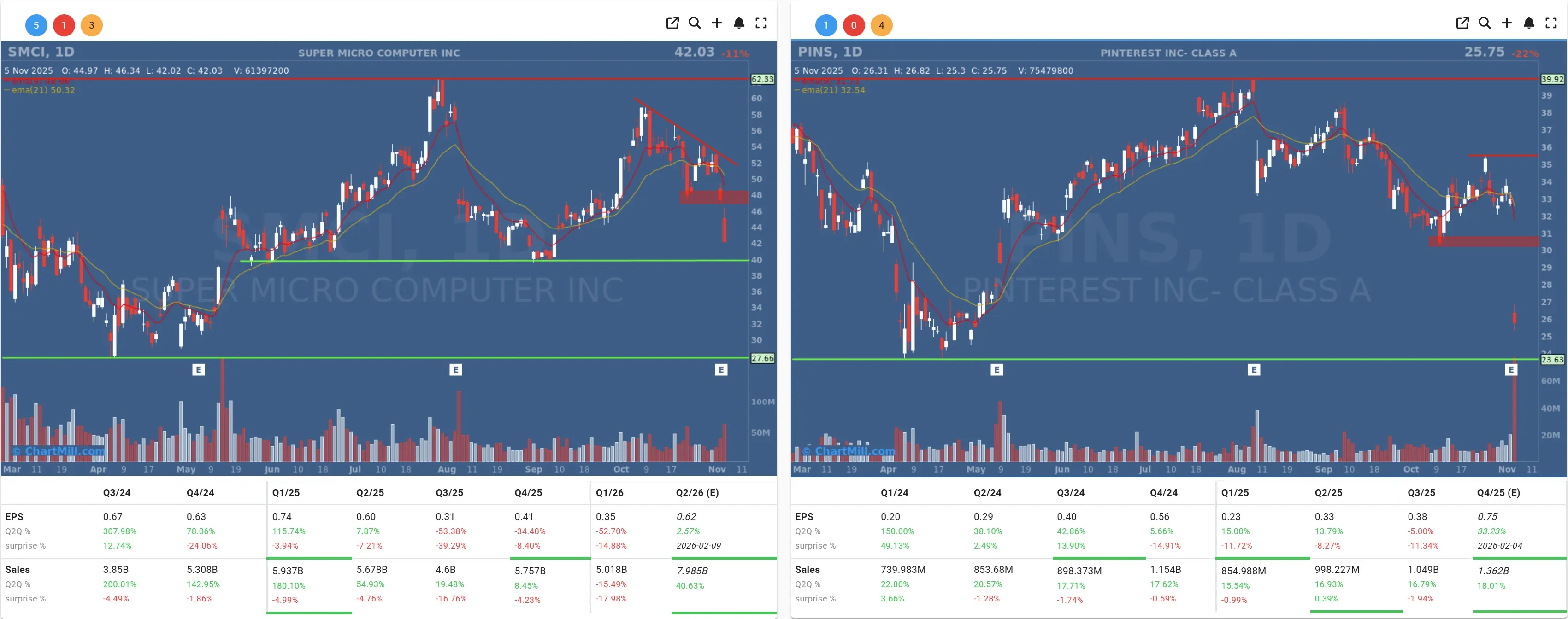

Super Micro Computer (SMCI | –11.33%) tumbled after issuing a cautious profit outlook.

Pinterest (PINS | –21.76%) plunged following weak guidance.

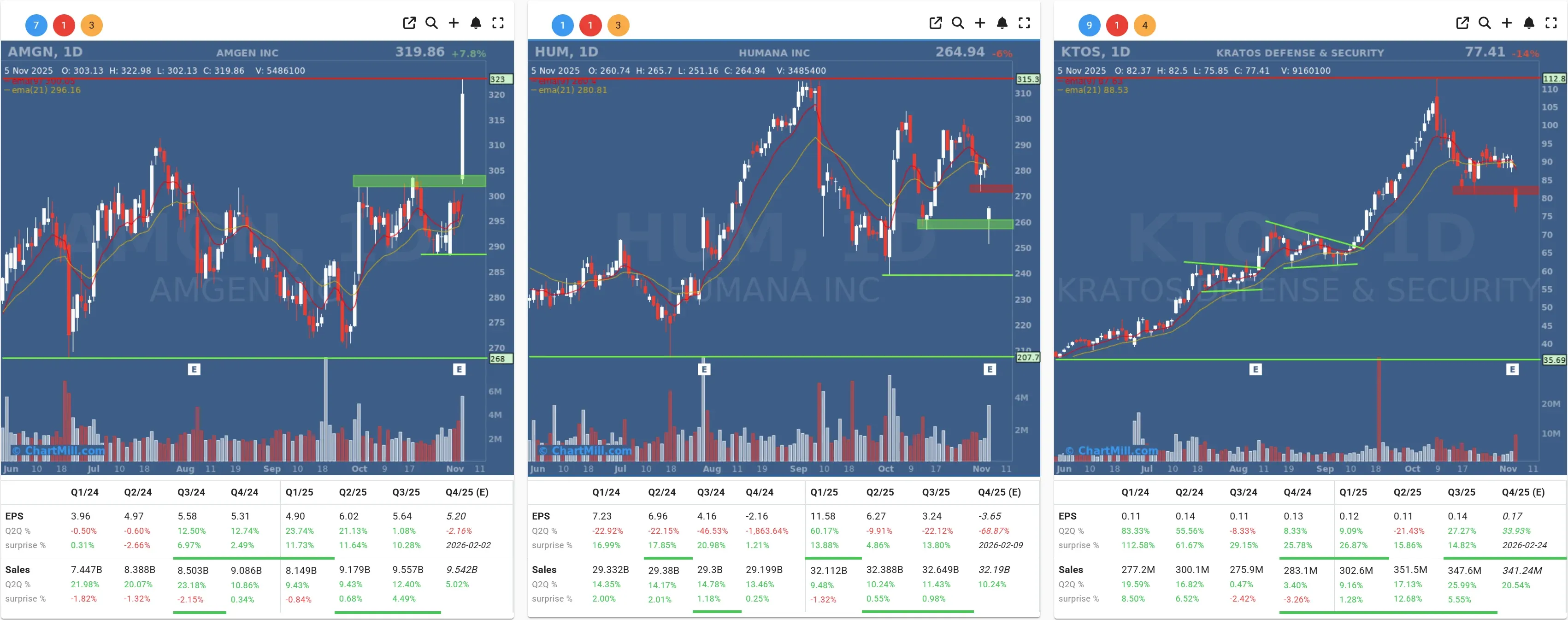

Amgen (AMGN | +7.81%) rallied sharply after upbeat results.

Humana (HUM | –6.01%) fell on a lowered outlook.

Kratos Defense (KTOS | –14.2%) sank on soft Q4 guidance.

Qualcomm’s Strong Numbers, Weak Reaction

Qualcomm (QCOM | –2.62% after-hours) beat its own expectations with 11% revenue growth to $11.3 billion and adjusted EPS of $3.00, topping its guidance. However, a reported net loss of $3.1 billion, due to special charges, took some shine off the report.

The company guided for $11.8–12.6 billion in Q1 revenue and adjusted EPS between $3.30–3.50, indicating ongoing momentum in its core smartphone and IoT businesses.

Still, the stock slipped in after-hours trading, apparently, even solid beats don’t guarantee applause in this market.

Looking Ahead

Despite a few hiccups, the tone on Wall Street remains cautiously upbeat. Investors continue to bet that the AI boom and steady U.S. economy can carry equities higher, even as central bankers and big-bank CEOs warn of stretched valuations.

For now, though, the market seems happy to ignore the storm clouds. After all, as long as the “buy-the-dip” crowd keeps showing up, gravity might just have to wait its turn.

Kristoff - ChartMill

Next to read: Rebound in Market Breadth After Sharp Sell-Off