ALAMOS GOLD INC-CLASS A (NYSE:AGI) was identified as an affordable growth stock by our screener. The company demonstrates strong growth potential while maintaining reasonable valuation metrics, along with solid profitability and financial health. Below, we examine why AGI stands out in the metals and mining sector.

Growth Prospects

AGI has shown impressive growth in recent years, with key highlights including:

- Earnings Per Share (EPS) growth of 51.85% over the past year.

- A three-year average EPS growth rate of 29.78%, indicating sustained profitability expansion.

- Revenue growth of 33.63% in the last year and an average annual revenue growth of 14.54% over the past several years.

- Analysts expect EPS to grow by 27.76% annually in the coming years, reinforcing its growth trajectory.

Valuation

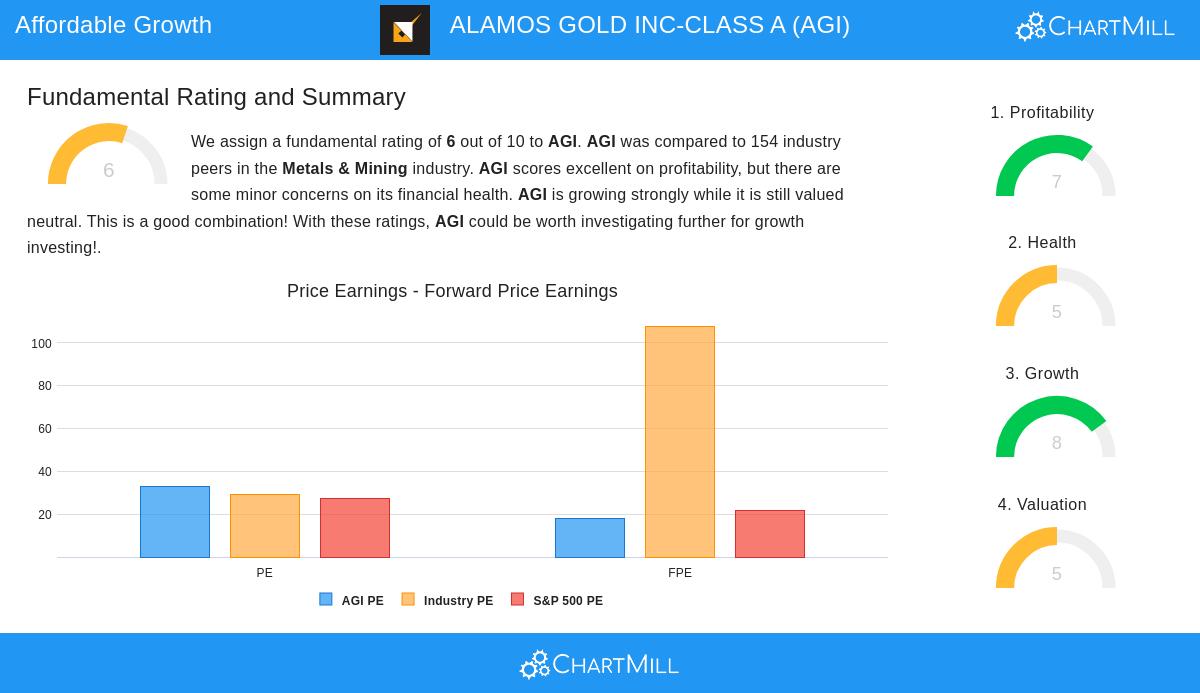

Despite strong growth, AGI remains reasonably valued:

- The Price/Earnings (P/E) ratio of 32.89 is slightly above the S&P 500 average but cheaper than 63.64% of its industry peers.

- A forward P/E of 18.13 aligns with the broader market, suggesting no significant overvaluation.

- The Price/Free Cash Flow ratio is favorable, ranking better than 65.58% of competitors, indicating efficient cash generation.

- A low PEG ratio (accounting for growth) suggests the stock is attractively priced relative to its earnings potential.

Profitability & Financial Health

AGI maintains a solid financial foundation:

- Profit margins are strong, with an 18.36% net margin outperforming 88.31% of industry peers.

- Operating margins of 36.95% rank in the top 8% of the sector.

- The company has a healthy balance sheet, with a Debt/Equity ratio of 0.07, well below industry averages.

- While liquidity metrics (Current Ratio, Quick Ratio) are slightly below peers, solvency remains sound with an Altman-Z score of 4.32, indicating low bankruptcy risk.

Dividend Considerations

AGI offers a modest dividend yield of 0.38%, which is below the industry average. However, the company has:

- A 10-year track record of consistent payouts.

- A dividend growth rate of 16.57% annually.

- A low payout ratio of 14.02%, ensuring sustainability.

For a deeper dive into AGI’s fundamentals, review the full fundamental analysis report.

Our Affordable Growth screener lists more stocks with strong growth and reasonable valuations, updated daily.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own analysis before making investment decisions.