Technical breakout investing focuses on identifying stocks with strong momentum and consolidation patterns, offering potential entry points for traders. Electronic Arts Inc (NASDAQ:EA) currently presents such an opportunity, with favorable technical ratings and a well-defined setup.

Technical Strength and Setup

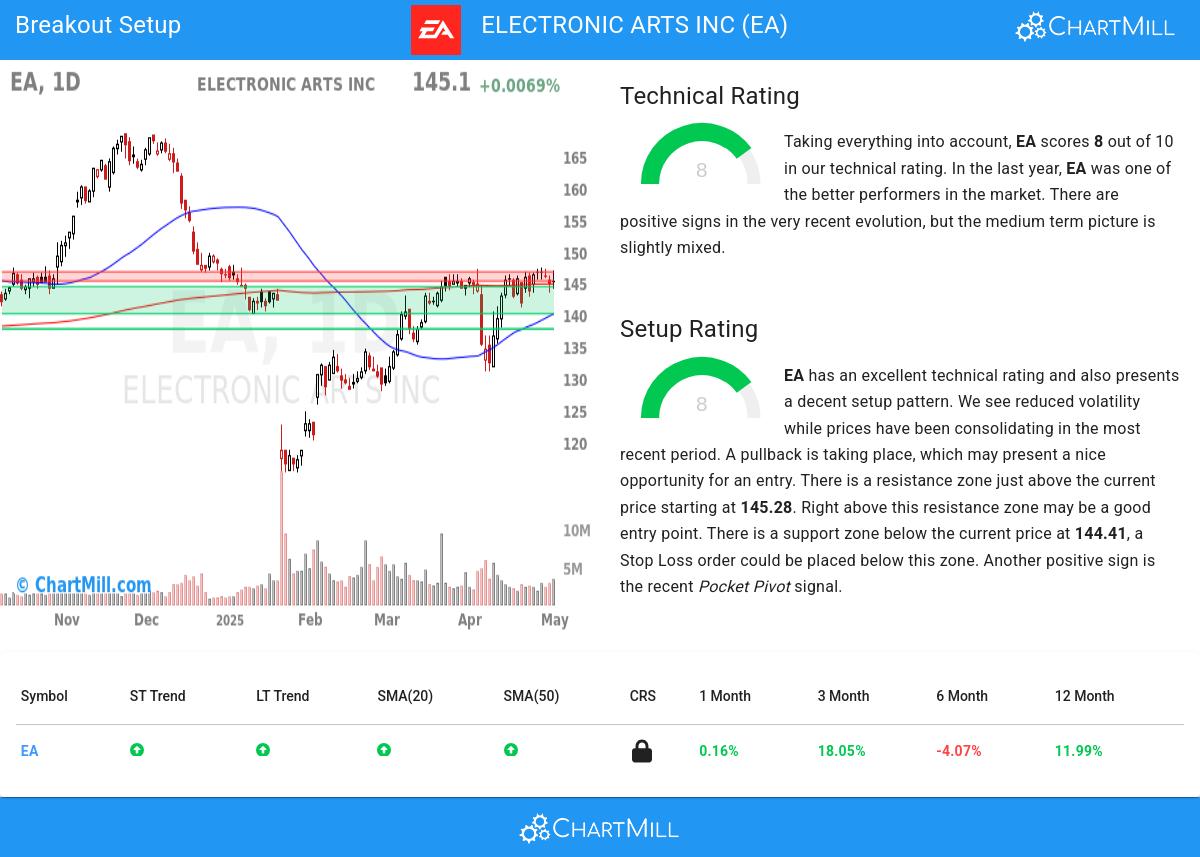

The ChartMill Technical report assigns EA a Technical Rating of 8 and a Setup Rating of 8, indicating both strong trend health and a favorable consolidation pattern. Key highlights include:

- Positive Trends: Both short-term and long-term trends are upward.

- Relative Strength: EA outperforms 78% of stocks in the Entertainment industry.

- Support and Resistance: A support zone lies between $140.13 and $144.41, while resistance sits at $145.28 to $146.73.

- Recent Performance: The stock has traded in a range of $131.15 to $147.44 over the past month, currently near the upper end.

The setup suggests a potential entry point above $146.74, with a stop-loss below $141.03. A recent Pocket Pivot signal—indicating accumulation—adds further bullish confirmation.

Market Context

While the S&P 500 shows a negative long-term trend, its short-term momentum is positive. EA’s resilience and strong technicals make it a candidate for breakout traders looking for stocks with clear support and resistance levels.

For more breakout setups, check the Technical Breakout Setups screen.