Wheaton Precious Metals Corp (NYSE:WPM) is a leading precious metals streaming company with a diversified portfolio of long-life, low-cost assets. The company partners with mining firms to secure future production, offering investors exposure to gold, silver, palladium, platinum, and cobalt without direct mining risks.

Mark Minervini’s Trend Template is a proven method for identifying stocks in strong uptrends. It focuses on price action, moving averages, and relative strength to ensure stocks meet high-performance standards. WPM currently aligns with several key Minervini criteria, making it a compelling candidate for further analysis.

Why WPM Fits the Minervini Trend Template

Strong Price Trends

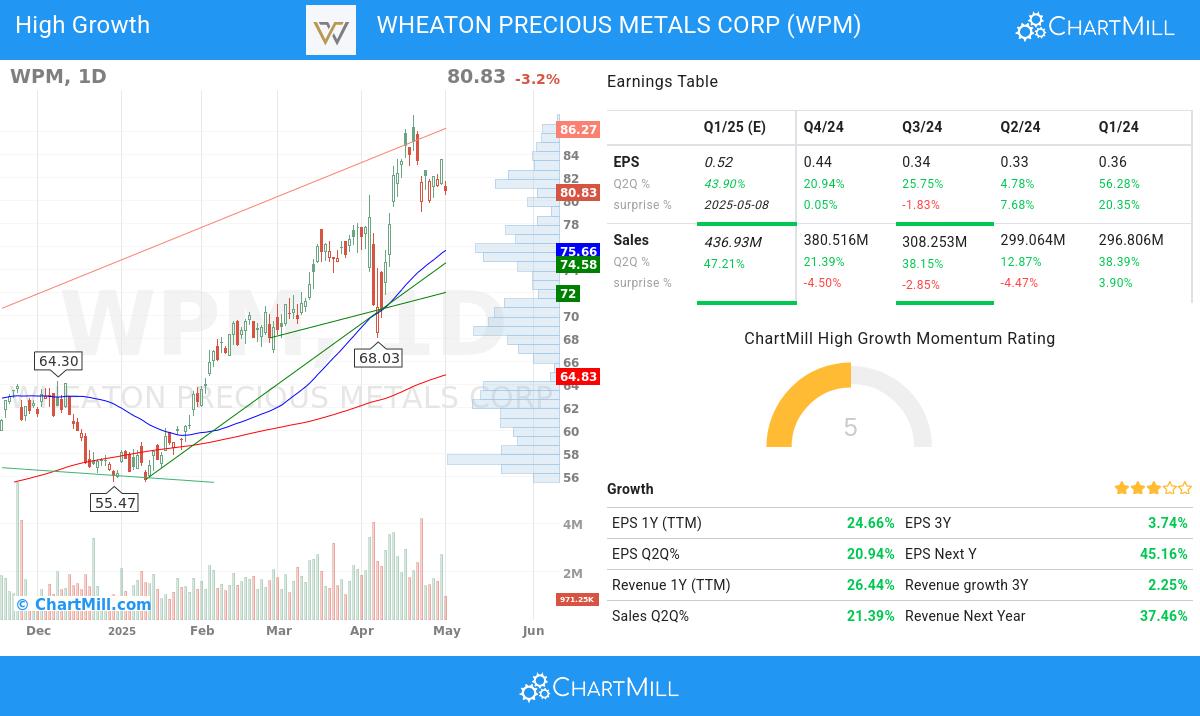

- Current Price Above Key Moving Averages: WPM trades at $80.83, well above its 50-day ($75.43), 150-day ($66.39), and 200-day ($64.73) moving averages.

- Upward-Sloping Averages: The 50-day, 150-day, and 200-day moving averages are all trending higher, confirming sustained momentum.

- 52-Week Performance: The stock is up 58.5% over the past year and trades within 8% of its 52-week high ($87.42), a bullish signal.

Relative Strength

WPM has a ChartMill Relative Strength (CRS) score of 96.16, outperforming 96% of all stocks. It also ranks in the top 18% of its Metals & Mining industry group, indicating strong sector leadership.

Earnings and Revenue Growth

- EPS Growth (TTM): +24.66%

- Revenue Growth (TTM): +26.44%

- Quarterly EPS Growth (Q2Q): +20.94%

- Quarterly Revenue Growth (Q2Q): +21.39%

The company has beaten EPS estimates in three of the last four quarters, with an average beat of 6.56%. Analysts have also raised next-year EPS and revenue estimates by 20% over the past three months.

Technical Setup

According to the ChartMill Technical Report, WPM scores a perfect 10 on technical rating and an 8 on setup quality. The stock is consolidating near highs with reduced volatility, presenting a potential breakout opportunity.

Key support levels include:

- $74.33–$75.43 (moving averages & trendlines)

- $71.91 (daily trendline)

Resistance is seen at $81.53–$81.65 and $83.01–$85.14.

Conclusion

Wheaton Precious Metals Corp (NYSE:WPM) meets multiple Minervini Trend Template criteria, including strong price trends, high relative strength, and solid earnings growth. The stock’s technical setup suggests a potential breakout, making it one to watch.

For more detailed analysis, see the full technical report here.