Technical breakout investing focuses on identifying stocks that exhibit strong price consolidation followed by a potential upward move. Traders look for setups where a stock has built a base of support and is poised to break through resistance levels, signaling further gains. Entergy Corp (NYSE:ETR) currently presents such an opportunity, with solid technical ratings and a favorable setup pattern.

Technical Strength and Setup Quality

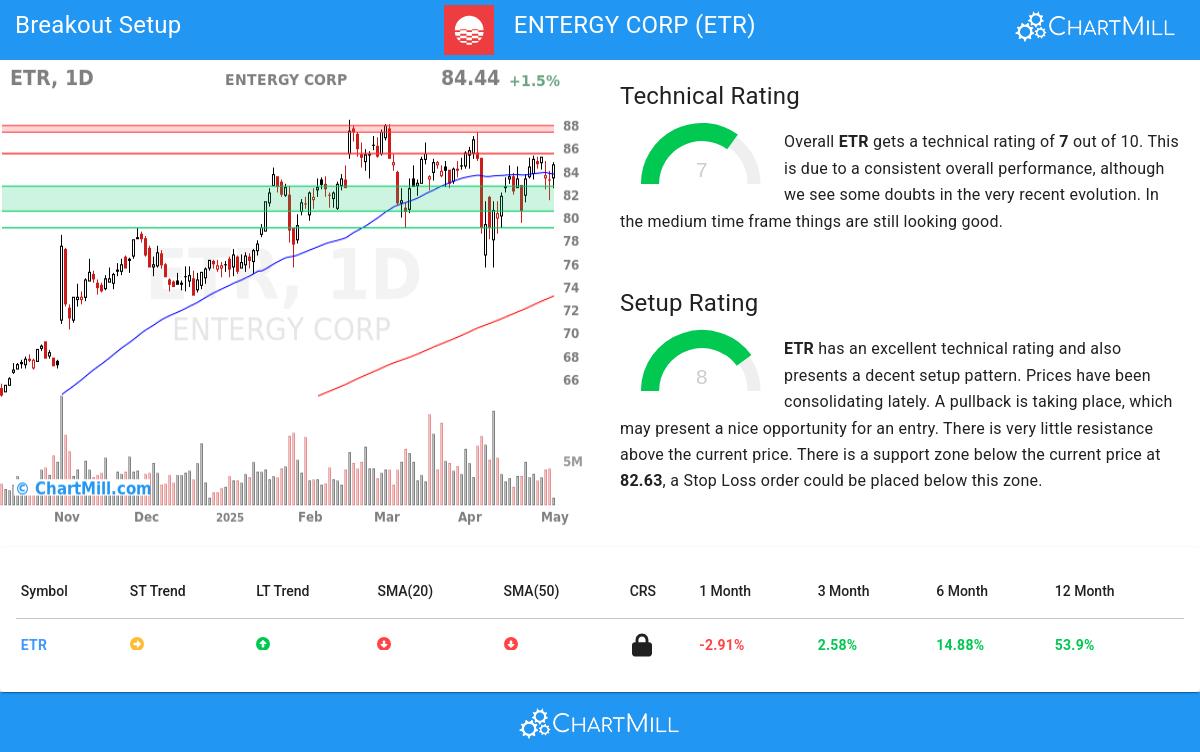

Entergy Corp (NYSE:ETR) has a Technical Rating of 7, indicating a positive long-term trend, though the short-term trend remains neutral. The stock has outperformed 93% of the market over the past year and ranks in the top tier of its industry, Electric Utilities, beating 97% of its peers.

The Setup Rating of 8 suggests a well-defined consolidation pattern, with prices stabilizing near key support levels. The stock has been trading in a range between $75.57 and $87.25 over the past month, and a breakout above $85.45 could signal further upside. Support is strong near $82.63, providing a clear stop-loss level for traders.

Key Takeaways from the Technical Report:

- Long-term trend: Positive

- Short-term trend: Neutral

- Support zones: Multiple levels between $80.46 and $83.73

- Resistance levels: $85.45 and $87.31-$87.89

- Volume: Healthy liquidity with an average of 4.56 million shares traded daily

For a deeper analysis, review the full technical report.

Potential Trading Setup

A breakout above $85.46 could serve as an entry point, with a stop-loss placed below $80.45. This setup limits downside risk to 5.86% while offering exposure to potential upside momentum.

For more breakout opportunities, explore the Technical Breakout Setups Screen.