Undervalued stocks present opportunities for investors who seek companies trading below their intrinsic value. These stocks often have strong fundamentals but may be overlooked by the market due to short-term sentiment or sector-specific trends. One such candidate is Cal-Maine Foods Inc (NASDAQ:CALM), a leading producer and distributor of shell eggs.

Why Cal-Maine Foods Stands Out

Cal-Maine Foods has demonstrated solid financial health and profitability, making it a compelling option for value investors. The company operates in the food products industry, specializing in conventional and specialty eggs, including organic, cage-free, and nutritionally enhanced varieties.

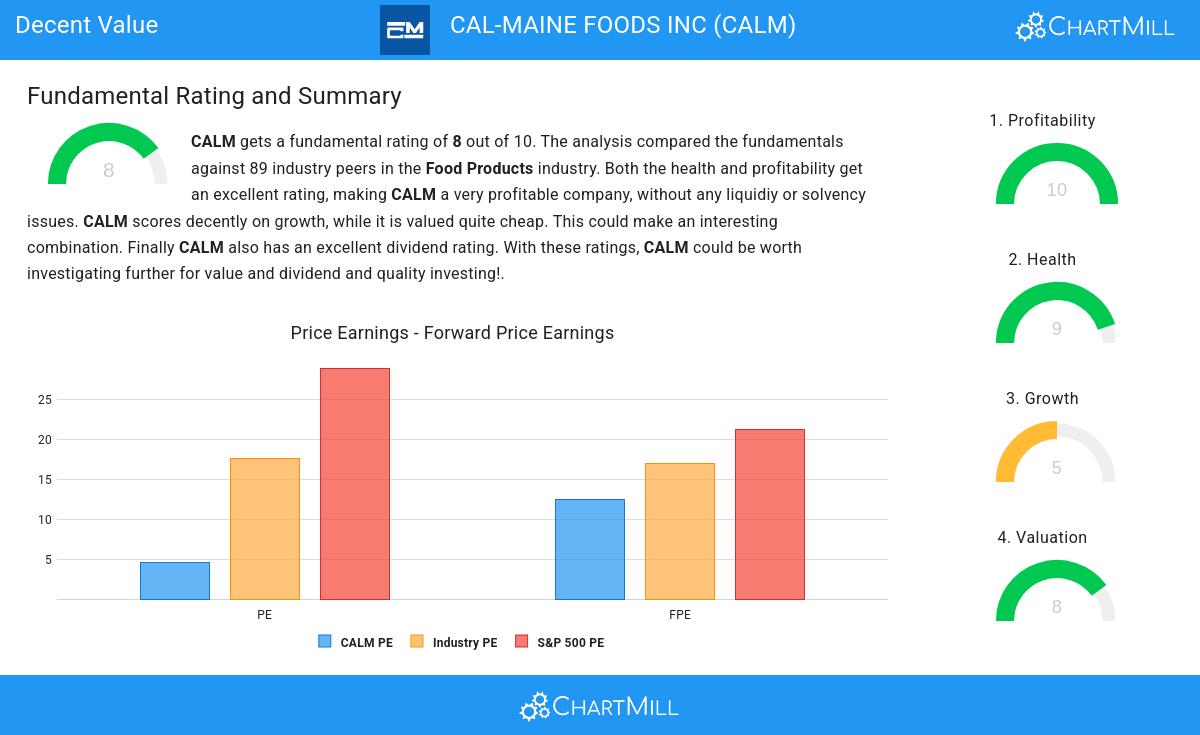

According to the fundamental analysis report, Cal-Maine Foods scores highly in several key areas:

- Profitability (10/10): The company boasts strong margins, with a Return on Assets (ROA) of 32.15% and a Return on Equity (ROE) of 41.60%, outperforming most industry peers.

- Financial Health (9/10): With no outstanding debt and a robust current ratio of 3.86, the company maintains excellent liquidity and solvency.

- Valuation (8/10): Trading at a Price/Earnings (P/E) ratio of 4.62, Cal-Maine is priced significantly lower than both industry and S&P 500 averages, suggesting potential undervaluation.

- Dividend (7/10): The company offers an attractive dividend yield of 14.92%, supported by a sustainable payout ratio of 21.16%.

While growth prospects appear weaker due to expected declines in earnings and revenue, the company’s strong profitability and financial stability make it a resilient choice in uncertain markets.

Key Considerations

Investors should note that Cal-Maine operates in a cyclical industry, where demand can fluctuate with economic conditions. However, its strong balance sheet and efficient operations position it well to weather downturns. Additionally, the company’s focus on specialty eggs aligns with shifting consumer preferences toward healthier and more sustainable food options.

For investors seeking undervalued stocks with solid fundamentals, Cal-Maine Foods presents an interesting case. Its combination of high profitability, financial strength, and an attractive dividend yield makes it worth further research.