Cintas Corp (NASDAQ:CTAS) is a company that provides corporate identity uniforms, first aid and safety services, and facility services. Quality investing focuses on identifying businesses with strong financials, competitive advantages, and sustainable growth potential. These companies often exhibit high profitability, efficient capital allocation, and resilience across economic cycles.

Why Cintas Corp Fits the Quality Investing Criteria

Cintas Corp meets several key metrics that quality investors look for:

-

Strong Revenue and EBIT Growth

- Revenue growth (5Y CAGR): 7.67%

- EBIT growth (5Y CAGR): 12.5%

The company has demonstrated consistent growth, with EBIT expanding faster than revenue, indicating improving operational efficiency.

-

High Return on Invested Capital (ROIC)

- ROIC (Ex Cash+GW): 51.32%

This exceptional figure shows Cintas effectively generates profits from its capital investments, a hallmark of a high-quality business.

- ROIC (Ex Cash+GW): 51.32%

-

Healthy Debt Management

- Debt/FCF: 1.36

The company can repay its debt in just over a year using free cash flow, reflecting strong financial health.

- Debt/FCF: 1.36

-

Profit Quality

- Profit Quality (5Y avg): 107.82%

Cintas converts net income into free cash flow efficiently, ensuring earnings are backed by real cash generation.

- Profit Quality (5Y avg): 107.82%

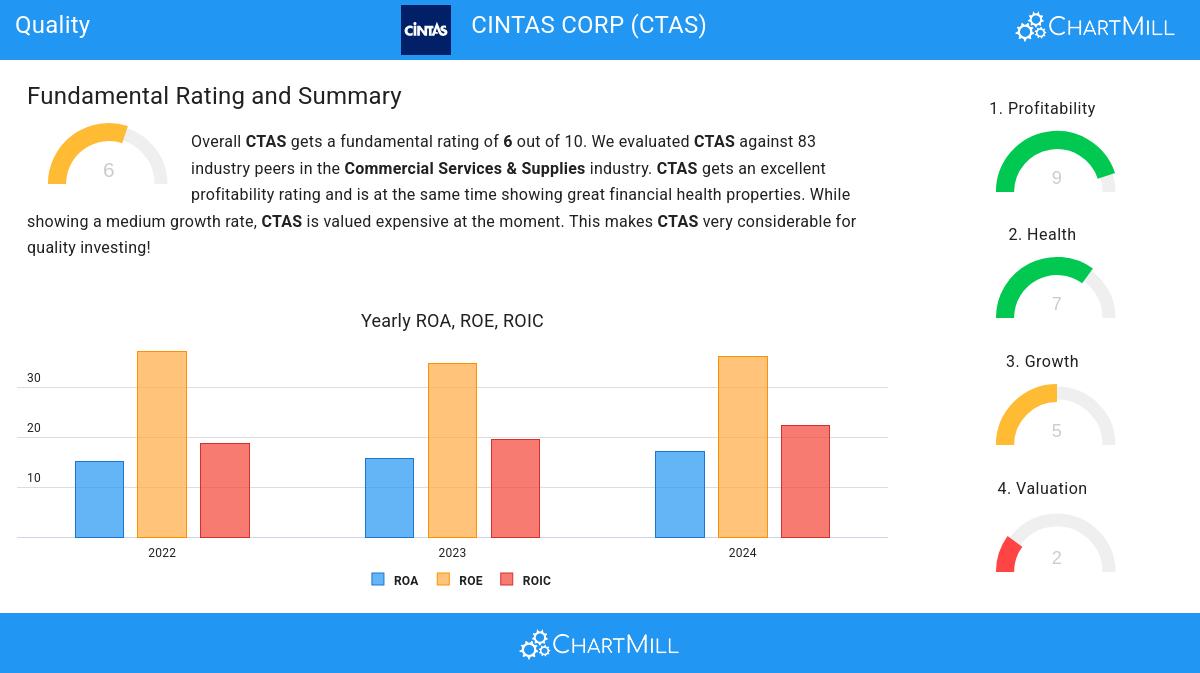

Fundamental Analysis Summary

Cintas Corp holds a solid fundamental rating of 6 out of 10, with strengths in profitability and financial health. Key highlights include:

- High Profit Margins: Operating margin of 22.77% and profit margin of 17.47%, both well above industry averages.

- Strong Solvency: Low debt levels and an Altman-Z score of 13.92 indicate minimal bankruptcy risk.

- Valuation Concerns: The stock trades at a high P/E ratio (49.00), which may be justified by its growth prospects but remains a consideration.

For a deeper analysis, see the full fundamental report.

Additional Considerations for Quality Investors

Beyond financial metrics, Cintas benefits from:

- A recurring revenue model through uniform rentals and facility services.

- Pricing power due to brand strength and service quality.

- Global operations, reducing dependency on any single market.

Explore More Quality Stocks

Interested in finding similar companies? Check out the Caviar Cruise screen for more high-quality investment candidates.