PEGASYSTEMS INC (NASDAQ:PEGA) develops enterprise software for AI-powered decision-making and workflow automation. The company serves industries requiring real-time process optimization, making it a potential fit for growth-focused investors.

The CANSLIM investing method, developed by William O’Neil, combines fundamental and technical analysis to identify high-growth stocks with strong momentum. Stocks meeting CANSLIM criteria typically exhibit accelerating earnings, leadership in their sector, and institutional interest.

How PEGA Meets CANSLIM Criteria

C – Current Earnings Growth

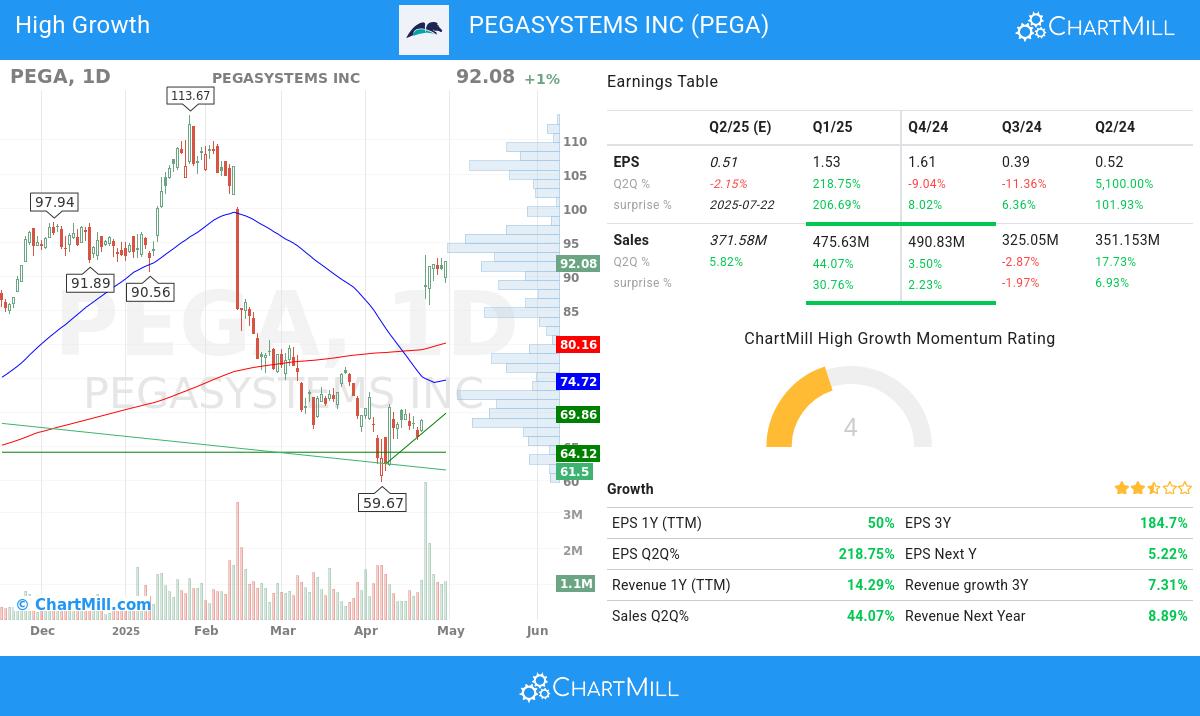

PEGA reports a 218.75% year-over-year EPS growth and 44.07% revenue growth in the latest quarter, exceeding the CANSLIM threshold of 20-25%. This acceleration suggests strong business execution.

A – Annual Earnings Growth

The company’s 3-year EPS growth of 184.70% far surpasses the 25% minimum, indicating sustained profitability.

N – New Highs & Innovation

PEGA operates in AI-driven automation, a high-growth sector. While not at a 52-week high, its relative strength of 91.12 places it among the top market performers.

S – Supply & Demand

With no debt (Debt/Equity = 0) and strong liquidity, PEGA maintains a healthy balance sheet. Trading volume has increased recently, reflecting investor interest.

L – Market Leadership

PEGA outperforms 82% of software industry peers, reinforcing its leadership position.

I – Institutional Sponsorship

Institutional ownership stands at 48.11%, below the 85% threshold, suggesting room for further institutional accumulation.

M – Market Direction

The S&P 500’s long-term trend is negative, but PEGA’s short-term uptrend aligns with CANSLIM’s preference for bullish market phases.

Technical & Fundamental Overview

Technical Analysis

PEGA’s technical rating is 9/10, with a strong short-term uptrend. Key support levels are at $69.86 and $64.12-64.55, while resistance sits near $92.09. The stock has gained 54.63% over the past year, though recent volatility suggests waiting for consolidation before entry.

Full Technical Report

Fundamental Analysis

PEGA scores 6/10 on fundamentals, with high profitability (ROE of 32.18%) but mixed growth projections. Revenue growth remains solid at 14.29% YoY, though future EPS growth is expected to slow.

Full Fundamental Report

Conclusion

PEGASYSTEMS INC (NASDAQ:PEGA) meets several CANSLIM criteria, including strong earnings growth, sector leadership, and institutional interest. While market conditions warrant caution, PEGA’s fundamentals and technical strength make it a stock to watch.

For more CANSLIM-compliant stocks, explore our predefined screener.