Undervalued stocks present opportunities for investors who seek companies trading below their intrinsic value. These stocks often have strong fundamentals but may be overlooked by the market due to short-term sentiment or sector-specific concerns. One such candidate is Qifu Technology Inc (NASDAQ:QFIN), a Chinese fintech company specializing in credit technology services.

Strong Fundamentals Support Undervaluation

Qifu Technology Inc (NASDAQ:QFIN) operates in the consumer finance sector, providing credit-driven and platform services to financial institutions. The company’s financial health and profitability stand out, making it a compelling candidate for value investors.

Key Highlights from the Fundamental Analysis

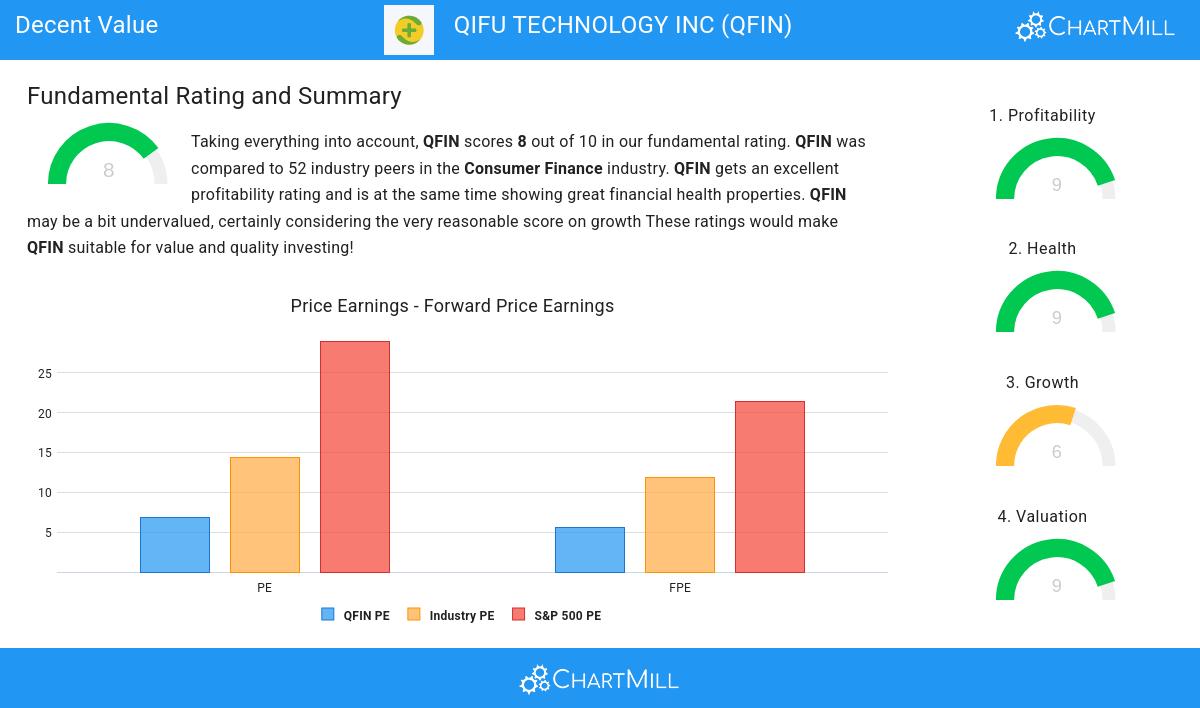

- Valuation Rating: 9/10 – QFIN appears undervalued with a Price/Earnings (P/E) ratio of 6.90, significantly lower than both the industry average (14.35) and the S&P 500 (28.98).

- Profitability Rating: 9/10 – The company boasts strong margins, including a 36.49% profit margin and 43.86% operating margin, outperforming most peers.

- Financial Health Rating: 9/10 – With a solid Altman-Z score of 3.15 and low debt levels, QFIN demonstrates financial stability.

- Growth Rating: 6/10 – While past earnings growth has been strong (57.05% YoY), future revenue growth is expected at a moderate 8.48%.

The combination of low valuation multiples and strong profitability suggests QFIN may be trading below its true worth.

Why QFIN Stands Out

- Attractive Valuation Metrics – The P/E ratio of 6.90 and forward P/E of 5.58 indicate the stock is priced conservatively relative to earnings.

- High Profitability – Exceptional return metrics (ROIC of 18.81%, ROE of 25.90%) highlight efficient capital use.

- Financial Resilience – A low debt-to-equity ratio (0.06) and strong liquidity (current ratio of 2.45) reduce financial risk.

- Dividend Yield – At 3.11%, the yield is competitive, though slightly below the industry average.

For a deeper dive into the analysis, review the full fundamental report.

Potential Risks

While QFIN’s fundamentals are strong, investors should consider:

- Regulatory Environment – Chinese fintech firms face evolving regulations.

- Revenue Growth Slowdown – Future revenue growth projections are lower than past performance.

- Dividend Sustainability – Recent dividend cuts may concern income-focused investors.

Conclusion

Qifu Technology Inc (NASDAQ:QFIN) presents a compelling case as an undervalued stock with strong profitability and financial health. While risks exist, the company’s fundamentals suggest potential upside for long-term investors.

For more undervalued stock ideas, explore this screener.