Dividend stocks can be an attractive option for investors looking for steady income. Companies with a history of consistent payouts and strong financials often provide reliable returns. Bristol-Myers Squibb Co (NYSE:BMY) stands out as a potential candidate for dividend-focused portfolios, offering a high yield and solid fundamentals.

Why Bristol-Myers Squibb Co (NYSE:BMY) Stands Out

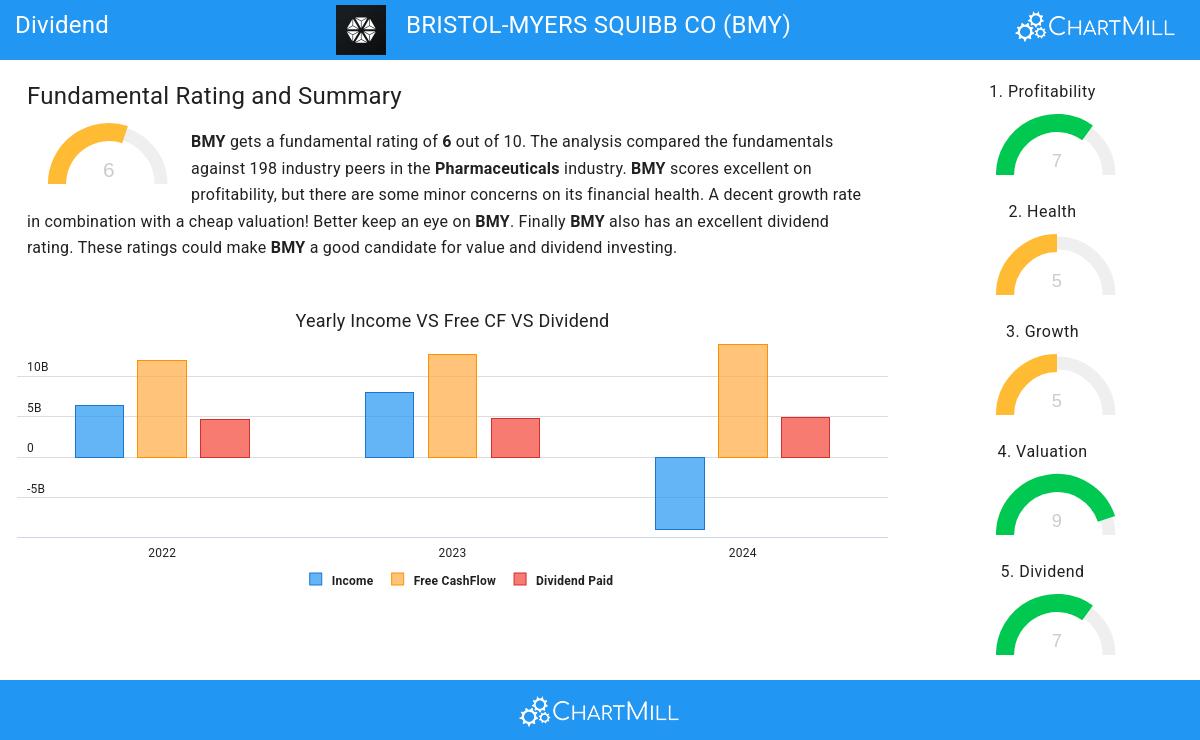

BMY currently offers a dividend yield of 5.12%, significantly higher than the S&P 500 average of 2.46%. The company has a strong track record, having paid dividends for at least 10 years without reductions in the past three years. Additionally, its dividend has grown at an average annual rate of 11.67%, indicating a commitment to rewarding shareholders.

Key Dividend Metrics

- Dividend Yield: 5.12%

- 5-Year Dividend Growth Rate: 11.67%

- Payout Ratio: 90.59%

While the payout ratio is high, earnings growth has outpaced dividend growth, suggesting sustainability. Investors should monitor this ratio to ensure the company can maintain its payouts.

Financial Health and Profitability

BMY’s Profitability Rating is 7, reflecting strong margins and returns. The company boasts an Operating Margin of 27.11% and a Return on Equity of 31.16%, outperforming most peers in the pharmaceuticals industry.

However, its Health Rating of 5 indicates some financial concerns, including a high Debt-to-Equity ratio of 2.67. While solvency metrics remain acceptable, investors should be aware of the company’s leverage.

Valuation

BMY trades at a P/E ratio of 6.79, well below the industry average of 19.18 and the S&P 500’s 28.98. This suggests the stock is undervalued, making it an appealing option for value investors.

Growth Outlook

BMY has shown mixed growth trends. While past earnings per share (EPS) declined by 24.57% on average, analysts expect a 38.96% annual EPS growth in the coming years. Revenue growth has been steady, though future projections indicate a slight decline.

Final Thoughts

Bristol-Myers Squibb Co (NYSE:BMY) presents a compelling case for dividend investors, with its high yield, consistent growth, and strong profitability. While financial leverage is a consideration, the stock’s valuation and earnings potential make it worth further research.

For a deeper analysis, review the full fundamental report here.

Explore more high-dividend stocks: Best Dividend Stocks Screen.